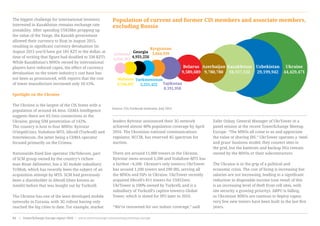

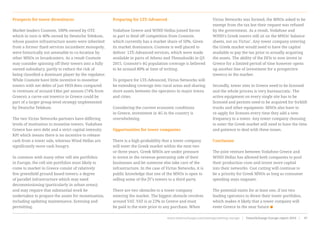

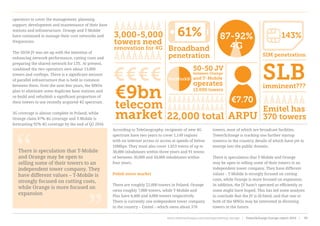

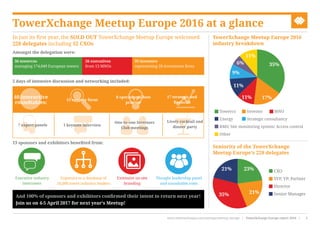

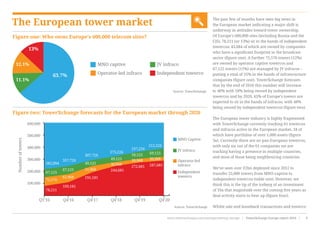

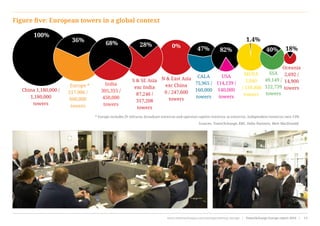

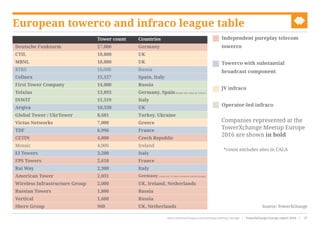

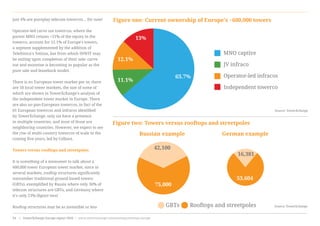

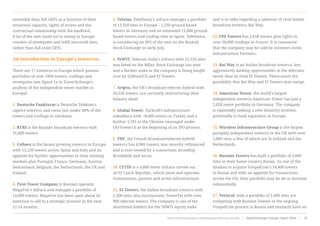

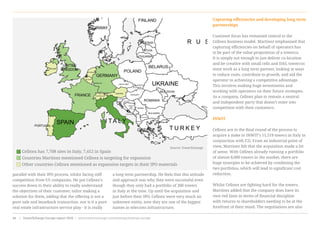

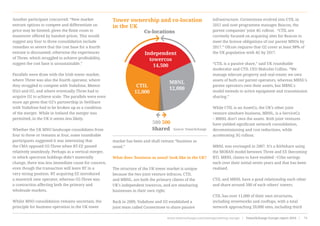

The European tower market is undergoing major changes, with more towers expected to be owned by independent tower companies in the coming years. Currently, 13% of Europe's 600,000 towers are owned by independent towercos, but this is forecasted to increase significantly to 48% by 2020. Major industry developments include several recent tower portfolio transactions and mobile network operators showing increased openness to tower sales and infrastructure sharing. The inaugural TowerXchange Meetup Europe in 2016 brought together over 200 industry leaders and was deemed very successful, setting the stage for further discussion and dealmaking in this evolving market.

![Hamstrung rooftop co-locations

and potential tower monetisations in

the German market

Insights from the Germany roundtable at the TowerXchange Meetup Europe 2016

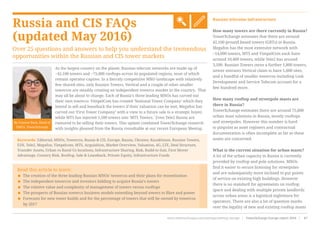

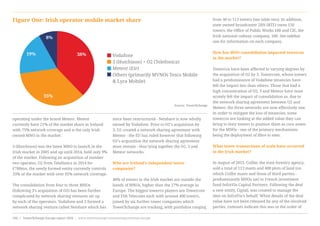

Who are the key players?

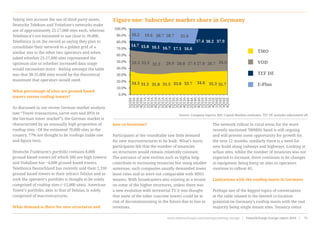

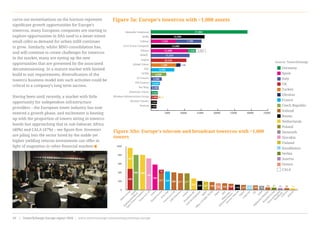

Germany has three mobile network operators

following Telefónica’s acquisition of E+ in 2014.

Telefónica now boasts the largest market share

sitting just under 38%, Deutsche Telekom has just

under 36% and Vodafone just under 27% (figure

one), the remainder of the market is accounted for

by a number of MVNOs.

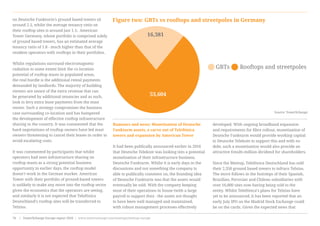

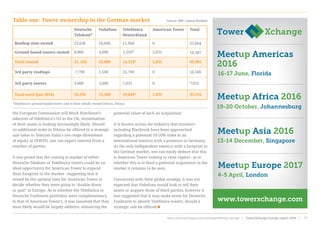

Each of the operators retain their assets with

Deutsche Telekom’s subsidiary Deutsche Funkturm

managing their portfolio of 27,000 sites and

their subsidiary Omega Towers owning the

7,700 sites transferred from Telefónica following

the E+ acquisition (predominantly rooftops, of

which approximately 50% are expected to be

decommissioned). The fourth owner of towers

in the German market is independent towerco

American Tower, which owns a portfolio of 2,031

towers in the country (table one). [Editor’s note:

Since the Meetup it has been announced that

Telefónica has sold their 2,350 ground-based towers

to subsidiary, Telxius].

What degree of infrastructure sharing is there in

the market?

There is an established culture of infrastructure

sharing between each of the operators, with all

three using third party towers and leasing space

on their towers to third parties. It is estimated that

Deutsche Funkturm have approximately three times

as many tenants on their sites than the number of

third party sites they use.

Read this article to learn:

< The breakdown of tower ownership in the German market

< Expected growth in new build and co-locations

< Why tenancy ratios on rooftop sites are so low in the country

< How a potential monetisation of Deutsche Funkturm and carve out of Telefónica sites could

affect market dynamics

Keywords: 4G, Acquisition, American Tower, American Tower Germany, Capacity Enhancements, Co-

locations, Decommissioning, Deutsche Funkturm, Deutsche Telekom, Europe, Europe Insights, Germany,

Infrastructure Sharing, Investment, Lease Rates, Masts & Towers, MNOs, Network Rollout, Rooftop,

Sigfox, Site Level Profitability, Telefónica, Telxius, Tenancy Ratios, Tower Count, Towercos, Vodafone

The German tower industry, whilst considered a

relatively stable, low growth market, has started to

see a spate of activity that could alter dynamics in the

country with a potential monetisation of one tower

portfolio, a carve out of another and new investment

raised for a third. At the 2016 TowerXchange Meetup

Europe, key actors in the country met to examine

the substance behind such speculations, whilst

discussing growth opportunities in the market

and the challenges presented by the country’s

proportionally high number of rooftop sites.

www.towerxchange.com/meetups/meetup-europe | TowerXchange Europe report 2016 | 35| TowerXchange Europe report 2016 | www.towerxchange.com/meetups/meetup-europe74](https://image.slidesharecdn.com/224de5bd-d42e-46e4-ad9b-2ab6fb6b5970-160712111105/85/TX_MeetupEurope2016_Report-74-320.jpg)