The customer satisfaction @ citi bank project report mba marketing

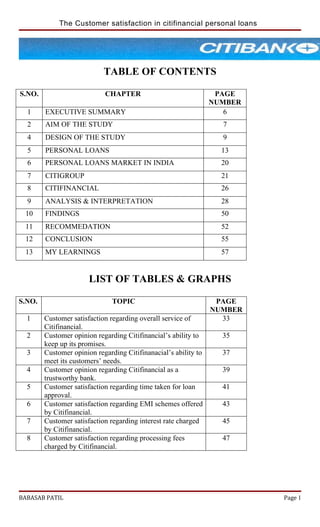

- 1. The Customer satisfaction in citifinancial personal loans TABLE OF CONTENTS S.NO. CHAPTER PAGE NUMBER 1 EXECUTIVE SUMMARY 6 2 AIM OF THE STUDY 7 4 DESIGN OF THE STUDY 9 5 PERSONAL LOANS 13 6 PERSONAL LOANS MARKET IN INDIA 20 7 CITIGROUP 21 8 CITIFINANCIAL 26 9 ANALYSIS & INTERPRETATION 28 10 FINDINGS 50 11 RECOMMEDATION 52 12 CONCLUSION 55 13 MY LEARNINGS 57 LIST OF TABLES & GRAPHS S.NO. TOPIC PAGE NUMBER 1 Customer satisfaction regarding overall service of 33 Citifinancial. 2 Customer opinion regarding Citifinancial’s ability to 35 keep up its promises. 3 Customer opinion regarding Citifinanacial’s ability to 37 meet its customers’ needs. 4 Customer opinion regarding Citifinancial as a 39 trustworthy bank. 5 Customer satisfaction regarding time taken for loan 41 approval. 6 Customer satisfaction regarding EMI schemes offered 43 by Citifinancial. 7 Customer satisfaction regarding interest rate charged 45 by Citifinancial. 8 Customer satisfaction regarding processing fees 47 charged by Citifinancial. BABASAB PATIL Page 1

- 2. The Customer satisfaction in citifinancial personal loans EXECUTIVE SUMMARY The project is on “CUSTOMER SATISFACTION REGARDING CITIFIACIAL PERSOAL LOANS”. I was assigned south Bangalore where I was required to collect & analyze data from south Bangalore. The research involved studying existing customers. It covered each and every aspect of personal loan, which can affect customer satisfaction. The main objective of the study was to find out areas where customers are not satisfied with the service offered by Citifinancial regarding personal loan. I was required to collect data from existing customers, analyze it, interpret it & make recommendations which can help Citifinancial to improve on areas where it is lacking & achieve better customer satisfaction by focusing on such areas. The report will first give you a brief about the research methodology, which I was supposed to use in the study. After this you will come to know about personal loans & the current trends in personal loans market in India. You will also get information on Citigroup & Citifinancial. Apart from this you will come to know about how I analyzed & interpreted the collected data. I hope that you will find this report interesting & will help you in conducting further studies on this sector. CHAPTER-1 BABASAB PATIL Page 2

- 3. The Customer satisfaction in citifinancial personal loans CHAPTER-2 DESIGN OF THE STUDY BABASAB PATIL Page 3

- 4. The Customer satisfaction in citifinancial personal loans DESIGN OF THE STUDY THE PROBLEM: Citifinancial is witnessing below average industry growth with respect to its personal loans. Despite having a good network of its branches & DSAs in cities where it is present, it is witnessing a low growth as compared to its competitors. OBJECTIVE: Citifinancial holds customer dissatisfaction as the main reason beyond low growth in its personal loans. So, the objective of this study is to find out from the existing customers, whether they are satisfied with the Citifinancial personal loans or not, where the study will cover customer reaction towards each & every aspect of the product. The study will try to find out the areas where Citifinancial needs to improve. GEOGRAPHICAL AREAS: I was allotted south Bangalore where I supposed to cover areas such as BTM, Koramangala, HSR layout, Audugodi, JP Nagar, Jayanagar, Banashankari & Basavanagudi. SCOPE: The study covered each & every aspect of the customers. The study focused on customer reaction with respect to the overall service and each & every aspect of the product such as interest rate, EMI etc. LIMITATIONS: Though the study has covered each & every aspect of customer satisfaction but it has neglected customer-employee interaction, which contributes highly to the customer satisfaction. Due to this, though the study may help in finding out the areas where Citifinancial needs to improve with respect to product features but it will not help Citifinancial in deciding whether to train its employees or not for deal in a better way with the customers. DESIGN OF THE STUDY-RESEARCH METHODOLOGY RESEARCH DESIGN: BABASAB PATIL Page 4

- 5. The Customer satisfaction in citifinancial personal loans The research was Exploratory where it tried to cover Who, Where, When, How & Why about the existing customers of Citifinancial. DATA COLLECTION: Mainly two types of data were used for data collection viz: Secondary data: The main source was the customer database, which was given by Citifinancial . It was used to find out all general information about the existing customers such as their names, their residential & official address & their phone numbers. Primary data: The main source was the questionnaire, which was designed to collect all the primary data such customer reaction towards all the aspects of the product. RESEARCH TYPE: The type of research used to collect primary data was Quantitative, where all the findings were quantified to draw interpretations. On the basis of which conclusions were made. Telephonic interview was used to collect data, where customers were interviewed for five to ten minutes over the telephone. DESIGN OF THE STUDY-RESEARCH METHODOLOGY TYPE OF QUESTIONS: To collect the primary data, a questionnaire was devised which consisted of: Dichotomous questions: Having three options Balanced scaling questions: Having three points on which the customers were required to rate. Apart from this, Demographic based questions were there to collect data about the customers regarding their names, age, income, occupation, household income, amount of loan & the number of installments. SAMPLING TECHNIQUE: Stratified sampling was used to cover all types of customers on the basis of income. SAMPLE SIZE: I was required to collect a sample of 50 from the database given. BABASAB PATIL Page 5

- 6. The Customer satisfaction in citifinancial personal loans ANALYSIS: Single Tabulation was used for arranging the collected data & for analyzing & interpretation CHAPTER-3 PERSONAL LOANS PERSONAL LOANS DEFINITIONS: “An amount of money borrowed from a bank or other lender by an individual”. “A loan based on a consumer's income, debt and credit history” BABASAB PATIL Page 6

- 7. The Customer satisfaction in citifinancial personal loans “Money lent to an individual by a financial institution for a specific personal purpose except buying a house. One main difference between a personal loan and a home loan is that most personal loans are unsecured”. “A loan obtained by an individual for personal (as opposed to business or investment) purposes. A personal loan may or may not be secured”. “A loan that establishes consumer credit that is granted for personal use; usually unsecured and based on the borrower's integrity and ability to pay”. A personal loan is a lump sum which you borrow from a bank, building society or another lender. A personal loan could be the best option for you if you are looking to borrowing money for between 1 and 5 years and is particularly ideal if you have other debts that you're looking to consolidate into one loan to reduce your overall monthly payments. The simplest explanation of the use of the word "personal" to describe these types of loans is that the money that is borrowed is to be used for personal reasons. If the aim of the loan was to finance the purchase of a home, that is a mortgage. If the purpose of the loan is to help a business to expand, that is a business loan. If you are taking out a loan to fund something that will be for your own personal use, or to help you out with personal issues, then that is a personal loan. The best way to expand on this would be to look at what a personal loan could be used for. PERSONAL LOANS A personal loan is an amount of money offered, normally by lending institutions such as banks and building societies, on the condition that it will be paid back at some later date. Personal loans are available in a whole host of formats and can range from £500 upwards. The term of the loan is often dependent on whether the lender requires security to be offered by the borrower and the size of the regular repayments you wish to make. Under most personal loan arrangements you receive a lump sum, equal to the amount of the agreed loan and in return you agree to make regular repayments. These repayments are normally monthly and cover both the interest due and the capital outstanding loan amount. If you have established the loan as a 'repayment' type loan then the repayments will include an amount to pay off some of the capital and reduce your outstanding debt. Payments are made throughout the term of the loan to ensure that the total debt is repaid to the lending institution. AMOUNT OF PERSONAL LOAN Amount wise personal loans may range from 15,000 to 10, 00,000. RATE OF INTEREST BABASAB PATIL Page 7

- 8. The Customer satisfaction in citifinancial personal loans Currently, interest rates across all banks are in range of 10% to 22%. The interest rate usually depends on two factors: Amount of loan: Higher the amount lower will be the interest rate & vice verse. Type of loan: While secured loan carries lower rate where as unsecured loan carries higher rate. PERSONAL LOANS USES OF PERSONAL LOAN The range of uses for the money is very wide indeed. Common uses include the purchase of a new car, a holiday or the repayment (consolidation) of existing debt. Frequently the lending institution will ask for details of the reason you require the loan. Although the purpose of the loan may have little impact on their decision to grant the money, it can have some influence on the maximum term of the loan. It is more likely that larger sized loans, for purchases such as cars, home improvements etc. will result in a longer repayment term. It is not uncommon for the purchase of a car to established with a repayment term of 3 years whilst the term for home improvement loans can be for much longer terms (sometimes as long as ten years). SUITABILITY OF PERSOAL LOAN If you are looking to borrow money over a period of less than ten years, whether you need the money for a purchase or perhaps to repay existing debt, then a personal loan may be suitable for your needs. Personal loans are just another form of credit. If you are considering a personal loan to run alongside other forms of personal credit such as overdrafts and credit cards, you must give careful consideration to whether you will be able to afford the total of your regular payments. When considering the situation it is wise to take into account your ability to pay were you unable to work due to illness or should you lose your employment. PERSONAL LOANS ACCESSABILITY TO PERSOAL LOAN BABASAB PATIL Page 8

- 9. The Customer satisfaction in citifinancial personal loans There are hundreds of potential lenders willing to offer you the opportunity to borrow from them. However the offer of finance does depend upon your ability to repay the debt and your previous credit history. Those applicants that have had credit difficulties in the past can find it more difficult to obtain access to a personal loan compared to those applicants that have a better credit history. It is normally true that the better the credit risk you are, the easier you will find it to obtain a personal loan. It is also likely that people who have the best credit histories will be offered the best deals. This normally means a lower interest rate is charged or the repayment terms are longer. DIFFERENCE BETWEEN PERSONAL & BANK LOAN There isn't much of a difference between a bank loan and a personal loan. They are in essence the same thing, in that you are borrowing an amount of money from a product provider that you will repay at agreed intervals with interest added to the sum. The difference is that a bank specifically provides a bank loan. A few years ago, the bank was one of the only places a customer could get a loan, which is why people used to say they needed a good relationship with their bank manager. Obviously, this isn't the case now, as building societies and many other financial companies also offer loans. MERITS & DEMERITS OF PERSONAL LOAN MERITS DEMERITS Quick High rate of disbursement interest. of loan. PERSONAL LOANS TYPES OF PERSOAL LOAN Unsecured personal loan: Is a debt that you can acquire where you do not have to use any specific collateral to back the loan. Usually, the people who would be eligible for this type of loan would be people who do not own a home, or people with bad credit. An unsecured loan will mean less risk to the person taking out the loan than a secured loan. This is due to the fact that a person will not have to use their home as insurance for the loan. The negative aspect of this is that due to the lack of insurance, the interest payments set will be higher, as the loan provider will need to cover the added risk of not being able to get their money back. A positive aspect of the unsecured loan could be that your application is processed a lot quicker, so you can get hold of money more rapidly. This speed is due to the fact that your home will not need to be valued to make sure your security is available. Another upshot of this is that you can submit an application, get a reply and answer very quickly to your application, and just because you have submitted does not mean you are under an obligation to take up the loan. BABASAB PATIL Page 9

- 10. The Customer satisfaction in citifinancial personal loans Secured personal loan: Is a loan that is specifically assigned for home owners. This is where the home is used as collateral, which is a larger risk for a customer than an unsecured loan, because if you fall into difficulties or are unable to repay the loan for any particular reason your home is at risk. One of the most vital points to understand about a secured loan is that it is not best used as a solution to debt problems, because it is even more important that you have budgeted properly to cover the loan payments. Many people with debt problems have them precisely because they are not good at budgeting to cover loan payments. Secured personal loans could be taken out for various reasons. You could want to make home improvements, for which you can borrow money secured on your home, as you are hopefully increasing its value. Perhaps it could be for a debt consolidation loan, where you take out a loan for an amount large enough to pay off several other debts for a longer period PERSONAL LOANS MARKET IN INDIA PERSONAL LOANS MARKET IN INDIA BABASAB PATIL Page 10

- 11. The Customer satisfaction in citifinancial personal loans In recent times, personal loans market in India is witnessing a rapid growth. Over the year 2003-04 personal loans disbursement has grown by 40%. Consumer credit in India is currently growing at around 45%-50% annually, and considering that the Indian economy is expected to grow at around 8% this year, demand for consumer loans including personal loans is expected to remain strong. The growth is high in unsecured personal loans as compared to secured personal loans. Following are some of the factors responsible for growth in personal loans market in India: Falling interest rates: Interest rates have gradually fell form above 25% to below 20% across all banks over the years. Change in consumer behavior: Once customers hesitated to take loans from banks but now they are looking at it from a positive angle. Shift in focus of banks from corporate lending towards retail lending: Banks are now concentrating more on retail loans including personal loans, home loans & auto loans due to the growth in retail loans. Positive demographics: There is rapid growth in urban population, who are most likely to take retail loans. Apart from this middle class segment is growing, which account for about 70-80% of the total loan seekers. MAJOR PLAYERS: At preset ICICI Bank is the market leader having more than 30% market share in personal loans market, followed by HDFC Bank. Apart from this there are several other banks including Government banks, Private banks & MNC banks who are in the lead. In case of MNC banks, Citifinancial tops the list with respect to total loan disbursements & in terms of market share. It is followed by HSBC, Standard Chartered bank, ABN AMRO & others. CHAPTER-4 CITIGROUP BABASAB PATIL Page 11

- 12. The Customer satisfaction in citifinancial personal loans CITIGROUP LEGACY Citigroup Inc., today's pre-eminent financial services company, with some 200 million customer accounts in more than 100 countries, dates back to the history of Citibank, which began in 1812; Travelers Life & Annuity, since 1864; Smith Barney, founded in 1873; Banamex, formed in 1884 as a result of the merger of Banco Nacional Mexicano and Banco Mercantil Mexicano; and Salomon Brothers, which dates back to 1910 and later merged with Smith Barney, a subsidiary of Travelers Group at the time. Other major brand names under Citigroup's trademark red umbrella include Citi Cards, CitiFinancial, CitiMortgage, CitiInsurance, Primerica, Diners Club, Citigroup Asset Management, The Citigroup Private Bank and CitiCapital. FAMILY TREE Citigroup is largely organized into four groups: Citigroup Global Consumer Group, the Global Corporate and Investment Banking Group, Citigroup Global Investment Management, and Global Wealth Management. BABASAB PATIL Page 12

- 13. The Customer satisfaction in citifinancial personal loans CITIGROUP PRODUCT LINES Global Consumer Group Cards o World’s largest provider of credit cards o Third Quarter '04 Net Income of $1.267 billion Consumer Finance o World’s consumer finance leader o Third Quarter '04 Net Income of $643 million Retail Banking o Citibank: highest-rated, leading global brand o Third Quarter '04 Net Income of $1.225 billion Global Corporate and Investment Banking Group Capital Markets & Banking o #1 underwriter of Combined Debt and Equity and Equity-related transactions o Third Quarter '04 Net Income of $1.159 billion Global Transaction Services o Leading provider of transaction products; $7.3 trillion in assets under custody o Third Quarter '04 Net Income of $285 million CITIGROUP PRODUCT LINES Global Investment Management Life Insurance & Annuities o One of the fastest growing life insurers in the U.S with expanding international presence BABASAB PATIL Page 13

- 14. The Customer satisfaction in citifinancial personal loans o Third Quarter '04 Net Income of $282 million Asset Management o A leader with $500.7 billion in assets under management o Third Quarter '04 Net Income of $84 million Global Wealth Management Private Client Services o A leader in managed accounts with $1.087 trillion in total client assets o Third Quarter '04 Net Income of $195 million Private Bank o Offers widest range of services to more than 25,000 of the world’s most successful and influential families o Third Quarter '04 Net Income of $136 million CITIGROUP IN INDIA Citigroup opened its first office in India in 1902. Since then they have become one of India's most diverse and recognized financial service providers operating in 25 offices and branches across 18 cities. Citigroup India has 5,000 employees nationwide. Their operations encompass a premier global corporate and investment bank and a well-established consumer business under the Citibank and CitiFinancial brands. The global corporate and investment banking group provides a comprehensive range of financial services including treasury management, transaction services, securities custodianship, foreign exchange, fixed income and equities sales and trading, and corporate finance to corporate clients, governments and financial institutions. BABASAB PATIL Page 14

- 15. The Customer satisfaction in citifinancial personal loans Citibank India is the country's leading retail bank with a history of innovation and customer service. Today we are the largest issuer of credit cards and offer mortgages, personal loans, insurance, and investment services for on-shore customers. Citibank India also provides banking services to the international Indian community in 23 cities around the world. CITIFINANCIAL CITFINANCIAL BABASAB PATIL Page 15

- 16. The Customer satisfaction in citifinancial personal loans Since 1912, CitiFinancial has been helping people realize their financial goals and dreams. Headed by CEO and President Harry D. Goff, CitiFinancial is a member of Citigroup, the world's largest financial services provider. They have more than 2000 offices in the United States and Canada. Each branch manager runs their CitiFinancial office as if it is their own business, so loan decisions are made locally. They provide home improvement loans, bill consolidation loans, money for tuition, vacation getaways and unexpected expenses. They have a solution that helps you afford what you want or need most in life. They’ll get you the money you need when you need it! Products & Services: • Personal loans • Home loans • Auto loans Citifinancial personal loan: It can be used to pay off your credit card bills, meet your unexpected expenses or it can be used for education or travel purpose. At this time, CitiFinancial Personal Loans are not available for business purposes. Their specialty is extending credit for personal, family and household purposes. Qualification criteria: CitiFinancial grants personal loans to people over age 18 who have established credit and can secure the loan with personal property. Some established credit, like a gasoline or store credit card, is necessary, and employment or other steady income is required. We also make unsecured loans to homeowners. People just beginning to establish credit may be asked to have another responsible adult co-sign for the loan. CHAPTER-5 ANALYSIS & BABASAB PATIL Page 16

- 17. The Customer satisfaction in citifinancial personal loans INTERPRETATION ANALYSIS & INTERPRETATION Analysis has been made for each & every question given in the questionnaire. Mainly analysis has been done for the sample of 50 covering south Bangalore. This analysis represents only of south Bangalore & not of whole Bangalore & rest of India. Therefore the findings will show the picture of south Bangalore only. To have an in-depth analysis of the sample, the sample of 50 has been classified into 3 groups by using household income as classification data. Therefore the analysis will not only show the picture of the whole sample together but it will also show the picture of each group separately within the sample. On the basis of analysis, interpretation has been made for the whole sample as well as for each group within the sample. Before jumping on to the conclusion, one should know the type of questions being asked & the options being given, on the basis of which analysis & interpretations have been made. Type of questions: Dichotomous questions: options given were: Agree (it means customer is satisfied) Don’t agree (it means the customer is unsatisfied) Can’t say ANALYSIS & INTERPRETATION BABASAB PATIL Page 17

- 18. The Customer satisfaction in citifinancial personal loans Type of questions: Balanced scaling questions: Here the customer is required to rate on a scale of 1 to 3 including 1 & 3. Rating of 1 means ‘bad’ that is the customer is unsatisfied Rating of 2 means ‘average’ that is the customer is neither unsatisfied nor satisfied also. Rating of 3 means ‘good’ that is the customer is satisfied. CLASSIFICATION OF SAMPLE (TOTAL SAMPLE:50) The whole sample of 50 has been divided into 3 groups, using household income as classification data. Following are the 3 groups: Group 1: It consists of customers having household income of less than 15000. The total strength of this group is 15. Group 2: It consists of customers having household income in the range between 15000 & 25000 including both 15000 & 25000. The total strength of this group is 25. Group 3: It consists of customers having household income of more than 25000. The total strength of this group is 10. In the following pages you will encounter some tables & pie charts for each of the topic separately, being covered in the questionnaire. For each topic there will be one table showing responses of each group separately & combined together which forms the total sample of 50. Apart from this there will be 4 pie charts for each topic. While the first pie chart will show the responses of all groups taken together where as the other 3 will show the responses of each group separately. QUESTIONNAIRE . Name : ___________________________ Occupation : ___________________________ 1. Average family income per annum < Rs 15000 , >15000 <25000 , > 25000. 2. Age group 20 - 30, 30 - 40, 40 - 50, > 50 BABASAB PATIL Page 18

- 19. The Customer satisfaction in citifinancial personal loans 3. How customer is satisfied with citifinance service provided? 1, 2, 3 Rating of 1 means ‘bad’ that is the customer is unsatisfied Rating of 2 means ‘average’ that is the customer is neither unsatisfied nor satisfied also. Rating of 3 means ‘good’ that is the customer is satisfied. 4 . HOW IS CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO KEEP UP ITS PROMISES? 1, 2, 3 5. CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO MEET ITS CUSTOMERS’ NEEDS 1, 2, 3 6. CUSTOMER OPINION REGARDING CITIFINANCIAL AS A TRUST WORTHY BANK 1, 2, 3 7. CUSTOMER SATISFACTION REGARDING TIME TAKEN FOR LOAN APPROVAL 1, 2, 3 8. CUSTOMER SATISFACTION REGARDING EMI SCHEMES OFFERED BY CITIFINANCIAL 1, 2, 3 9 . CUSTOMER SATISFACTION REGARDING INTEREST RATE CHARGED BY CITIFINACIAL 1, 2, 3 10. CUSTOMER SATISFACTION REGARDING PROCESSING FEES CHARGED BY CITIFINANCIAL 1, 2, 3 ANALYSIS & INTERPRETATION Q.No-3) CUSTOMER SATISFACTION REGARDING OVERALL SERVICE OF CITIFINANCIAL. BABASAB PATIL Page 19

- 20. The Customer satisfaction in citifinancial personal loans CUSTOMER SATISFACTION-TOTAL SAMPLE 24% 42% 1 2 3 34% Only 42% of the total sample of customers is satisfied with the overall service of Citifinancial. customer satisfaction-group 1 13% 1 2 33% 54% 3 In group 1, only 13% of the customers are satisfied with the overall service of Citifinancial. BABASAB PATIL Page 20

- 21. The Customer satisfaction in citifinancial personal loans customer satisfaction-group 2 12% 1 48% 2 40% 3 In group 2, the situation is somehow better than group 1 as here, about 48% of the customers are satisfied with the overall service of Citifinancial. customer satisfaction-group 3 10% 20% 1 2 3 70% In group 3, about 70% of the customers are satisfied. This shows the higher income customers are much more satisfied than the lower end customers as group 3 denotes higher end whereas group 1 denotes lower ed customers. ANALYSIS & INTERPRETATION Q.No-4) CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO KEEP UP ITS PROMISES CUSTOMER OPINION-TOTAL SAMPLE 2% 24% 1 2 74% 3 It shows that about 74% of the total sample of customers agrees with the fact that citifinancial was able to keep up its promises. BABASAB PATIL Page 21

- 22. The Customer satisfaction in citifinancial personal loans customer opinion-group 1 7% 40% 1 2 3 53% In group 1, only 40 % customers agree with the fact that citifinancial was able to keep up its promises. customer opinion-group 2 12% 0% 1 2 3 88% In group 2, as against group 1, a staggering 88% customers agree with the fact that citifinancial was able to keep up its promises. customer opinion-group 3 10% 0% 1 2 3 90% I group 3, about 90% customers agree with the fact that citifinancial was able to keep up its promises. This again shows that high income group customers (group 3) are much more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 40% customers of group 1 who support the above statement. BABASAB PATIL Page 22

- 23. The Customer satisfaction in citifinancial personal loans ANALYSIS & INTERPRETATION Q.No-5) CUSTOMER OPINION REGARDING CITIFINANCIAL’S ABILITY TO MEET ITS CUSTOMERS’ NEEDS CUSTOMER OPINION-TOTAL SAMPLE 2% 28% 1 2 70% 3 It shows that about 70% of the total sample of customers agrees with the fact that Citifiancial was able to meet their personal needs. customer opinion-group 1 7% 33% 1 2 3 60% In group 1, only 33% of the customers agree with the fact that Citifinancial was able to meet their personal needs. BABASAB PATIL Page 23

- 24. The Customer satisfaction in citifinancial personal loans customer opinion-group 2 16% 0% 1 2 3 84% I group 2, as against group 1, a staggering 84% of the customers agree with the fact that Citifinancial was able to meet their personal needs. customer opinion-group 3 10% 0% 1 2 3 90% I group 3, about 90% customers agree with the fact that citifinancial was able to meet their personal needs. This again shows that high income group customers (group 3) are much more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 33% customers of group 1 who support the above statement. ANALYSIS & INTERPRETATION Q.No-6) CUSTOMER OPINION REGARDING CITIFINANCIAL AS A TRUST WORTHY BANK CUSTOMER OPINION-TOTAL SAMPLE 2% 24% 1 2 74% 3 It shows that about 74% of the total sample of customers agrees that Citifinancial is a trustworthy bank. BABASAB PATIL Page 24

- 25. The Customer satisfaction in citifinancial personal loans customer opinion-group 1 7% 40% 1 2 3 53% In group 1, only 40 % customers agree with the fact that Citifinancial is a trustworthy bank. customer opinion-group 2 12% 0% 1 2 3 88% In group 2, as against group 1, 88% customers agree with the fact that Citifinancial is a trustworthy bank. customer opinion-group 3 10% 0% 1 2 3 90% I group 3, about 90% customers agree with the fact that citifinancial is a trustworthy bank. This again shows that high income group customers (group 3) are much more satisfied with Citifinancial than the low income group customers (group 1), as 90% customers of group 3 support the above statement as against a mere 40% customers of group 1 who support the above statement. ANALYSIS & INTERPRETATION BABASAB PATIL Page 25

- 26. The Customer satisfaction in citifinancial personal loans Q.No-7) CUSTOMER SATISFACTION REGARDING TIME TAKEN FOR LOAN APPROVAL CUSTOMER SATISFACTION-TOTAL SAMPLE 0% 16% 1 2 3 84% It shows that 84% of the total sample customers are satisfied with the time taken for loan approval by Citifinancial. customer satisfaction-group 1 0% 20% 1 2 3 80% BABASAB PATIL Page 26

- 27. The Customer satisfaction in citifinancial personal loans customer satisfaction-group 1 0% 20% 1 2 3 80% About 80% customers of both groups 1 & 2 are satisfied with the total time taken by Citifinancial for loan approval. customer satisfaction-group 3 0% 0% 1 2 3 100% As against group 1 & 2, 100% customers of group 3 are satisfied with the total time taken by Citifinancial for loan approval. ANALYSIS & INTERPRETATION Q.No-8) CUSTOMER SATISFACTION REGARDING EMI SCHEMES OFFERED BY CITIFINANCIAL CUSTOMER SATISFACTION-TOTAL SAMPLE 8% 26% 1 2 66% 3 It shows that about 66% of the total sample customers are satisfied with the EMI schemes offered by Citifinancial. BABASAB PATIL Page 27

- 28. The Customer satisfaction in citifinancial personal loans customer satisfaction-group 1 13% 20% 1 2 3 67% In group 1, about 67% customers are satisfies with the EMI schemes offered by Citifinancial. customer satisfaction-group 2 8% 1 32% 2 60% 3 In group 2, about 60% customers are satisfied with the EMI schemes offered by Citifinancial. customer satisfaction-group 3 0% 20% 1 2 3 80% As against group 1 & 2, about 80% customers of group 3 satisfied with the EMI schemes offered by Citifinancial, indicating that they are the most satisfied among all groups, with Citifinancial. ANALYSIS & INTERPRETATION BABASAB PATIL Page 28

- 29. The Customer satisfaction in citifinancial personal loans Q.No-9) CUSTOMER SATISFACTION REGARDING INTEREST RATE CHARGED BY CITIFINACIAL CUSTOMER SATISFACTION-TOTAL SAMPLE 8% 1 2 38% 54% 3 It shows a mere 8% of the total sample customers are satisfied with the interest rate being charged by Citifinancial. & about 54% customers are unsatisfied with it. customer satisfaction-group 1 0% 33% 1 2 3 67% In group 1, a high of 67% customers are unsatisfied with the interest rate being charged by Citifinancial. The interesting thing is that not even a single customer is satisfied. BABASAB PATIL Page 29

- 30. The Customer satisfaction in citifinancial personal loans customer satisfaction-group 2 12% 1 2 32% 56% 3 Here also the scene is not so good as 56% customers of group 2 are unsatisfied with the interest rate being charged by Citifinancial. customer satisfaction-group 3 10% 30% 1 2 3 60% In group 3, though only 30% customers are unsatisfied but on the other had only 10% are satisfied with the interest rate being charged by Citifinancial. This shows that majority of the customers across all groups are unsatisfied with the interest rate being charged by Citifinancial. ANALYSIS & INTERPRETATION Q.No-10) CUSTOMER SATISFACTION REGARDING PROCESSING FEES CHARGED BY CITIFINANCIAL CUSTOMER SATISFACTION-TOTAL SAMPLE 8% 1 2 38% 54% 3 It shows a mere 8% of the total sample customers are satisfied with the processing fees being charged by Citifinancial. & about 54% customers are unsatisfied with it. BABASAB PATIL Page 30

- 31. The Customer satisfaction in citifinancial personal loans customer satisfaction-group 1 0% 33% 1 2 3 67% In group 1, a high of 67% customers are unsatisfied with the processing fees being charged by Citifinancial. The interesting thing is that not even a single customer is satisfied. customer satisfaction-group 2 12% 1 2 32% 56% 3 Here also the scene is not as good as 56% customers of group 2 are unsatisfied with the processing fees being charged by Citifinancial. customer satisfaction-group 3 10% 30% 1 2 3 60% In group 3, though only 30% customers are unsatisfied but on the other had only 10% are satisfied with the processing fees being charged by Citifinancial. This shows that majority of the customers across all groups are unsatisfied with the interest rate being charged by Citifinancial. ANALYSIS & INTERPRETATION BABASAB PATIL Page 31

- 32. The Customer satisfaction in citifinancial personal loans NUMBER OF CUSTOMERS WHO FACED ANY INCONVENIENCE FOR GETTIG IN TOUCH WITH ANY CITIFIANCIAL PERSOAL LOAN OFFICER OR THE CONCERNED AGENT FOR EQUIRY REGARDING STATUS OF PROCESSING OF LOAN Out of a sample of 50, not even a single customer faced any inconvenience I getting in touch with any Citifiancial personal officer or the concerned agent. NUMBER OF CUSTOMERS FACED ANY PROBLEM FROM CITIFINANCIAL DURING REPAYMENT Out of the sample of 50 customers being surveyed, only 5 customers faced any problem during repayment. CUSTOMER SATISFACTION REGARDING SOLUTION GIVEN TO THE PROBLEM REGARDING REPAYMENT BY CITIFIANCIAL In this, only the 5 customers who faced the problem were interviewed & all of them were satisfied with the solution give by Citifinancial. CHAPTER-6 BABASAB PATIL Page 32

- 33. The Customer satisfaction in citifinancial personal loans FINDINGS AND RECOMENDATION FINDINGS From the analysis part one can interpret that customers across all groups in the sample are satisfied with the service offered by Citifinancial except for the interest rate & processing charges. We have already seen that a very high percentage of customers across all groups in the sample are unsatisfied with the rate of interest & the processing fees being charged by Citifinancial. As I interviewed all the customers in the sample, one thing I found is that the main reason behind such unsatisfaction by a majority of the customers is the high rate of interest being charged by Citifinancial. It all depends on customer attitude & perception. People have a tendency of comparing each option with the other option available to them & then they evaluate. In case of Citifinancial, the same thing has happened. Here also the customers have perception that the rate charged by Citifinancial is comparatively higher than the rate charged by other institutions offering personal loans. If I say that Citifinancial charges 16% interest and I ask whether it is high or low, then you may not reply as you don’t have other options with which you can compare it. But, say if you have 3 options viz: Citifinancial charging 16% interest ICICI Bank charging 7.5% interest HSBC charging 15% interest. BABASAB PATIL Page 33

- 34. The Customer satisfaction in citifinancial personal loans FINDINGS Then in this case you will compare all the options & will definitely think that the rate charged by Citifinancial is high as compared to others. This is what has exactly happened with Citifinacial. Same is the case with the processing fees also as customers think that the fees charged by Citifinancial is very high. Except for the interest rate & the processing charges, customers are satisfied with all other aspects of the service being provided by Citifinancial. Only this thing is affecting the customer satisfaction regarding overall service offered by Citifinancial. There are many customers who are though satisfied with the overall service of Citifinacial but they are not satisfied with the interest rate & processing fees being charged by Citifinancial. This signals a danger for Citifinancial as its customers are not satisfied with the interest rate & processing charges. As many customers look out for only these two aspects, any other institution offering personal loan at a low rate may come & takeaway the customers of Citifinancial. This is now started happening with Citifinancial as its customers are now turning towards its competitors, who are offering personal loans at a comparatively lower rate. BABASAB PATIL Page 34

- 35. The Customer satisfaction in citifinancial personal loans RECOMMENDATION RECOMMENDATION My recommendation will clearly focus on the interest rate & the processing fees being charged by Citifinancial. I would not recommend Citifinancial to fix interest rate only according to what the customers want & neglecting the RBI guidelines. I would not recommend Citifinancial to lower its interest rate but I can recommend that Citifinancial should try to balance the following three things while fixing the rate: RBI guidelines Preference of customers Rates being charged by its competitors The most important thing is that while fixing the interest rate Citifinancial should not only comply with the RBI guidelines but it should try to fix it competitively. The rates should be charged competitively with the rates being charged by the competitors especially the MNC banks. Since Citifinancial is an MNC, people when come here to take personal loan will definitely compare it with the personal loans being offered by other MNCs such as HSBC Bank, ABN AMRO Bank, Standard Chartered Bank, besides comparing it with the personal loans offered by India private banks & government banks. It is BABASAB PATIL Page 35

- 36. The Customer satisfaction in citifinancial personal loans natural as Citifinancial, HSBC Bank, ABN AMRO Bank, Standard Chartered Bank belong to same category, people will first try to compare any product of Citifinancial with that of the other three. So, Citifinancial should watch out its competitors especially the MNC banks which may easily take away its customers. CHAPTER-7 CONCLUSION CONCLUSION BABASAB PATIL Page 36

- 37. The Customer satisfaction in citifinancial personal loans The whole study shows how customers are satisfied with the personal loans offered by Citifinancial except for the interest & processing fees part, with which the customers are unsatisfied. This is not only the picture of south Bangalore but of whole Bangalore & of whole India. Customers across all cities/tows, wherever Citifinancial is present, are unsatisfied with the rate of interest & processing fees being charged by Citifinancial. Citifinancial is now working on it & will soon come out with a new rate that is competitively set & in accordance to RBI guidelines & customers preference. MY LEARNINGS BABASAB PATIL Page 37

- 38. The Customer satisfaction in citifinancial personal loans BABASAB PATIL Page 38