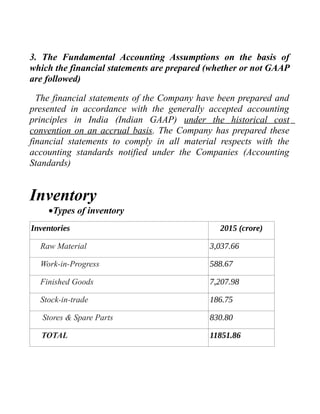

Apollo Tyres Ltd is an Indian tyre manufacturer founded in 1976 and headquartered in Gurgaon, India. It has four manufacturing plants located in India, South Africa, and Zimbabwe. Apollo Tyres generates most of its revenue from India but also has sales in Europe and Africa. The company prepares its financial statements according to Indian GAAP and uses the weighted average method to value its inventory, which includes raw materials, work in progress, finished goods, and stores/spare parts. Between 2013-2015, Apollo Tyres' revenues declined slightly but profits increased. The company also saw decreases in inventory levels and current assets over this period. Contingent liabilities are disclosed in the notes to the financial statements

![YEAR INVENTORY (crore) TOTAL CURRENT

ASSETS (crore)

Inventory as %age of

current assets

2013 20310.75 36861.65 55.09

2014 20664.24 41718.03 49.53

2015 17782.06 37084.08 47.95

•The absolute and percentage change in inventory value from

1st

year to 2nd

and from 2nd

year to 3rd

year in absolute

Absolute change

[current year inventory – previous year inventory]

Year Current year

inventory

(crore)

Previous year

inventory

(crore)

Absolute change

(crore)

2015 - 2014 17782.06 20664.24 -2882.18

2014 - 2013 20664.24 20310.75 353.49

Percentage change

[(absolute change / previous year inventory)*100]

Year Absolute

Change (crore)

Previous year

inventory

(crore)

Percentage

change (%)

2015 - 2014 -2882.18 20664.24 -13.94

2014 - 2013 353.49 20310.75 1.74](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-4-320.jpg)

![6. The absolute and percentage change in current assets from 1st

year to 2nd

and from 2nd

year to 3rd

year

Absolute change

[current year's current asset – previous year's current asset]

Year Current Year's

current asset

(crore)

Previous Year's

current asset

(crore)

Absolute

Change (crore)

2015 - 2014 37084.08 41718.03 -4633.95

2014 - 2013 41718.03 36861.65 4856.38

Percentage change

[(absolute change / previous year current asset)*100]

Year Absolute

Change (crore)

Previous Year's

current asset

(crore)

Percentage

change (%)](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-5-320.jpg)

![2015 - 2014 -4633.95 41718.03 -11.10

2014 - 2013 4856.38 36861.65 13.17

7. Working capital (net current assets ) in each of the 3 years and

the percentage change in working capital from 1st

year to 2nd

and

from 2nd

year to 3rd

year (Note: Working capital = Current Assets –

Current Liabilities)

WORKING CAPITAL

[Total Current Assets – Total Current Liabilities]

Year Total of Current

Assets (crore)

Total of Current

Liabilities

(crore)

Working Capital

(crore)

2013 36861.65 28709.79 8151.86

2014 41718.03 30778.49 10939.54

2015 37084.08 25847.08 11237

Percentage change

(current year – previous year)/previous year *100

Year Current year

working

Previous Year

Working Capital

Percentage](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-6-320.jpg)

![10. Events occurring after the balance sheet date

No events occurring after balancesheet

11. Revenue trends

•The absolute change and percentage change in revenue from 1st year

to 2nd and from 2nd year to 3rd year

Absolute change

[Current Year Net Revenue – Previous Year Net Revenue]

Year Current Year

Net Revenue

Previous Year

Net Revenue

Absolute

Change

2015 - 2014 127,257 133,103 -5846

2014 - 2013 133,103 127,950 5153

Percentage change:

[(Absolute Change / Previous Year Net Revenue)*100]

Year Absolute

Change

Previous Year

Net Revenue

Percentage

Change (%)

2015 - 2014 -5846 133103 -4.39

2014 - 2013 5153 127950 4.02

Profit after tax](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-8-320.jpg)

![Absolute change

[Current Year Net Revenue – Previous Year Net Revenue

Year Current Year Net

Revenue

Previous Year Net

Revenue

Absolute Change

2015 - 2014 9,776 10,051 -275

2014 - 2013 10,051 6130 3921

Percentage change:

[(Absolute Change / Previous Year Net Revenue)*100]

Year Absolute

Change

Previous Year

Net Revenue

Percentage

Change (%)

2015 - 2014 -275 10051 -2.73

2014 - 2013 3921 6130 63.96

EPS

Absolute change

[Current Year Net Revenue – Previous Year Net Revenue]

Year Current Year

Net Revenue

Previous Year

Net Revenue

Absolute

Change

2015 - 2014 6,450.81 4426.19 2024.62

2014 - 2013 4426.19 4002.14 424.05](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-9-320.jpg)

![Percentage change:

[(Absolute Change / Previous Year Net Revenue)*100]

Year Absolute

Change

Previous Year

Net Revenue

Percentage

Change (%)

2015 - 2014 2024.62 4426.19 45.74

2014 - 2013 424.05 4002.14 10.59

•Gross Profit Margin (Gross Profit ÷ Net Sales)

Year Gross Profit Net Sales Gross Profit

Margin

2015 14,133.17 12726 1.11

2014 12787.14 13310 0.96

•Operating Profit Margin (Operating Profit ÷ Net Sales)

Year Operating Profit Net Sales Operating Profit

Margin

2015 19,844 127,257 0.155

2014 19,734 133,103 0.148](https://image.slidesharecdn.com/18de9d1f-c297-4458-8e40-2b4674892167-161014172548/85/The-apollo-tyres-ltd-10-320.jpg)