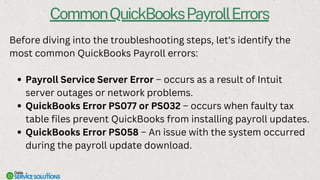

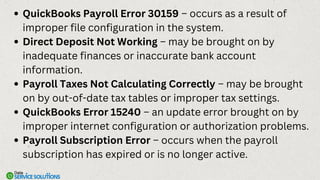

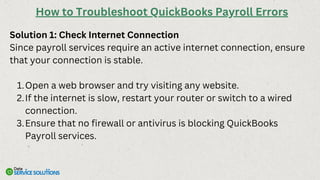

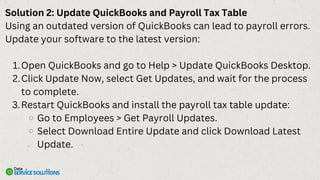

Issues with internet connectivity, out-of-date software, improper payroll setup, or security limitations can all lead to QuickBooks Payroll failures. Payroll update difficulties, direct payment problems, inaccurate tax computations, and subscription verification issues are examples of frequent errors.