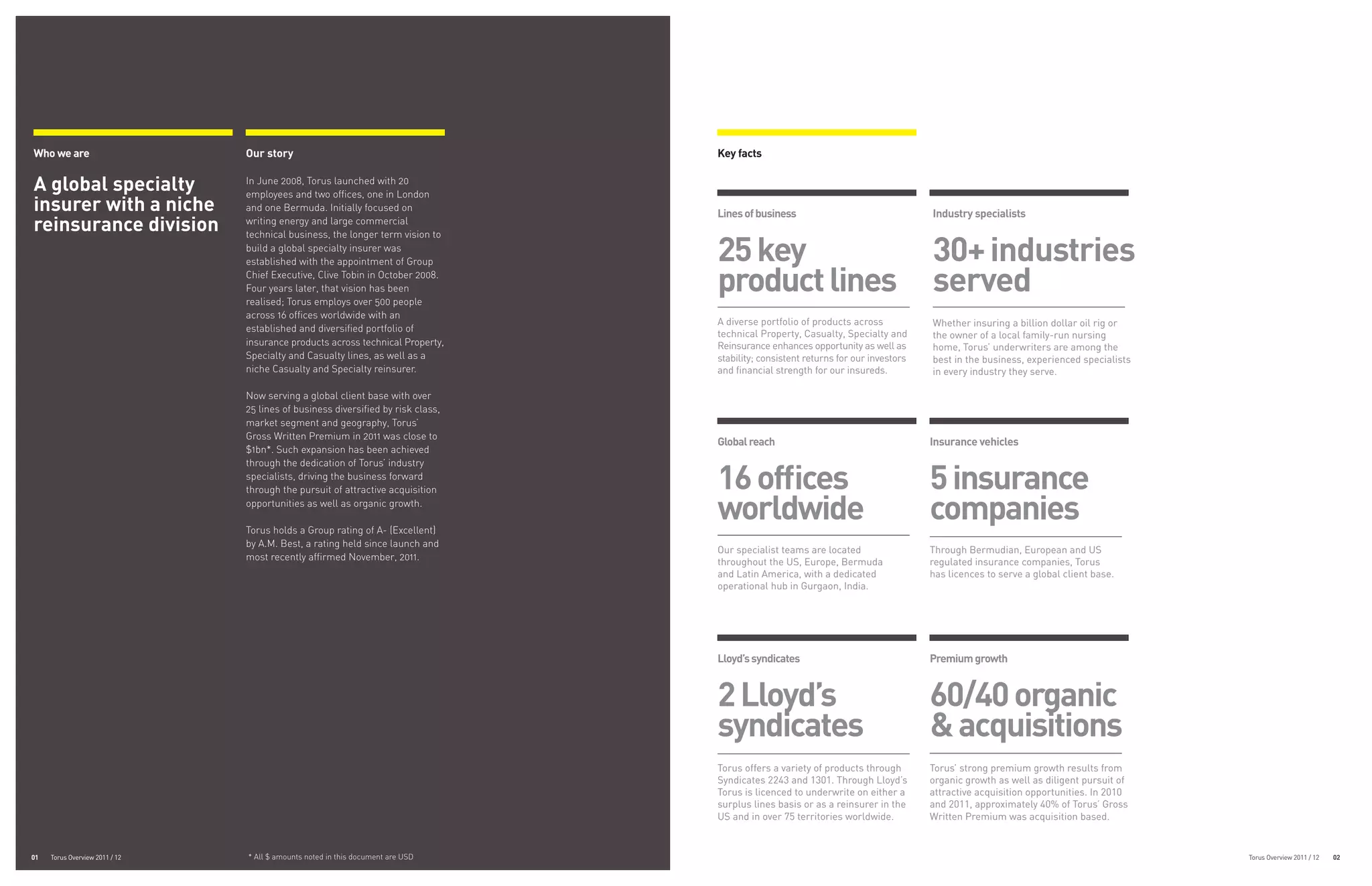

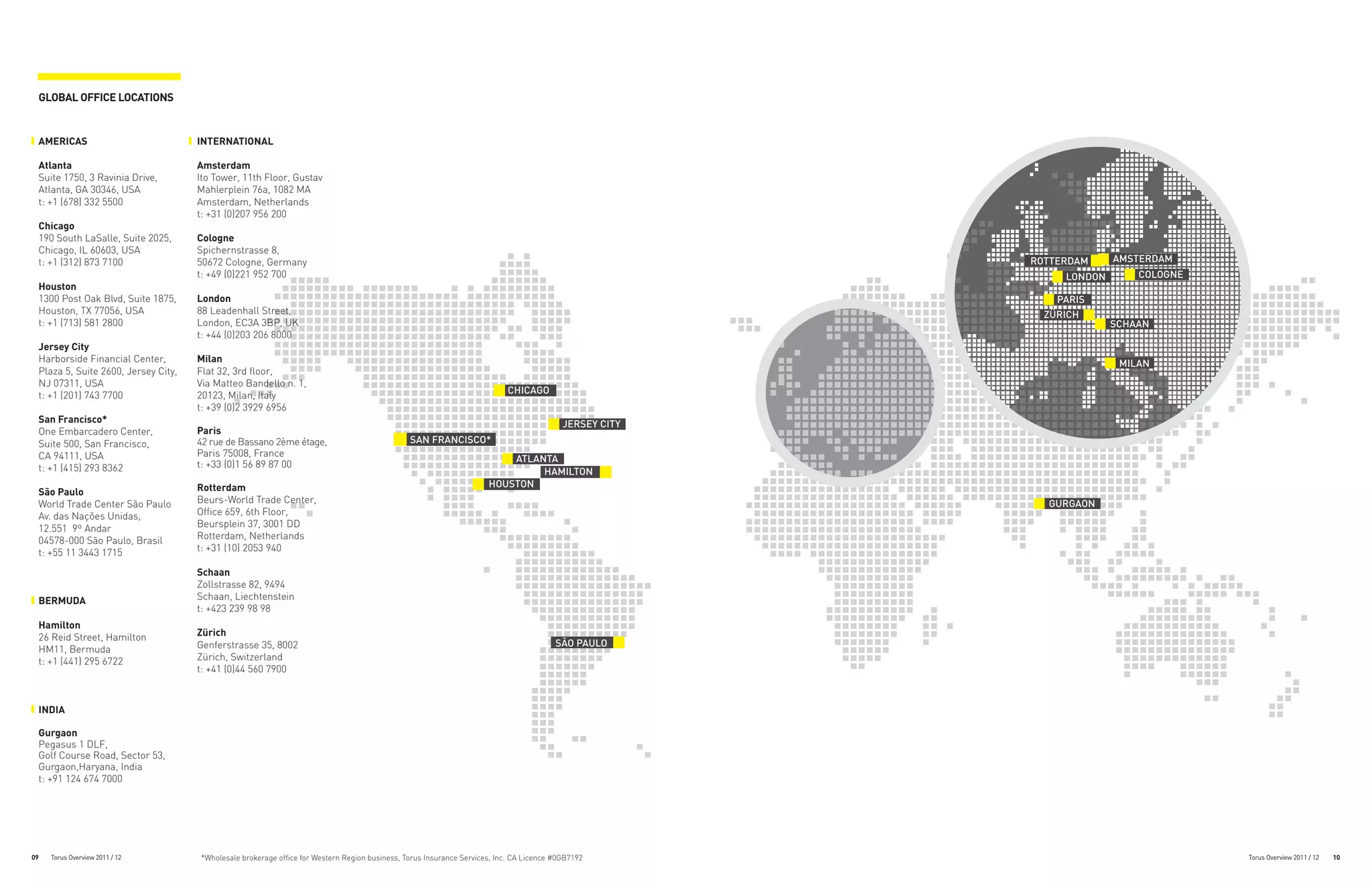

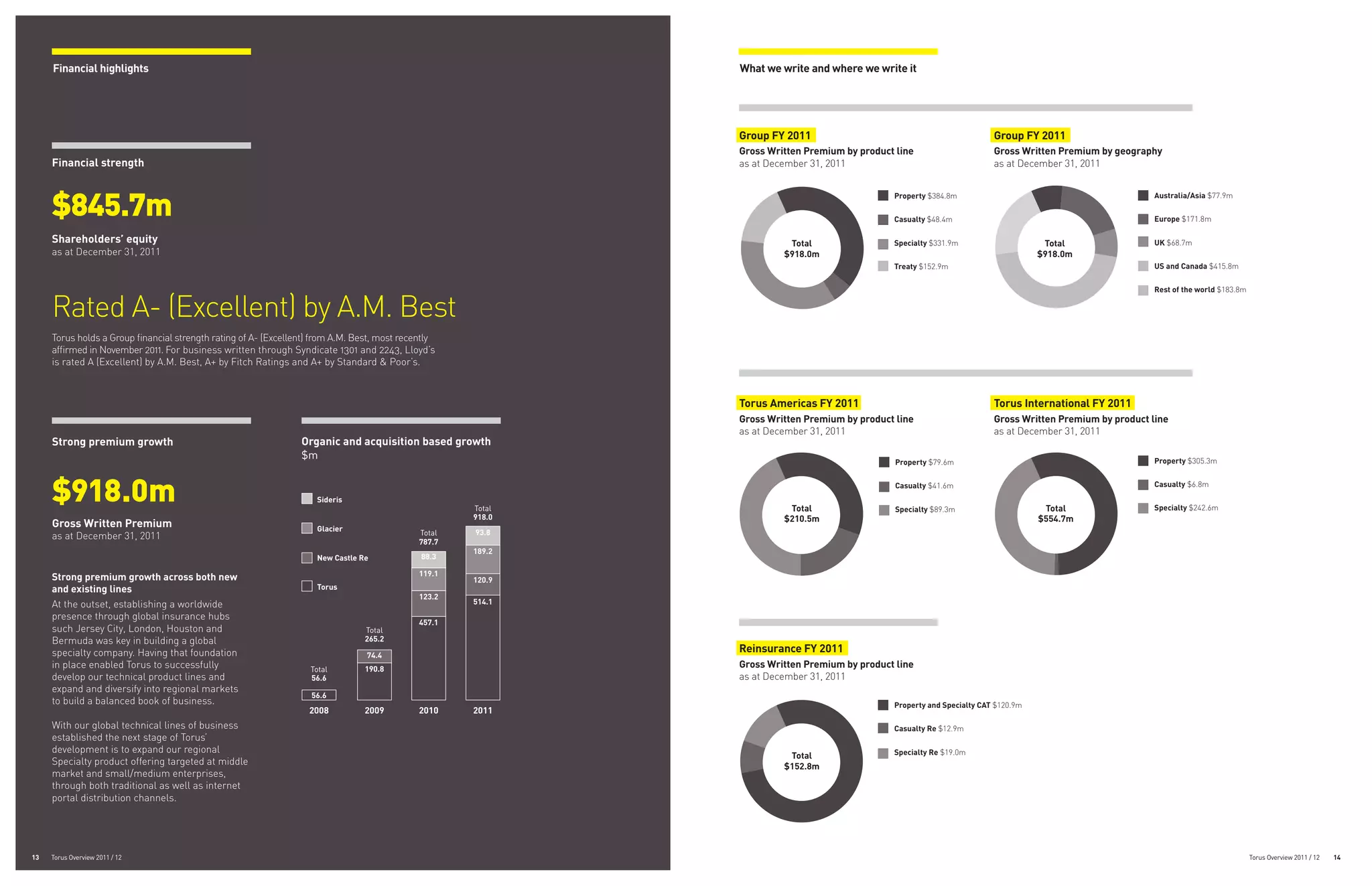

Torus is a global specialty insurer with over 500 employees across 16 offices worldwide. It offers 25 product lines across property, casualty, and specialty insurance. Torus has experienced strong growth since launching in 2008, both organically and through acquisitions, with gross written premium reaching nearly $1 billion in 2011. It operates through regulated insurance companies in Bermuda, Europe, and the US, as well as two Lloyd's syndicates.