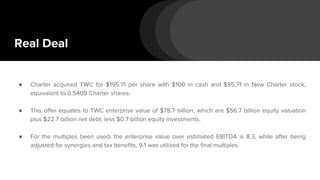

- Charter Communications acquired Time Warner Cable in May 2016 in a deal valued at $78.7 billion.

- The acquisition enhanced Charter's competitiveness by making it one of the largest television providers in the US alongside Comcast, AT&T, and Verizon.

- It also provided an opportunity for Time Warner Cable to improve its poor customer satisfaction ratings.