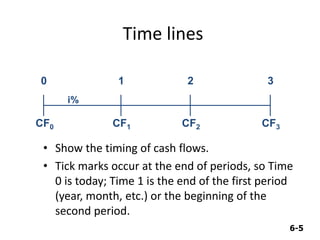

This document discusses the time value of money concept. It defines time value of money as the purchasing power of money changing over time, with money in the present being worth more than the same amount in the future due to inflation, risk, and opportunity costs. The document outlines key time value of money concepts like interest rates, present and future values, annuities, and timelines. It provides examples of calculating future values using the compound interest formula and shows how to draw timelines for cash flows occurring at different points in time.