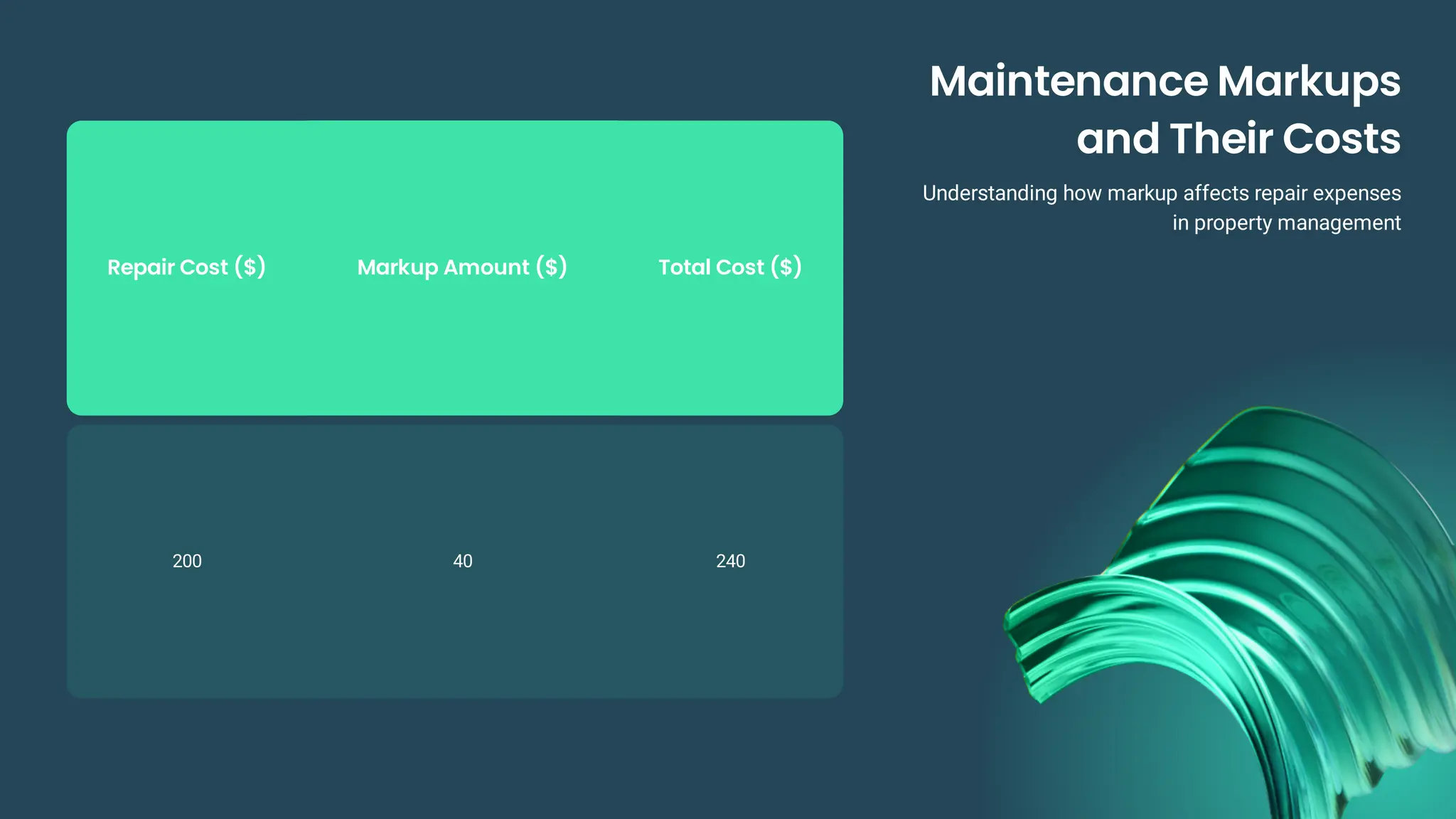

The document examines hidden costs in property management that investors need to understand for informed decision-making. Key expenses include management fees, leasing and renewal fees, maintenance markups, and eviction-related costs, which can significantly impact cash flow and overall profits. It emphasizes the importance of transparent cost communication and proactive budgeting to mitigate these hidden costs.