Embed presentation

Download to read offline

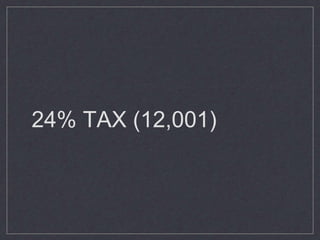

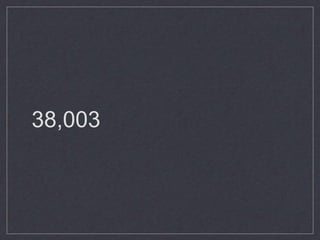

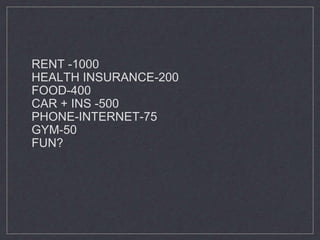

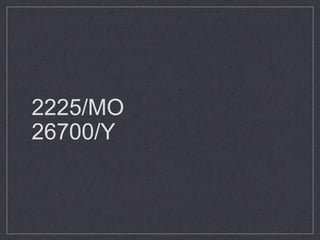

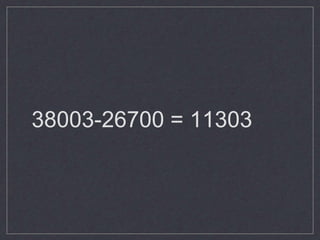

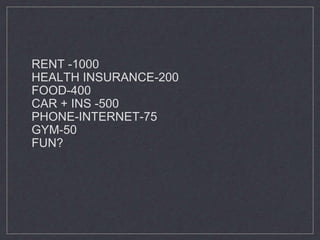

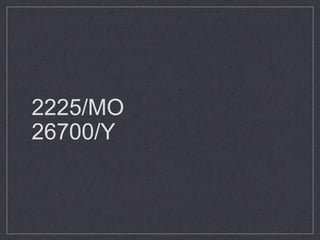

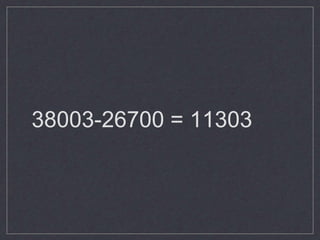

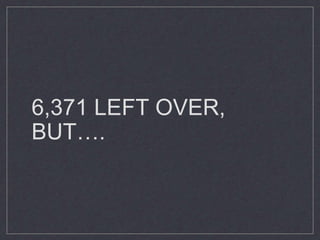

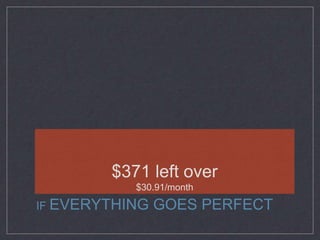

This document summarizes the financial situation of a recent college graduate making $50,004 per year before taxes. After accounting for a 24% tax rate, rent, health insurance, food, transportation, phone and internet, gym membership, and minimum loan payments, the graduate would be left with only $371 per month. Additional unexpected costs like weddings, travel, or car repairs could eliminate any remaining funds. Maintaining this lifestyle would require living paycheck to paycheck with little room for savings or emergencies.