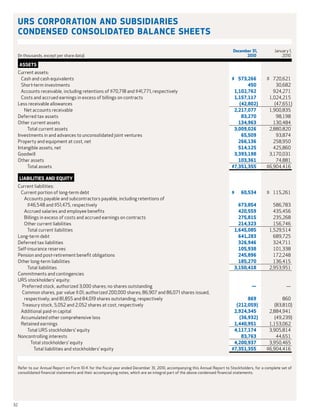

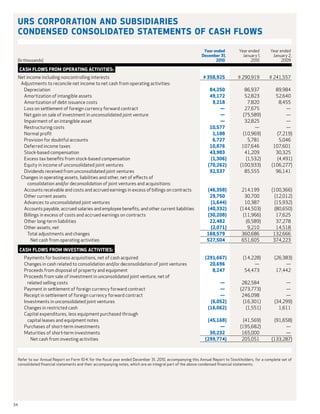

URS Corporation is a leading engineering and construction firm. In 2010, it reported revenues of $9.2 billion and net income of $288 million. It completed the acquisition of Scott Wilson Group, a UK-based engineering firm, expanding its international operations. The acquisition added over 5,500 employees and increased URS' presence in key markets like the UK, Europe, India, and China. The company's diversification across sectors like federal, infrastructure, power, and industrial has allowed it to deliver consistent results through economic cycles.