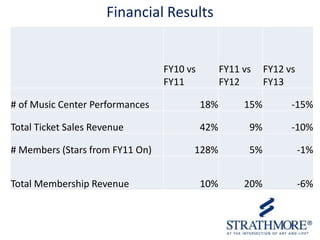

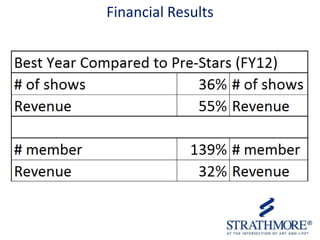

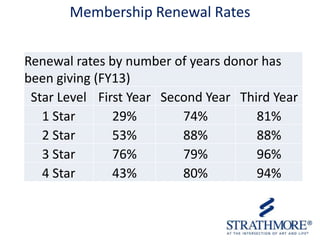

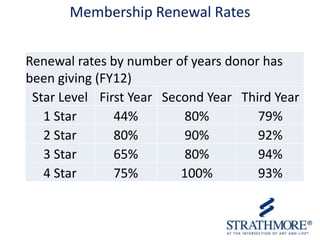

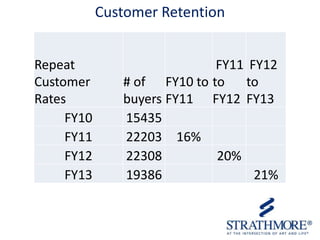

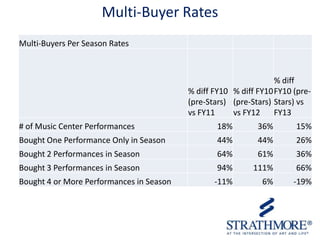

The Strathmore case study outlines the organization's transition to a subscription model for enhancing donor loyalty and revenue, showing a significant decline in subscribers over several years. The implementation involved extensive research, staff training, and public launch efforts, leading to increased revenue, programming flexibility, and better donor engagement. Financial results indicated a mix of performance in ticket sales and membership renewals, highlighting varying retention rates based on donor engagement over time.