THE SBA 504 PROGRAM

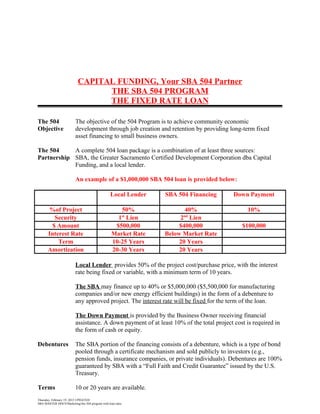

- 1. CAPITAL FUNDING, Your SBA 504 Partner THE SBA 504 PROGRAM THE FIXED RATE LOAN The 504 The objective of the 504 Program is to achieve community economic Objective development through job creation and retention by providing long-term fixed asset financing to small business owners. The 504 A complete 504 loan package is a combination of at least three sources: Partnership SBA, the Greater Sacramento Certified Development Corporation dba Capital Funding, and a local lender. An example of a $1,000,000 SBA 504 loan is provided below: Local Lender SBA 504 Financing Down Payment %of Project 50% 40% 10% Security 1st Lien 2nd Lien $ Amount $500,000 $400,000 $100,000 Interest Rate Market Rate Below Market Rate Term 10-25 Years 20 Years Amortization 20-30 Years 20 Years Local Lender provides 50% of the project cost/purchase price, with the interest rate being fixed or variable, with a minimum term of 10 years. The SBA may finance up to 40% or $5,000,000 ($5,500,000 for manufacturing companies and/or new energy efficient buildings) in the form of a debenture to any approved project. The interest rate will be fixed for the term of the loan. The Down Payment is provided by the Business Owner receiving financial assistance. A down payment of at least 10% of the total project cost is required in the form of cash or equity. Debentures The SBA portion of the financing consists of a debenture, which is a type of bond pooled through a certificate mechanism and sold publicly to investors (e.g., pension funds, insurance companies, or private individuals). Debentures are 100% guaranteed by SBA with a “Full Faith and Credit Guarantee” issued by the U.S. Treasury. Terms 10 or 20 years are available. Thursday, February 19, 2015 UPDATED SBA MASTER DOCS/Marketing/sba 504 program with loan rates

- 2. GREATER SACRAMENTO CDC dba CAPITAL FUNDING **YOUR SBA-504 PARTNER** Program Highlights: - Up to 90% financing. - Fully amortized loans, no call dates. Use of Funds: - Purchase, construction, or renovation of commercial real estate and/or purchase of equipment (10+ year life) - Fixed asset financing for franchises. Financing Structure - 50% Bank first deed of trust - 40% SBA-504 second deed of trust - 10% Borrower down-payment in most cases. Terms: - Up to 20 years for Real Estate, fully amortized, no call dates. - Up to 10 years for Equipment, fully amortized, no call dates. Interest Rate: - Bank: Fixed or Variable. - SBA: Fixed Below Market. Eligibility Highlights: - Net worth of less than $15 million. - Net profit of less than $5 million average over last two years. - Job creation requirements depending on project size. - Owner to occupy 51% of existing building or 60% of a new construction project. Prequalification: Prequalification services available at no cost. For More Information Call Ray, Dennis, Glen, Jerry or Bart : (916) 339-1096 Web site: GSCDC.COM Thursday, February 19, 2015 UPDATED SBA MASTER DOCS/Marketing/SBA 504 with loan rates