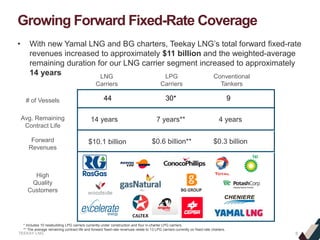

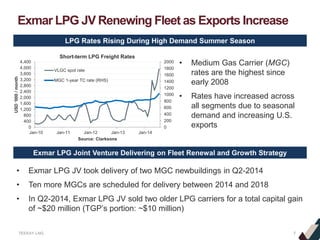

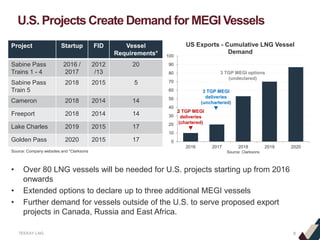

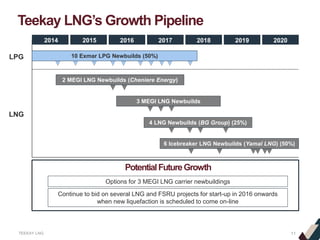

Teekay LNG finalized agreements to provide six icebreaker LNG carriers for the Yamal LNG project in Russia through a new joint venture. It also acquired ownership interests in four LNG carrier newbuildings from BG Group. These projects increased Teekay LNG's forward fixed-rate revenues to $11 billion over an average of 14 years. Teekay LNG's joint venture with Exmar took delivery of two new mid-size LPG carriers and sold two older LPG carriers. Teekay LNG continues to pursue growth opportunities in the LNG and LPG markets.