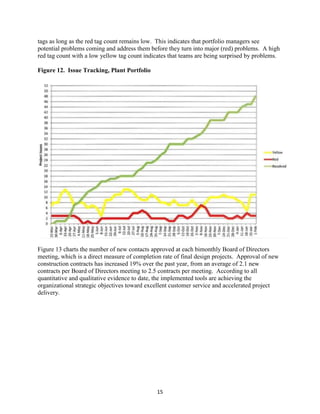

TRA manages a large capital improvement program for water and wastewater systems across northern Texas. To improve project delivery, TRA implemented a Project Execution Maturity Model focusing on collaboration, coordination, and integrated planning. As part of a pilot program, TRA created a visual portfolio board to track the status of pipeline projects. Weekly standup meetings use the board to focus on resolving issues and advancing projects, improving communication and accountability across departments.