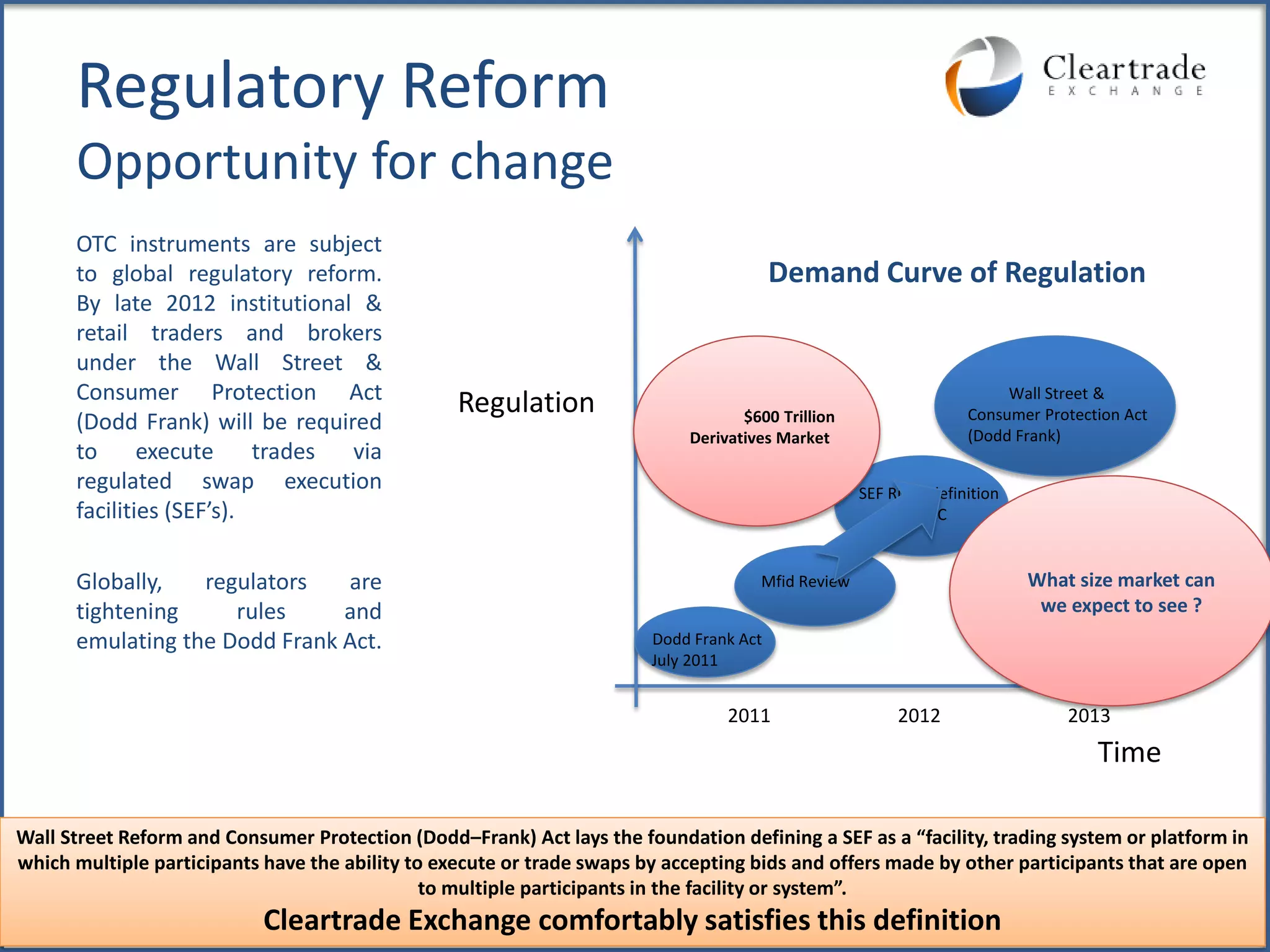

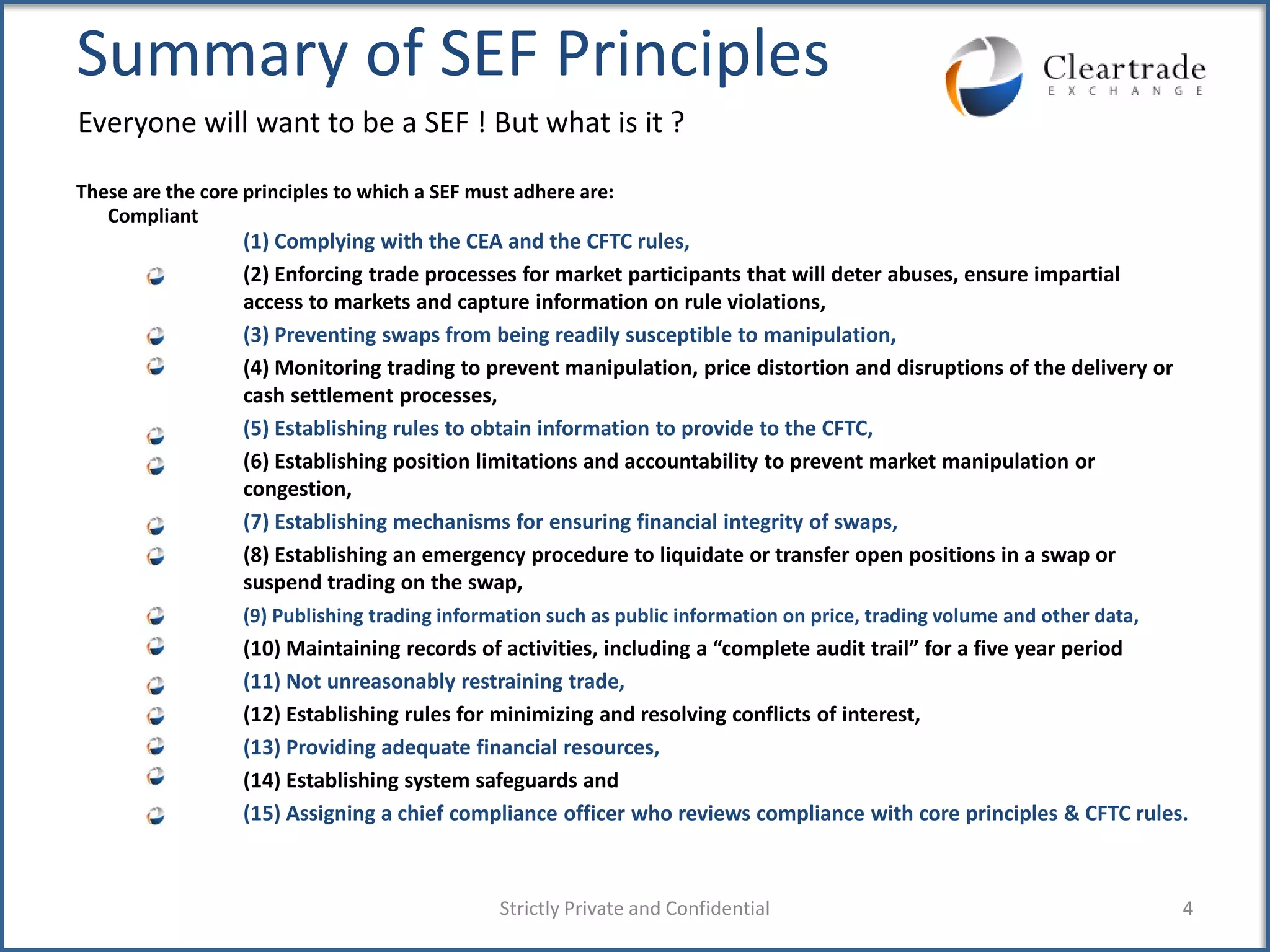

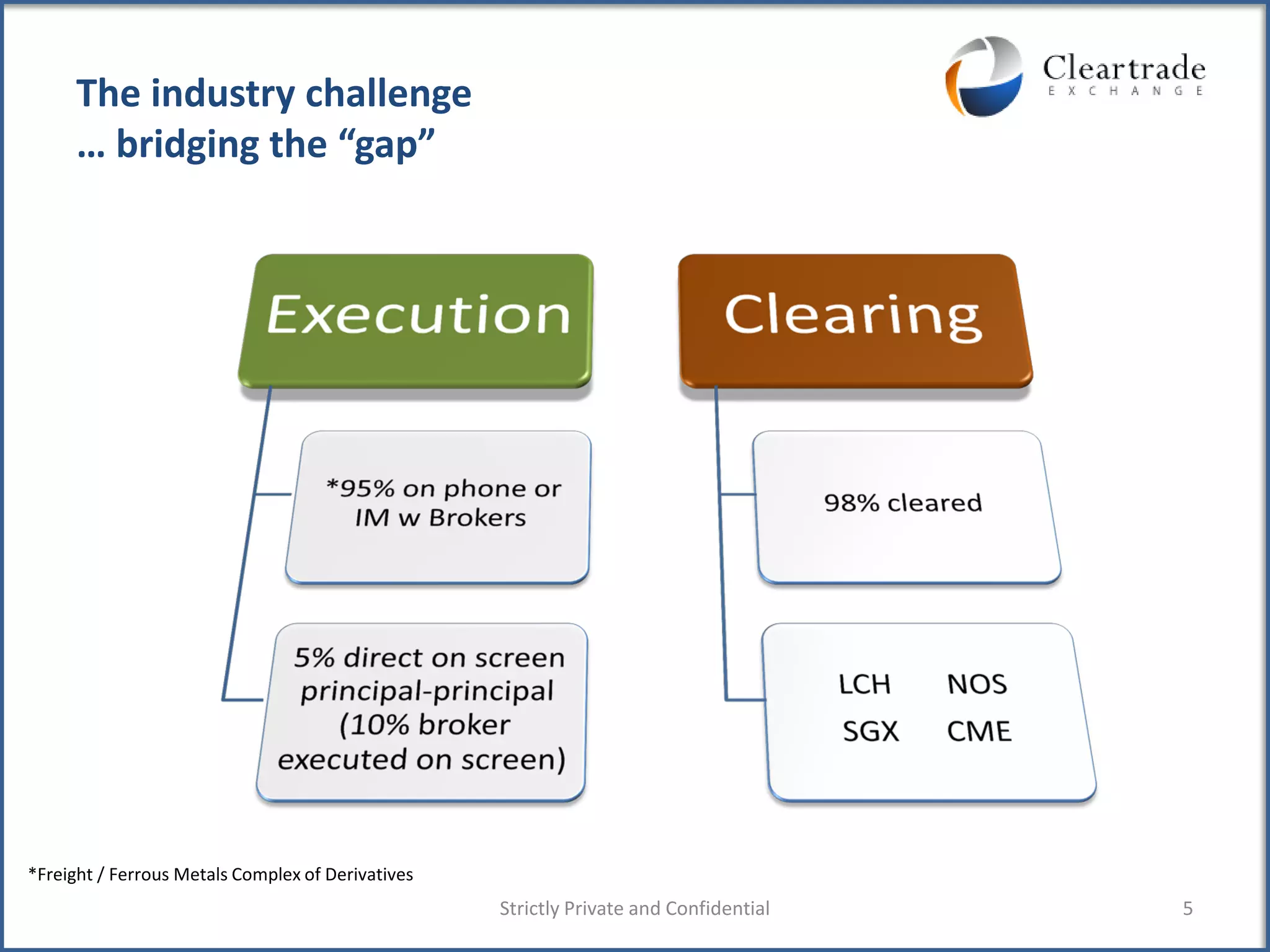

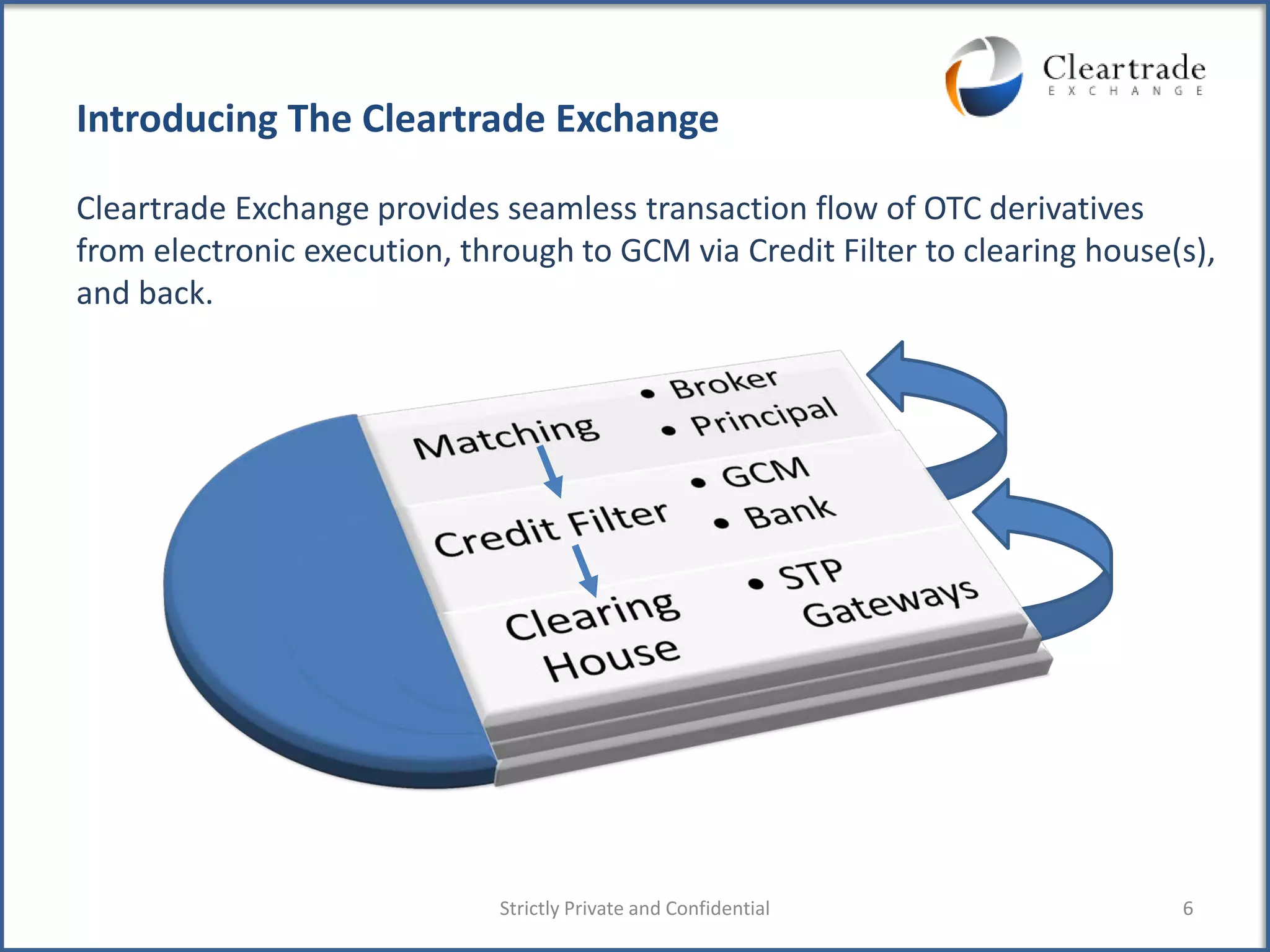

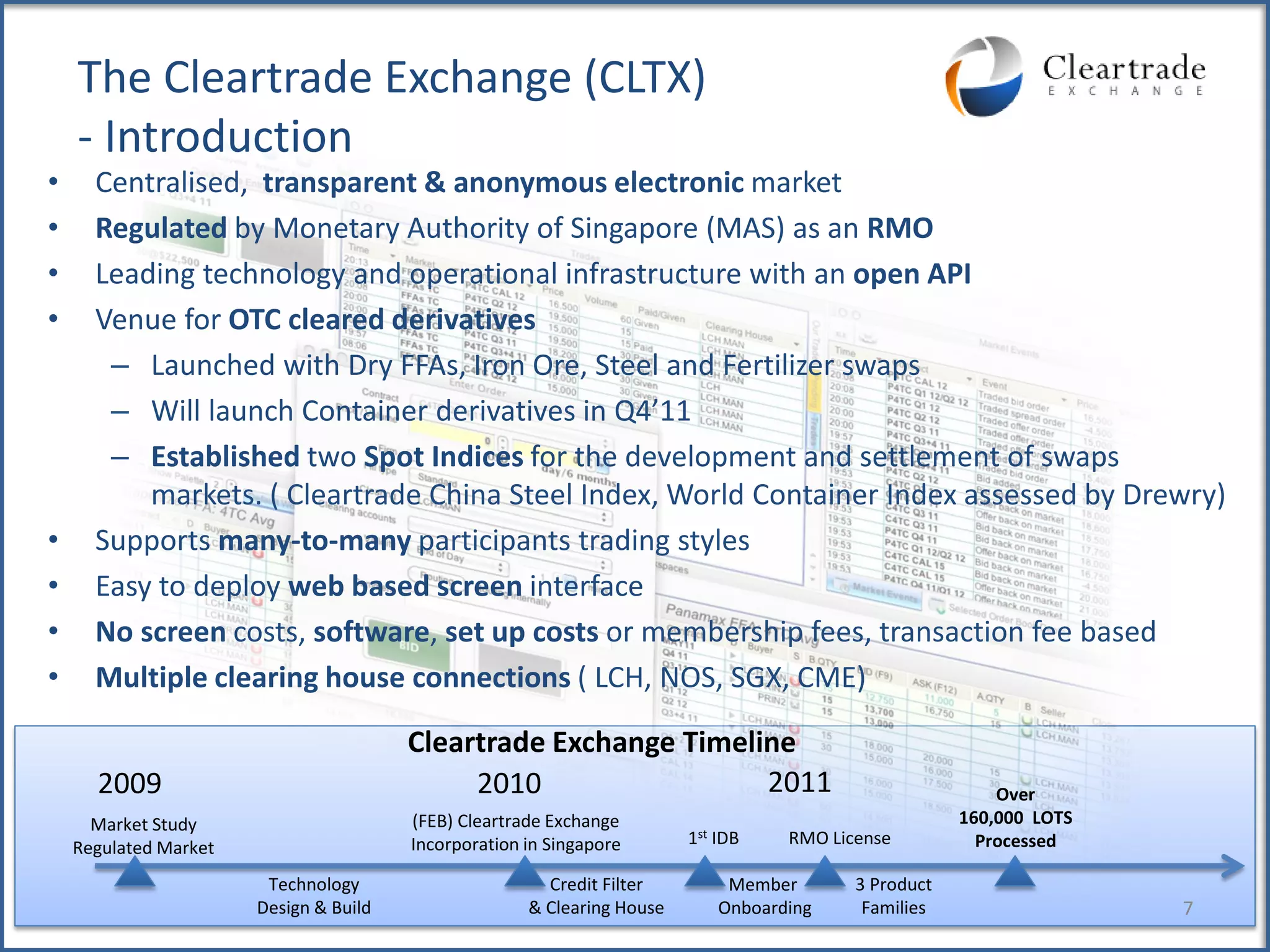

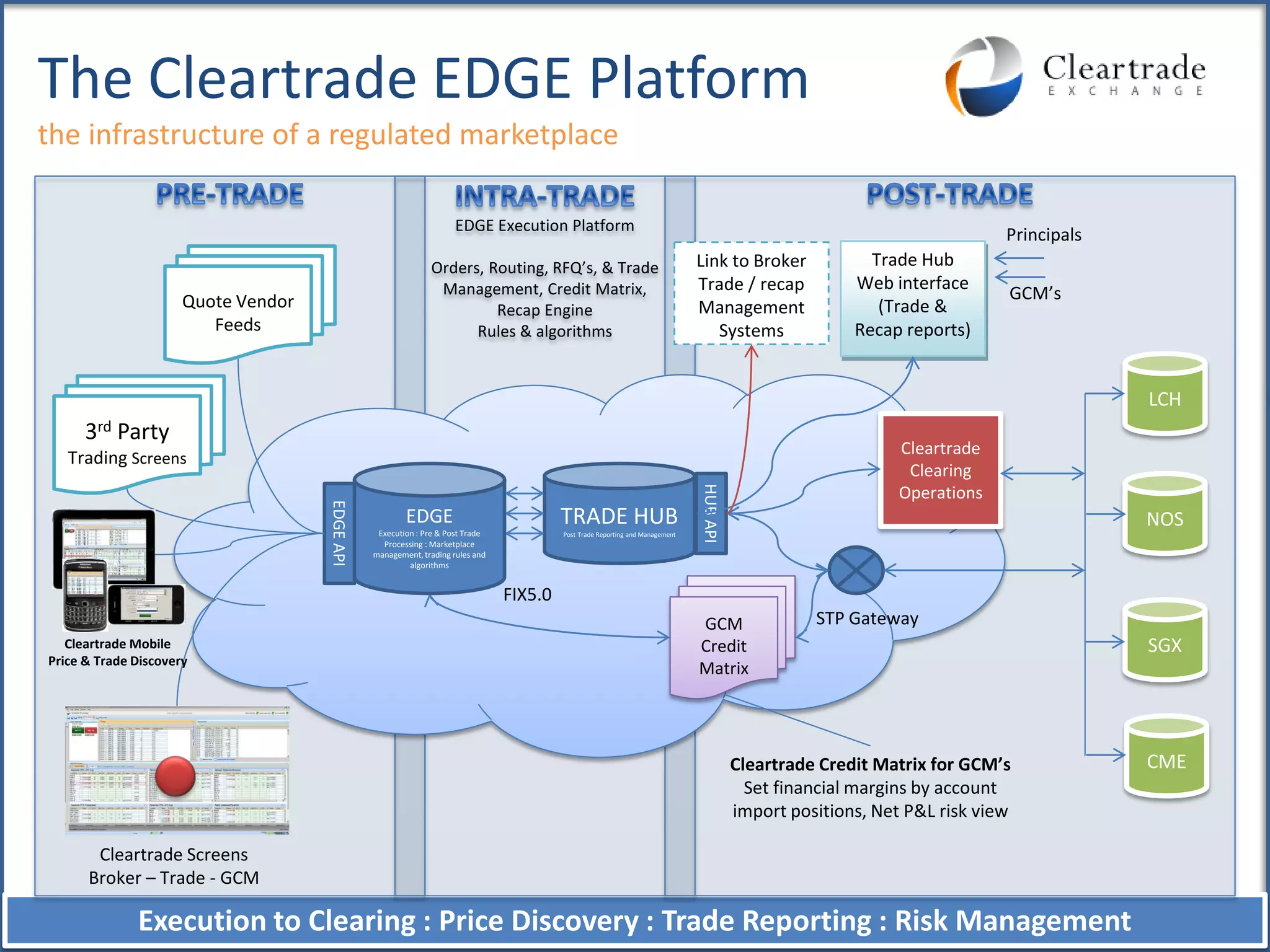

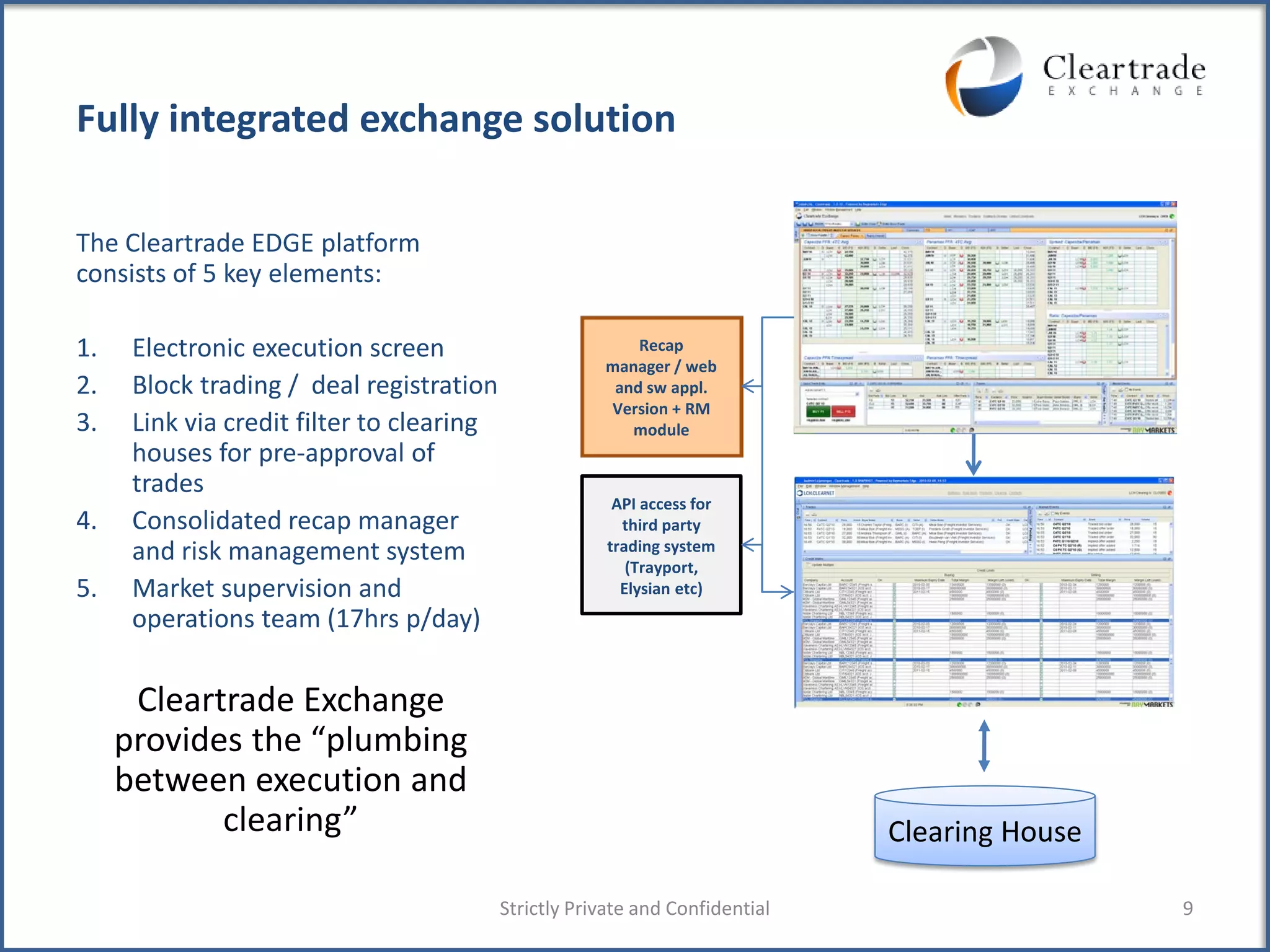

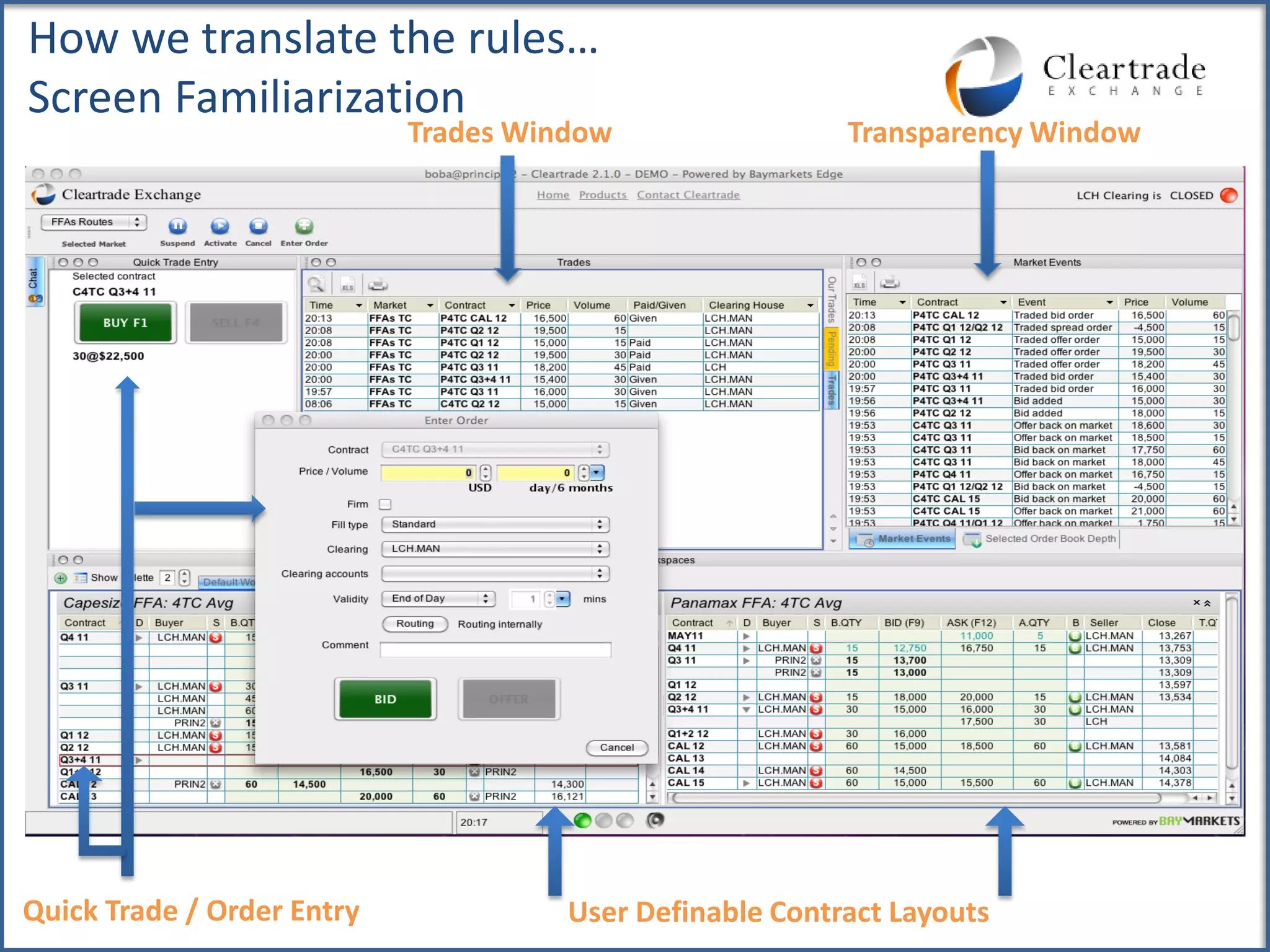

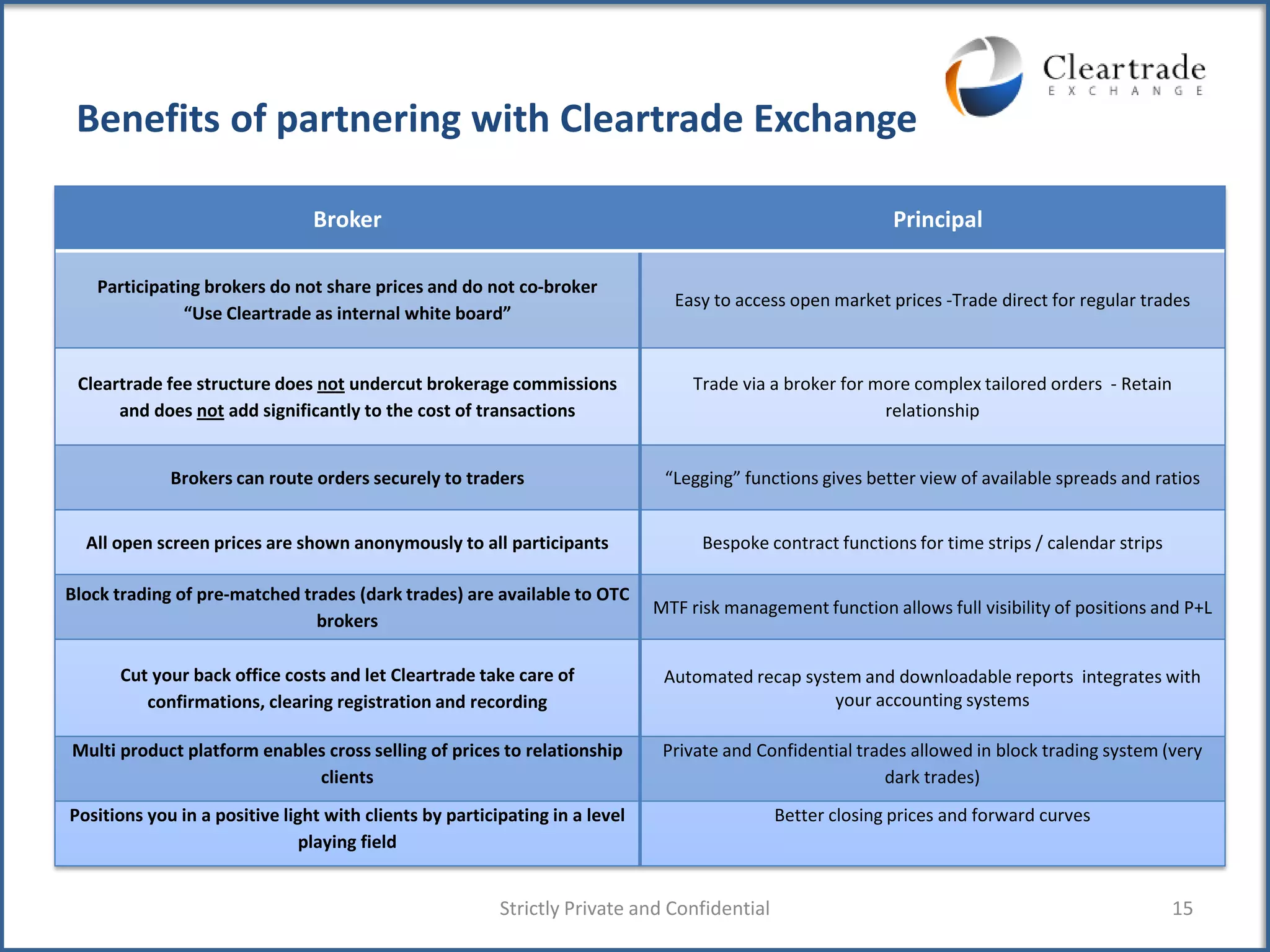

This document discusses the opportunities for Cleartrade Exchange to become a regulated market operator (RMO) for over-the-counter (OTC) derivatives under new regulations. It notes that the Dodd-Frank Act requires OTC trades to be executed on regulated swap execution facilities (SEFs) by late 2012. Cleartrade Exchange aims to satisfy this definition by providing a centralized, transparent, and anonymous electronic market for cleared OTC derivatives. Its platform offers many-to-many trading, connectivity to multiple clearinghouses, and post-trade processing to seamlessly connect trading to clearing.