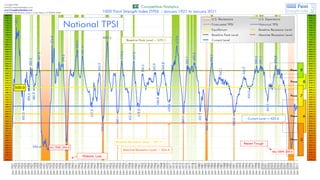

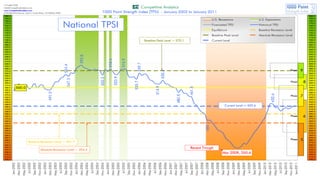

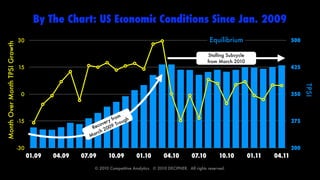

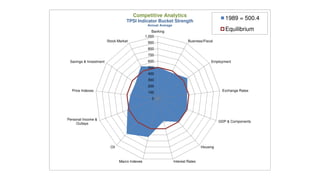

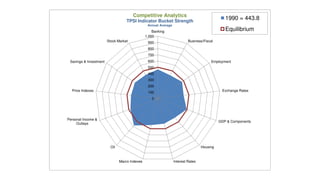

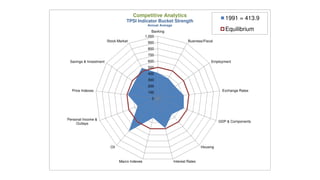

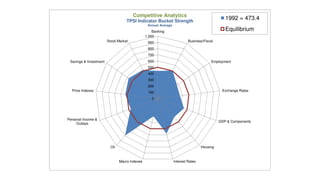

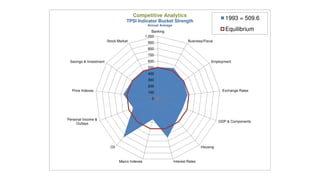

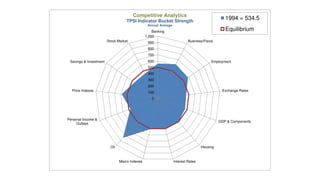

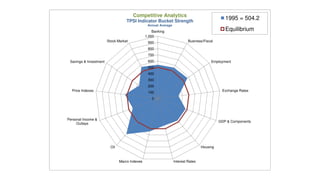

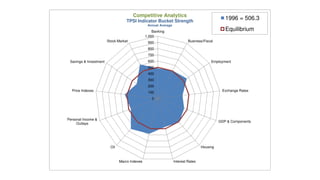

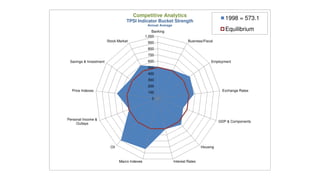

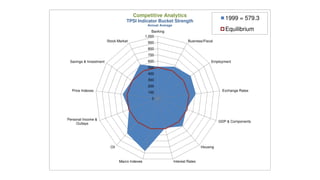

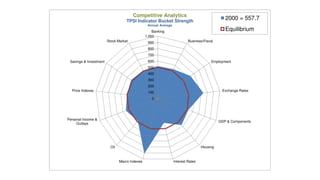

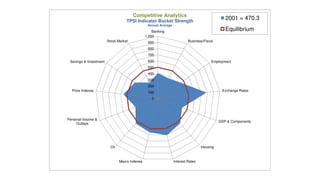

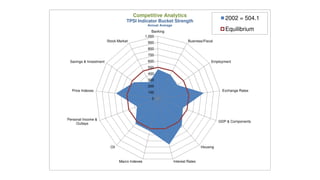

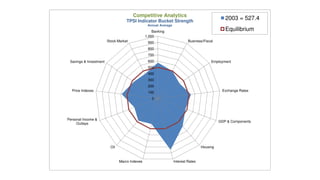

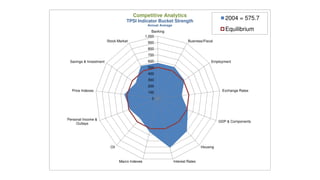

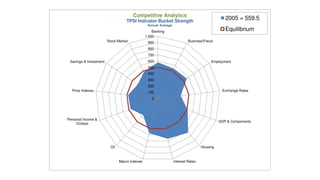

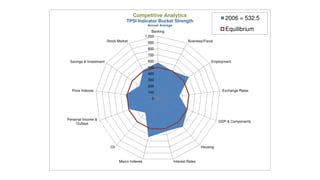

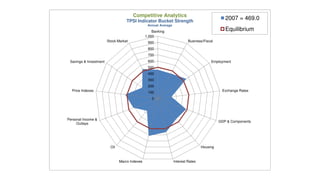

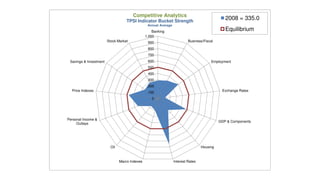

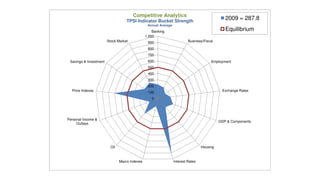

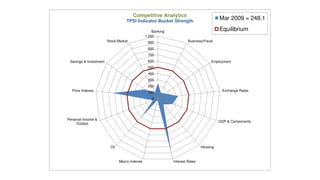

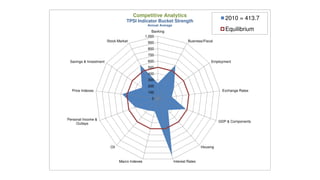

The document discusses the U.S. National Economic Tpsi (Thousand Point Strength Index), which illustrates cyclical trends in the economy characterized by phases of robust growth followed by contraction. It emphasizes the tendency of the economy to oscillate above and below sustainable growth levels, and the importance of understanding these dynamics through a normalized equilibrium level of 500.0. Additionally, the document includes observations on changes in Tpsi values over time and highlights the philosophical and psychological underpinnings of economic behavior.