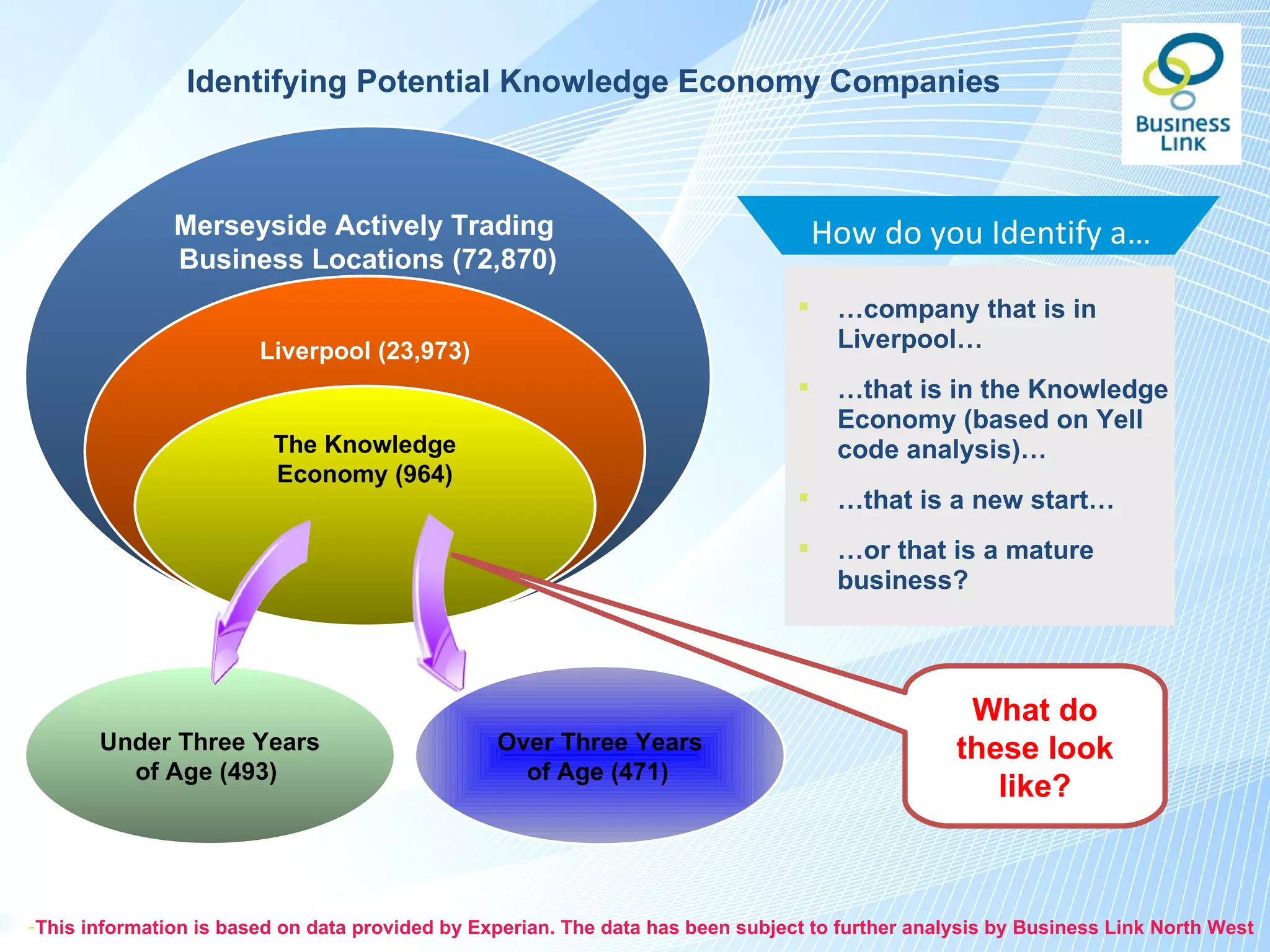

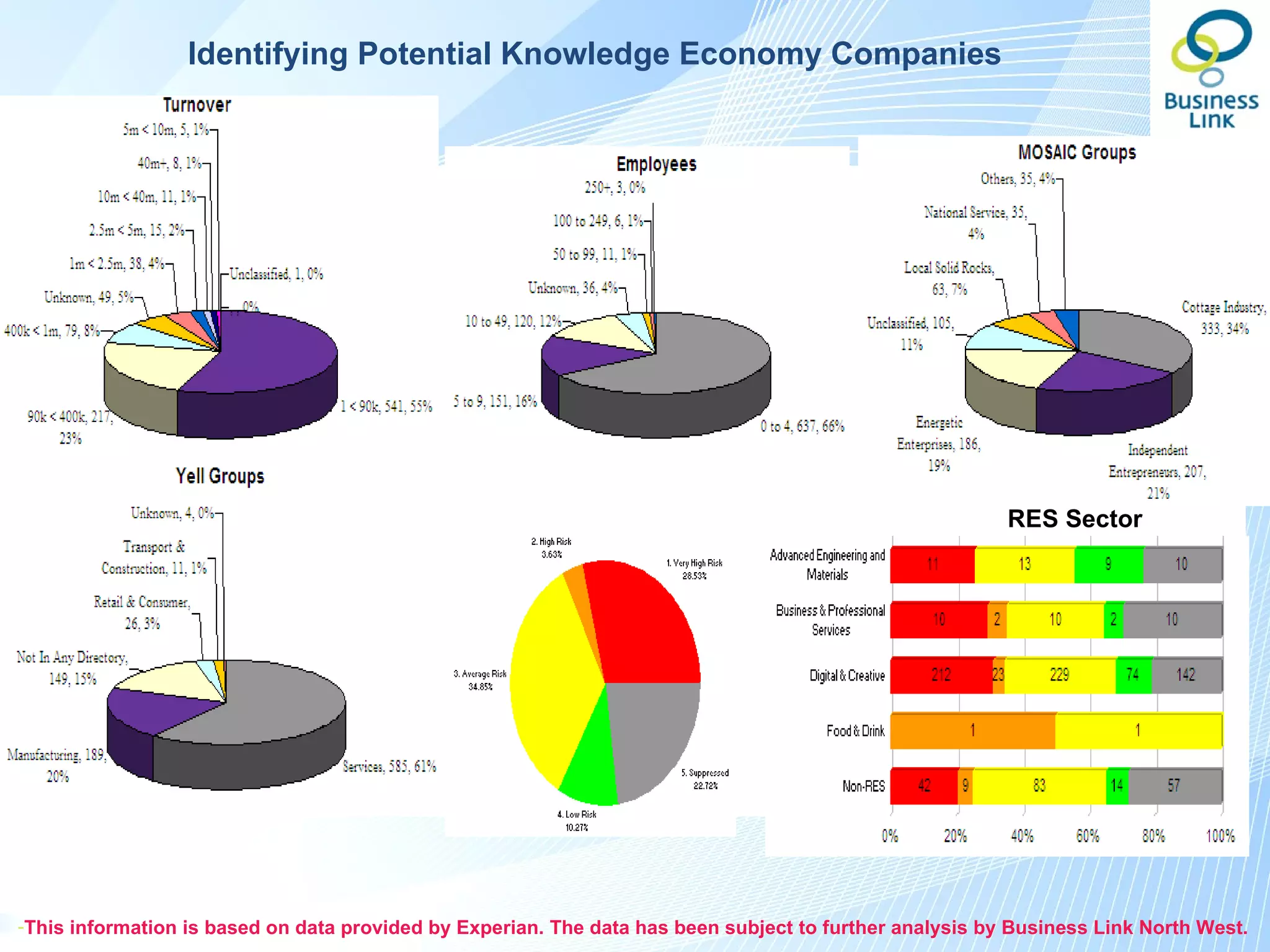

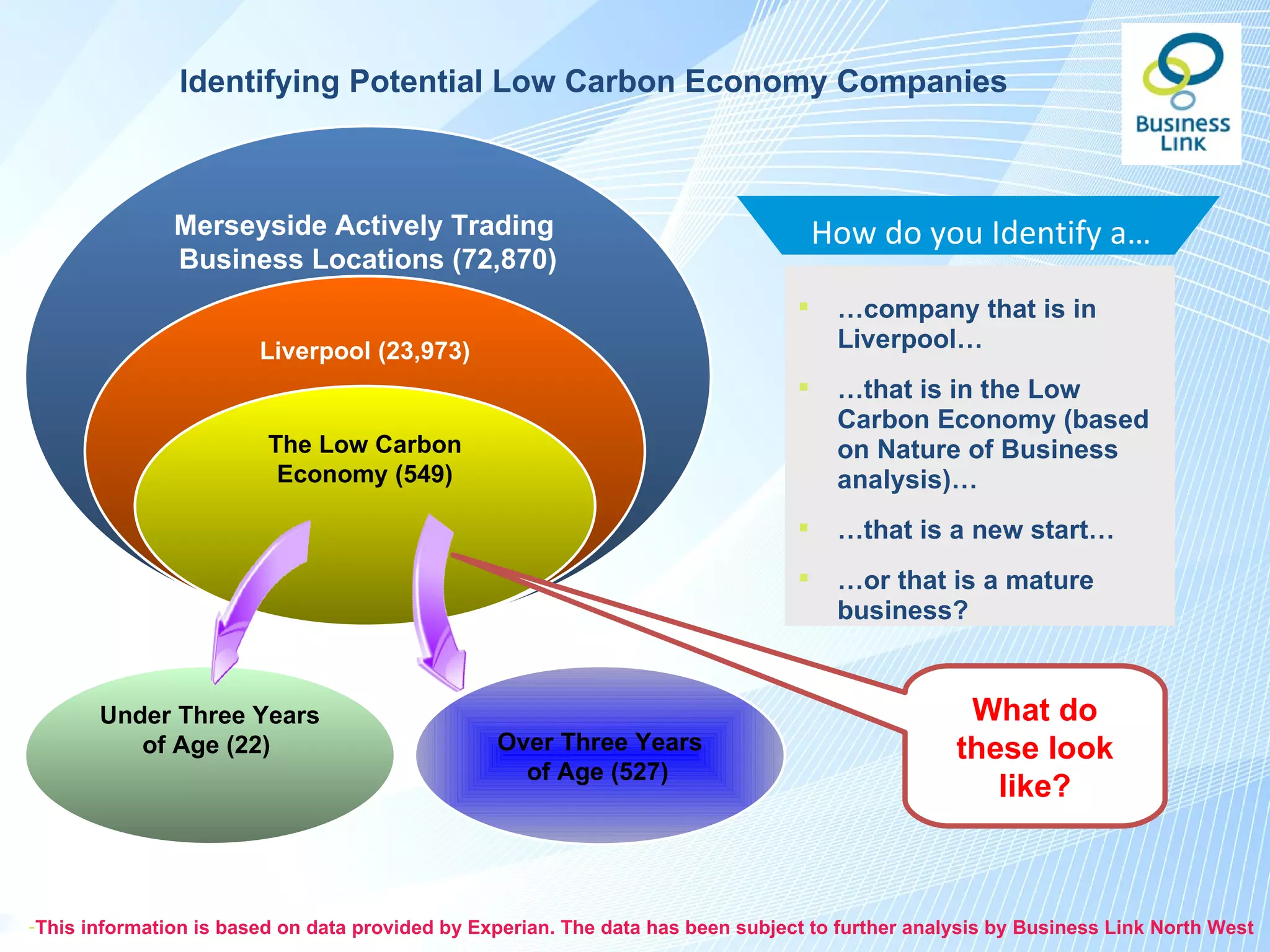

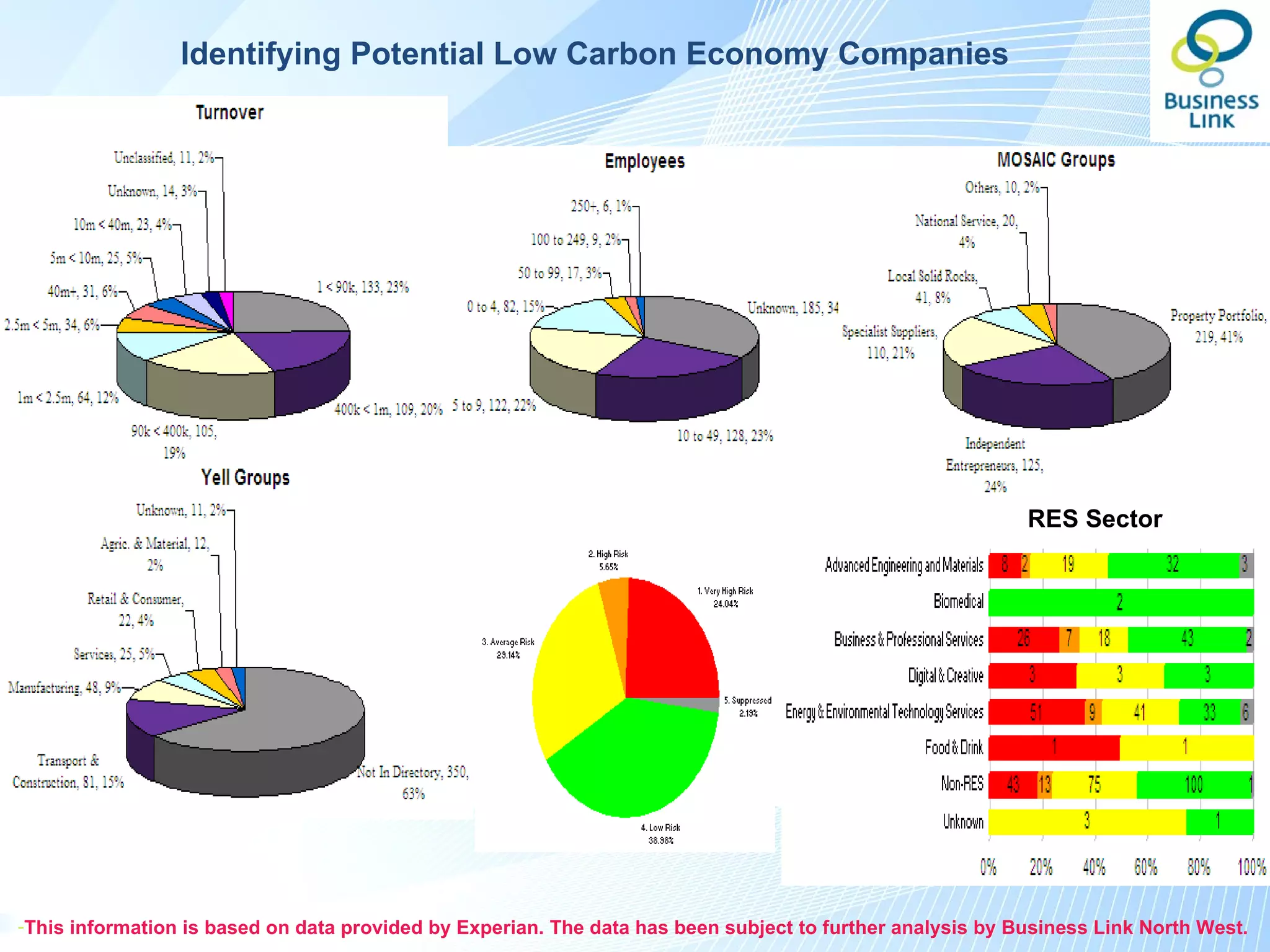

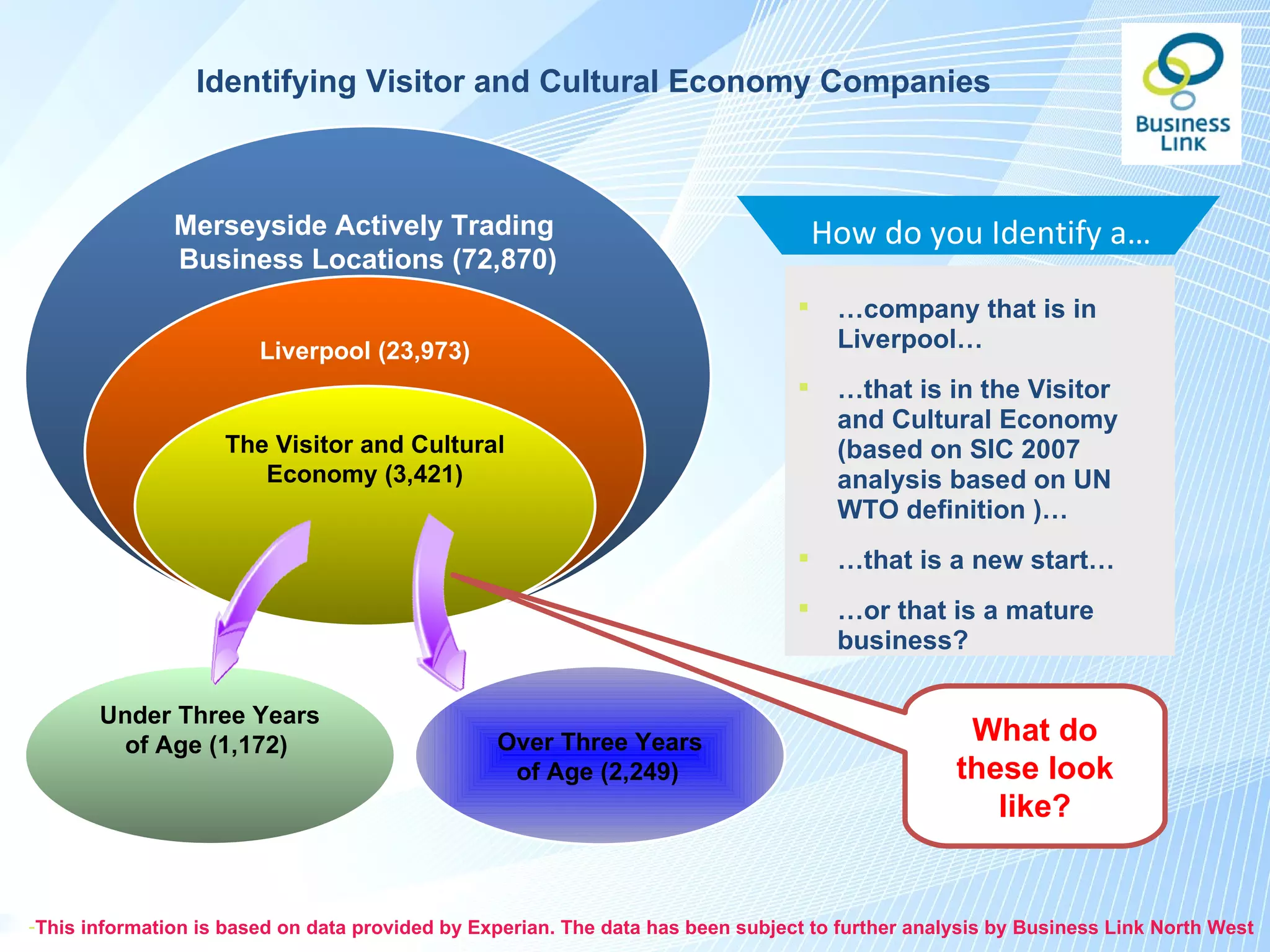

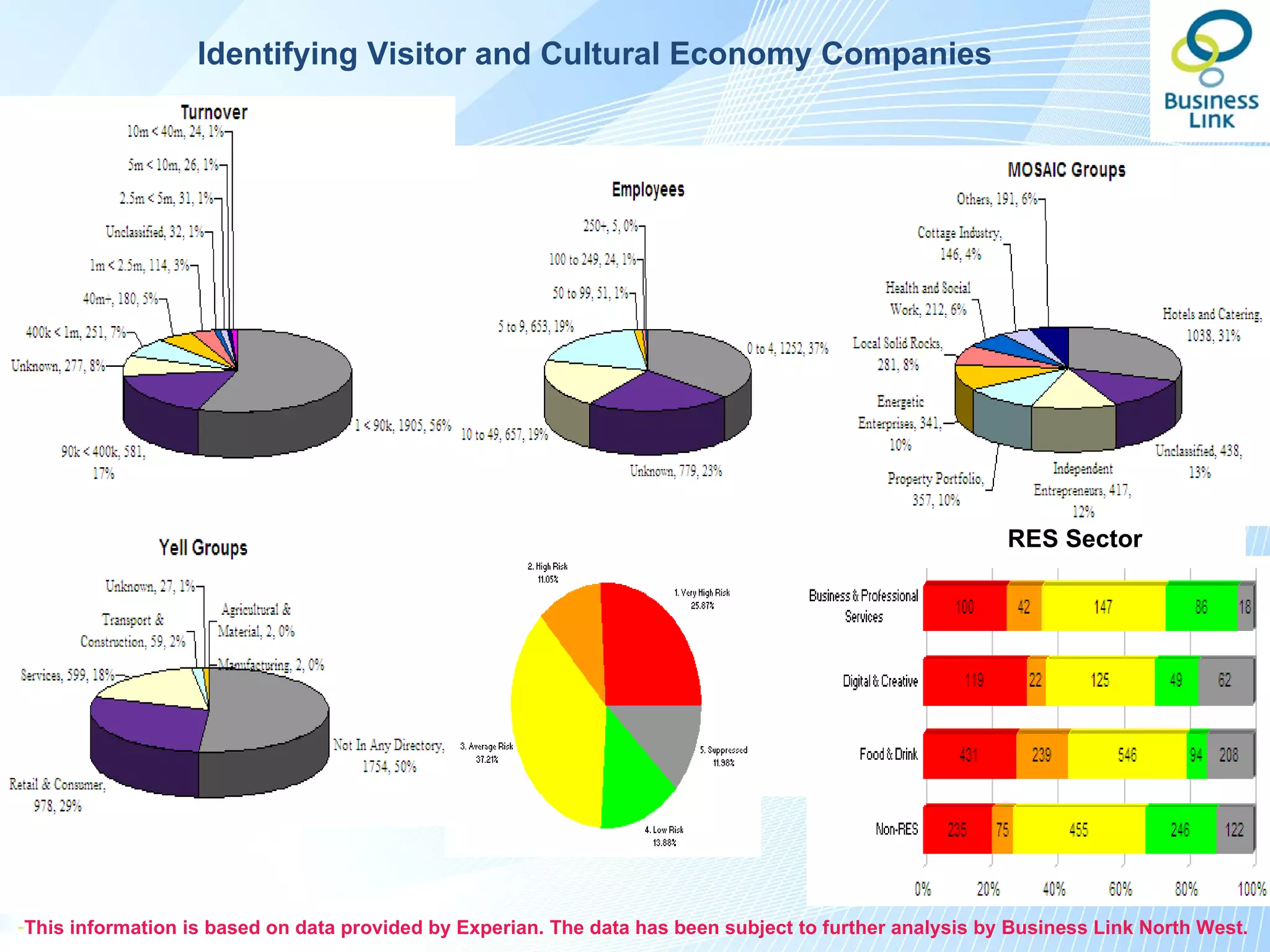

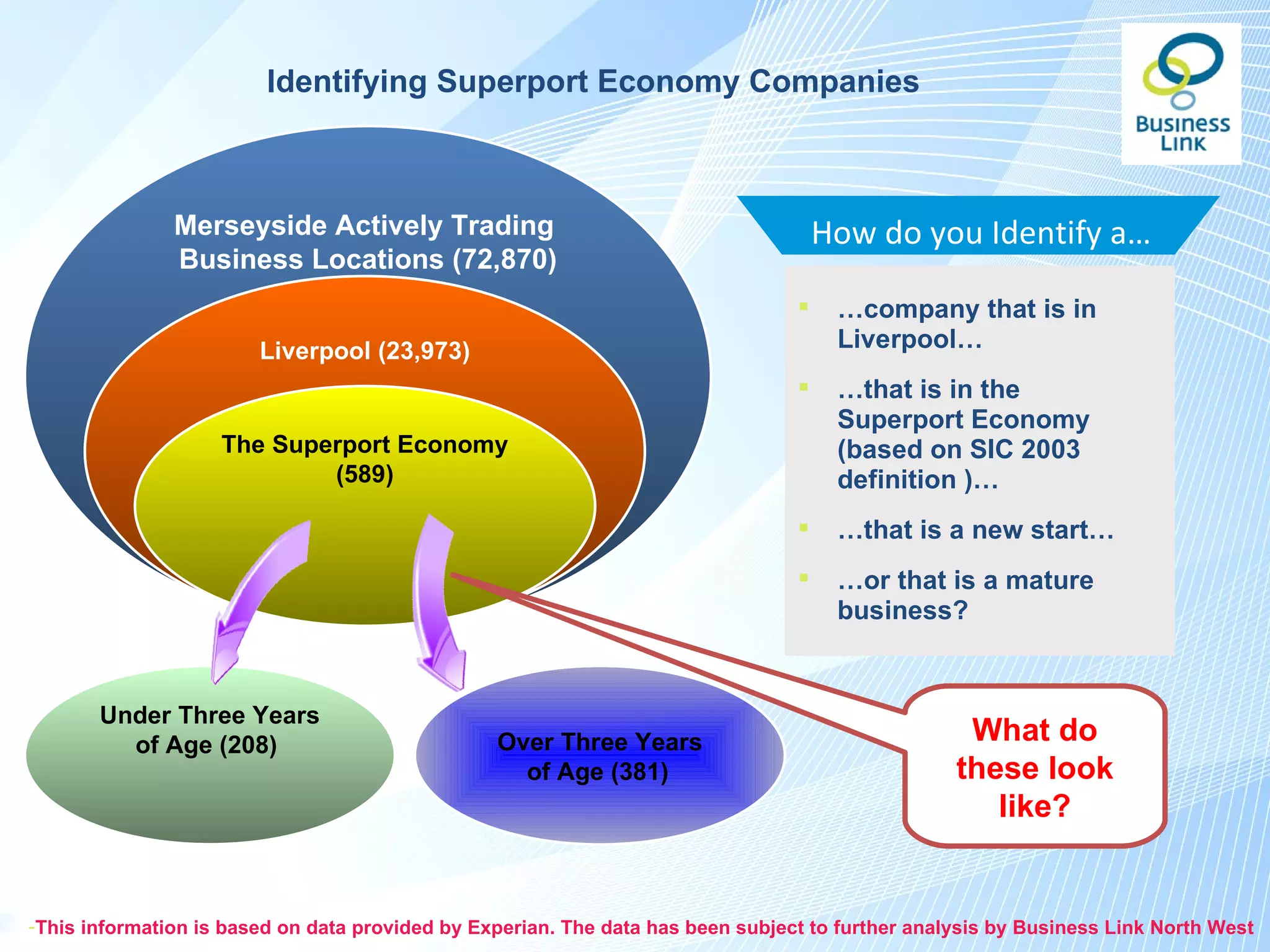

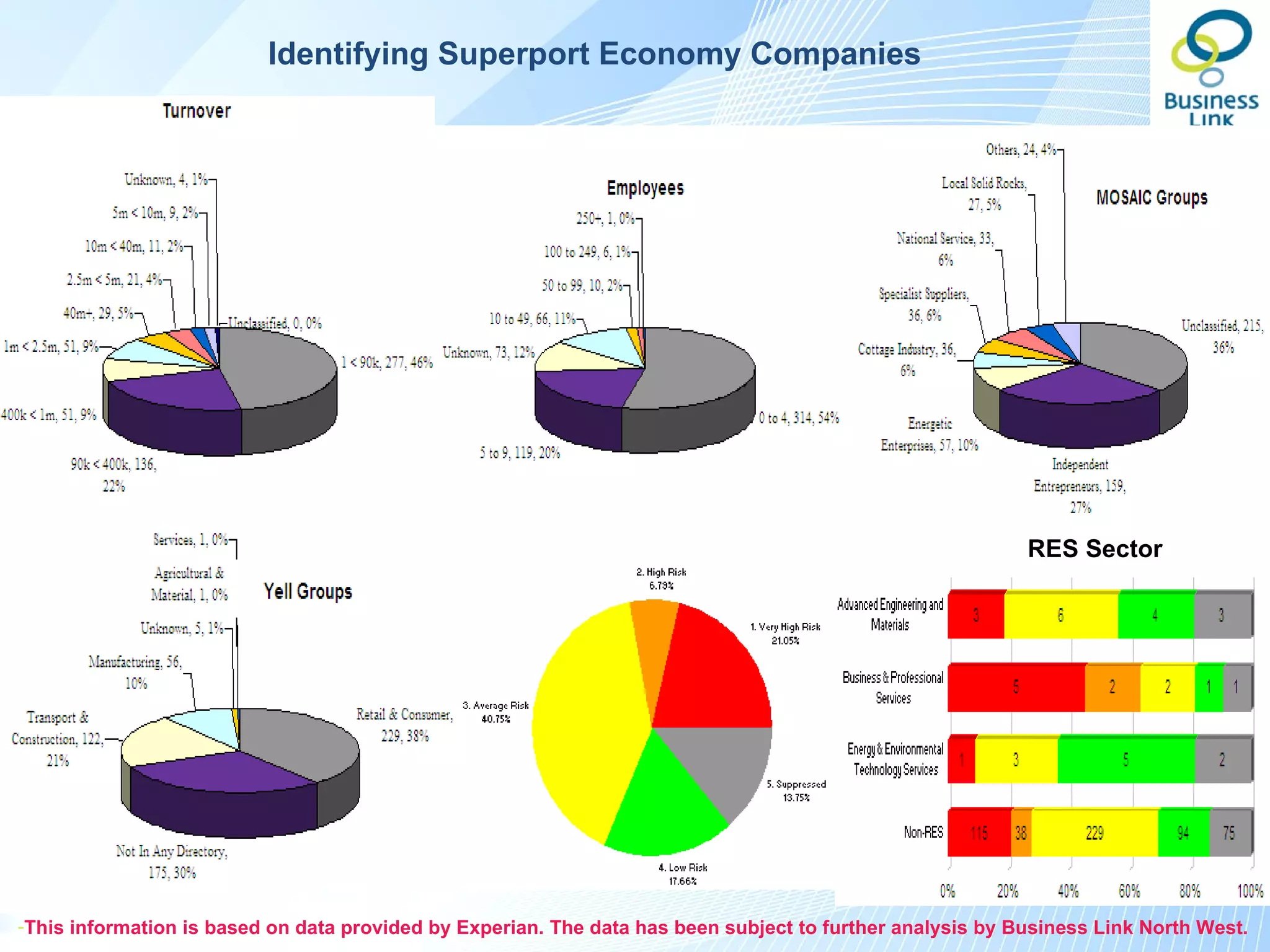

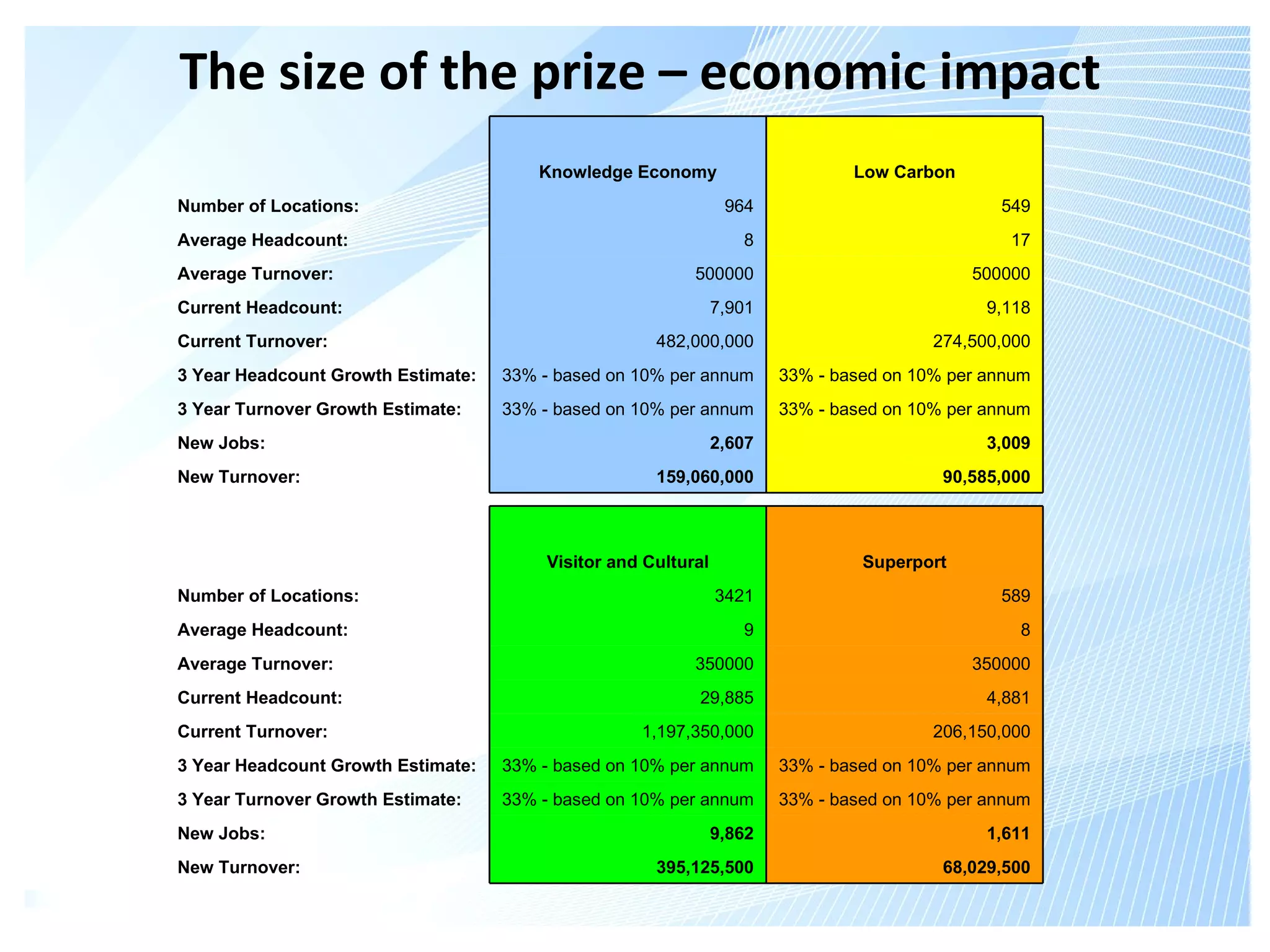

The document presents an analysis of Liverpool City Region’s transformational sectors, focusing on the low carbon economy, knowledge economy, visitor and cultural economy, and superport, to enhance business support interventions. It highlights the challenges in accurately defining and classifying businesses within these sectors using existing statistical frameworks and suggests adopting granular classification systems for better identification and marketing. Furthermore, it analyzes the economic impact and growth potential of these sectors, emphasizing the need for collaboration among agencies to optimize business support efforts.