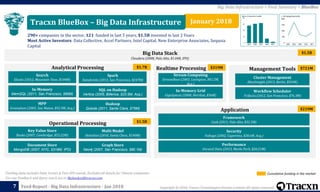

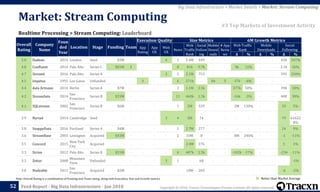

The document provides an overview of the big data infrastructure sector as of January 2018. It details that over $6 billion has been invested in the sector, with 162292 companies covered on the Tracxn platform. The top markets for investment are management tools, operational processing in graph stores, and real-time processing in stream computing. Notable companies include Cloudera, MongoDB, Hortonworks, and MarkLogic.

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

Data Collective

80

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > Data Collective

Investments

[Soonicorn] Elastic (2012, Mountain View, $104M, Series C)

Search, analyze and visualize Data

[Soonicorn] Confluent (2014, Palo Alto, $81M, Series C)

Real-time data stream platform on Apache Kafka

[Soonicorn] Trifacta (2012, San Francisco, $76.3M, Series E)

Self-service data preparation software

[Minicorn] TigerGraph (2012, Redwood City, $31M, Series A)

Graph database for massive parallel processing

[Minicorn] Fauna (2012, San Francisco, $29.5M, Series A)

A multi-model database capable to supporting SQL, document and

graphical methods of storing data

Big Data Infrastructure Notable Portfolio

[Unicorn] Uber (2009, San Francisco, $13.2B, Series G)

Mobile app that connects passengers with vehicle drivers for hire

[Unicorn] Facebook (2004, Menlo Park, $2.3B, Public)

Social networking site

[Unicorn] Zynga (2007, San Francisco, $707M, Public)

Casual games developer and publisher for mobile and web platforms

[Unicorn] Square (2009, San Francisco, $490M, Public)

Mobile point of sale provider

[Unicorn] Ginkgo Bioworks (2008, Boston, $429M, Series D)

Designs microbes to produce cultured ingredients

[Unicorn] Tango (2009, Mountain View, $367M, Series D)

Free video & voice calls app

[Unicorn] Illumio (2013, Sunnyvale, $267M, Series D)

Adaptive security platform based data center security for workloads

Other Notable Portfolio

Top Exits Recent News on Fund & Portfolio

Geographical Spread Stage of Entry

Jan 2018

Elastic Appoints Betsey Nelson to Board and Janesh

Moorjani as CFO, GlobeNewswire

Nov 2017

Elastic Releases 6.0 with New User Experience Features

for Managing and Operating the Elastic Stack,

GlobeNewswire

Nov 2017 Elastic acquires search startup Swiftype, TechCrunch

Nov 2017

Elasticsearch expands presence in big data analysis, The

Korea Times

Oct 2017

Elastic Partners with Alibaba Cloud to Deliver

Elasticsearch on Alibaba Cloud, GlobeNewswire

Sep 2017

Elastic Delivers ArcSight Integration for Flexible, Scalable,

and Real-Time Security Analytics Capabilities,

GlobeNewswire

Jun 2017 Elastic Acquires Opbeat, APMdigest

May 2017

Elastic Adds Machine Learning into the Elastic Stack,

GlobeNewswire

Apr 2017

Google to add open-source search engine Elasticsearch to

its Cloud Platform, SiliconAngle

None

1 1 1

2

1

3

2

1

1

1

2013 2014 2015 2016 2017 2018

Follow On New Investments

4

-

1

4

9

Undisclosed

Series C+

Series B

Series A

Seed18

-

-

-

-

US](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-80-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

Blumberg Capital

81

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > Blumberg Capital

People

Investments

[Unicorn] Nutanix (2009, San Jose, $340M, Public)

Converged Compute and storage infrastructure

[Unicorn] Hootsuite (2008, Vancouver, $250M, Series B)

Social Media Management System

[Soonicorn] Kreditech (2012, Hamburg, $281M, Series C)

Personal lending based on big data points

[Soonicorn] Addepar (2009, Mountain View, $206M, Series D)

Portfolio tracker for investors and advisors.

[Soonicorn] Fundbox (2012, Tel Aviv, $108M, Series C)

Invoice Financing for SMEs

[Soonicorn] Yotpo (2011, Tel Aviv, $101M, Series D)

Generates Reviews from Customers

[Soonicorn] Credorax (2007, Herzliya, $80M, Series B)

Smart acquiring and next generation payment processing

[Soonicorn] Revionics (2002, Austin, $56.7M, Series D)

Solutions for optimization of pricing, promotions, markdown, space

and assortment

[Soonicorn] CoverHound (2010, San Francisco, $53M, Series C)

Insurance marketplace for comparing and purchasing insurance plans

[Soonicorn] Zooz (2010, Tel Aviv, $40.5M, Series C)

Technology payment platform with smart routing facility

[Soonicorn] Zeek (2013, Tel Aviv, $12.5M, Series B)

Marketplace for used gift cards.

[Minicorn] Deep Instinct (2015, Tel Aviv, $32M, Series B)

Deep learning based threat detection against APT & zero-day threats

[Minicorn] Trulioo (2009, Vancouver, $25.3M, Series B)

Global ID Verification services & analytics with cyber identity data

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

David J.

Blumberg

Founder & Managing

Partner

Geographical Spread Stage of Entry

Dec 2017

Panoply, Chartio and Stitch Partnership Offers World’s

First Automatic Cloud Data Stack, Business Wire

Nov 2017

Panoply accelerates data integration with its smart data

warehouse, SiliconAngle

Oct 2017 Panoply Funding Climbs to $13 Million, DEVOPSdigest

Sep 2017

Panoply Raises $5M Series A Funding To Provide Smart

And Agile Data Warehouse Solution, Tech Company News

Aug 2016

Panoply.io raises $7M Series A for its data analytics and

warehousing platform, TechCrunch

None

1 1

2

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

-

-

2

Undisclosed

Series C+

Series B

Series A

Seed1

1

-

-

-

Israel

US](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-81-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

Mayfield

82

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > Mayfield

Investments

[Unicorn] Lyft (2012, San Francisco, $4.2B, Series H)

On-Demand Taxi

[Soonicorn] Adknowledge (2004, Kansas City, $262M, Series D)

Digital Marketing Technology For Advertisers

[Soonicorn] Poshmark (2011, Menlo Park, $203M, Series E)

Mobile P2P Marketplace for fashion products

[Soonicorn] ClassPass (2011, New York City, $154M, Series C)

Membership programs for fitness classes across multiple gyms

[Soonicorn] 3D Robotics (2009, Berkeley, $152M, Series D)

Develops both consumer and commercial drones & autopilot systems

[Soonicorn] Webroot (1997, Broomfield, $109M, Series A)

Endpoint protection suite and threat intelligence platform

[Soonicorn] FiveStars (2011, San Francisco, $105M, Series C)

Customer loyalty program which integrates with merchant POS

systems

[Soonicorn] Centrify (2004, Sunnyvale, $94M, Series E)

Unified identity and access management for enterprise

[Soonicorn] Lendingkart (2014, Ahmedabad, $66.2M, Series C)

Online platform that provides working capital for SMBs in India

[Soonicorn] Amagi (2008, Bangalore, $60.7M, Series D)

Cloud based Localised Advertising on National TV Channels

[Soonicorn] BigPanda (2012, San Francisco, $57.5M, Series B)

Data analytics based automated IT incident management solution

[Soonicorn] Versa Networks (2012, Cupertino, $57.4M, Series

B)

SD-WAN and SD-Security solutions based on NFV

Other Notable Portfolio

Top Exits Recent News on Fund & Portfolio

Geographical Spread Stage of Entry

Jan 2018

MapR Recognized for Enterprise Internet of Things (IoT)

Innovation , GlobeNewswire

Jan 2018

MapR Names John Schroeder Chairman and Chief

Executive Officer, Business Wire

Jan 2018

MapR Extends Open Approach to Governance Across All

Enterprise Data, GlobeNewswire

Dec 2017

Podium Achieves Certification on MapR Converged Data

Platform, GlobeNewswire

Dec 2017

MapR names new A/NZ country manager in partner

engagement push, Reseller

Dec 2017

MapR Recognized by InformationWeek, The Tech Tribune

and Stevie Award for Women in Business , GlobeNewswire

Dec 2017

MapR Speeds Up Secure BI/Analytics for Operational

Data, eWEEK

Nov 2017

Xcalar Teams with MapR To Deliver High-Performance

Data Access for Advanced Analytics, PRWeb

Oct 2017

MapR Recognized for Converged Big Data Platform; Doug

Natal Comments, ExecutiveBiz

None

1

2 2

1

2

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

1

1

-

1

Undisclosed

Series C+

Series B

Series A

Seed2

1

-

-

-

US

Latam](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-82-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

Alchemist Accelerator

130

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > Alchemist Accelerator

Investments

[Minicorn] LaunchDarkly (2014, Oakland, $32.3M, Series B)

Early User Feedback capture

[Minicorn] Clear Metal (2015, San Francisco, $12M, Series A)

Analytics platform for container shipping industry

[Minicorn] Sense.ly (2013, San Francisco, $11.5M, Series B)

Platform with a virtual nurse for health care monitoring and

management

[Minicorn] MoEngage (2014, Bangalore, $5M, Series A)

Mobile based platform for personalized marketing

[Minicorn] PlayVox (2012, San Francisco, $2.2M, Series A)

Employee Engagement Software for Call centers

[Minicorn] ShoppinPal (2011, Pune, $1.6M, Series A)

Mobile commerce platform for brick & mortar retail stores

Other Notable Portfolio

Top Exits Recent News on Fund & Portfolio

Geographical Spread Stage of Entry

May 2015

Qbox leverages $120K Lighter Capital loan to increase

gross margin, Lighter Capital

Aug 2013

StackSearch Announces $260,000 Funding Round,

Innovate Arkansas

Apr 2013 ARK Challenge is a game changer for three startups, Qbox

None

1

2

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

-

-

3

Undisclosed

Series C+

Series B

Series A

Seed3

-

-

-

-

US](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-130-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

Magma Venture Partners

131

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > Magma Venture Partners

People

Investments

[Soonicorn] AppsFlyer (2011, Herzliya, $84M, Series C)

Mobile App Tracking & Campaign Measurement

[Soonicorn] Magisto (2009, Ness Ziona, $20.5M, Series C)

Video editing app

[Minicorn] Innoviz Technologies (2016, Kfar Saba, $82M,

Series B)

Low-cost high definition solid-state LiDAR

[Minicorn] Indegy (2014, Haifa, $18M, Series A)

Industrial firewall based ICS security solution

[Minicorn] Avanan (2014, New York City, $16.4M, Series A)

Cloud based CASB solution

[Minicorn] TabTale (2010, Ramat Hasharon, $13.5M, Series A)

Developer and publisher of interactive games and educational apps for

kids

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Yahal Zilka

Co-Founder &

Managing Partner

Modi Rosen

Co-Founder &

Managing Partner

Geographical Spread Stage of Entry

Oct 2017

ScyllaDB Acquires Seastar.io Database-as-a-Service

Technology, PRWeb

Mar 2017

iguazio Demos Industry’s First Integrated Real-Time

Continuous Analytics Solution, DATAVERSITY

Mar 2017

ScyllaDB Takes on Cassandra to Boost Efficiency, Reduce

Latency, The New Stack

Mar 2017 ScyllaDB grabs $16 mln Series B, PE Hub

Dec 2016 Xplenty Raises $4M from Bain Capital Ventures, Citybizlist

None

1 11 1

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

1

1

1

Undisclosed

Series C+

Series B

Series A

Seed3

-

-

-

-

Israel](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-131-320.jpg)

![Copyright © 2018, Tracxn Technologies Private Limited. All rights reserved.Feed Report - Big Data Infrastructure - Jan 2018

500 Startups

132

Portfolio in Big Data Infrastructure | Exits | Funds Link | Website | LinkedIn | Twitter

Big Data Infrastructure > Investors > 500 Startups

People

Investments

[Unicorn] Grab (2012, Singapore, $3.4B, Series G)

Taxi Booking App

[Unicorn] Credit Karma (2007, San Francisco, $370M, Series D)

Aggregator of various consumer financial products.

[Unicorn] Twilio (2007, San Francisco, $240M, Public)

Cloud Communications API provider

[Unicorn] Canva (2012, Surry Hills, $82.6M, Series B)

Online design platform

[Soonicorn] Udemy (2010, San Francisco, $173M, Series D)

Marketplace for online courses

[Soonicorn] Smule (2008, San Francisco, $144M, Series F)

Developer of social music-making & sharing apps

[Soonicorn] Intercom (2011, San Francisco, $116M, Series D)

Customer communication and Retention Platform

[Soonicorn] Ipsy (2011, San Mateo, $107M, Series B)

Subscription for beauty products

[Soonicorn] Life360 (2008, San Francisco, $94.6M, Series C)

Mobile app that connects family members and close friends

[Soonicorn] VTS (2011, New York City, $87.8M, Series C)

Leasing and asset management software for brokers, investors &

owners.

[Soonicorn] SendGrid (2009, Boulder, $80.5M, Public)

Email delivery and analytics

[Soonicorn] Tradesy (2012, Santa Monica, $79.7M, Series C)

Mobile based P2P marketplace to buy and sell clothing items

[Soonicorn] VivaReal (2009, Sao Paulo, $74.5M, Series C)

Real estate marketplace in Latin America

Other Notable Portfolio

Top Exits

Recent News on Fund & Portfolio

Dave McClure

Founder, Partner

Geographical Spread Stage of Entry

Dec 2017

Panoply, Chartio and Stitch Partnership Offers World’s

First Automatic Cloud Data Stack, Business Wire

Nov 2017

Panoply accelerates data integration with its smart data

warehouse, SiliconAngle

Oct 2017 Panoply Funding Climbs to $13 Million, DEVOPSdigest

Sep 2017

Panoply Raises $5M Series A Funding To Provide Smart

And Agile Data Warehouse Solution, Tech Company News

Aug 2016

Panoply.io raises $7M Series A for its data analytics and

warehousing platform, TechCrunch

None

11

2013 2014 2015 2016 2017 2018

Follow On New Investments

-

-

-

-

1

Undisclosed

Series C+

Series B

Series A

Seed1

-

-

-

-

Israel](https://image.slidesharecdn.com/finalreportbig-datainfrastructurelonglist1516798130361-180131114652/85/Tracxn-Big-Data-Infrastructure-Startup-Landscape-132-320.jpg)