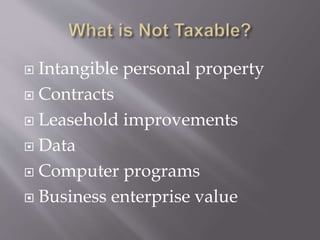

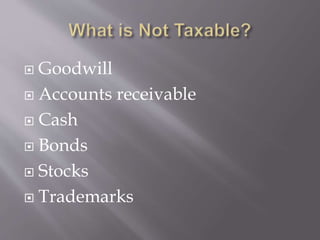

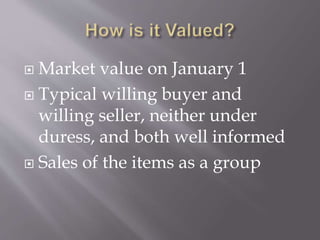

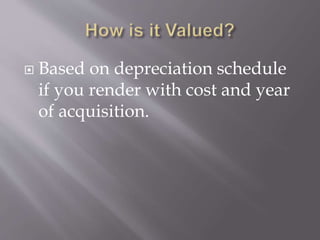

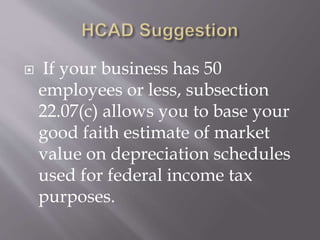

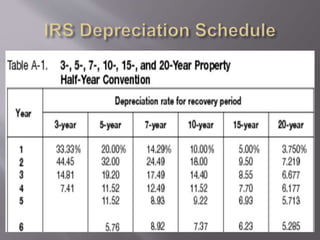

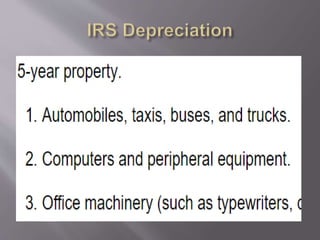

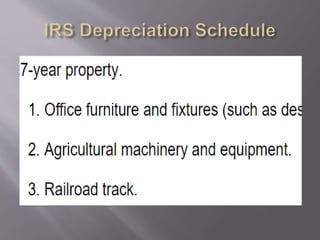

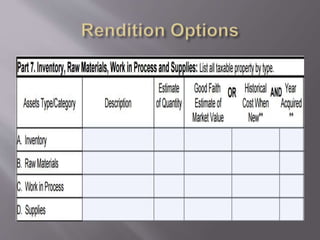

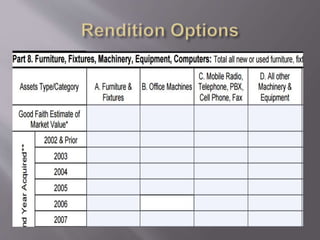

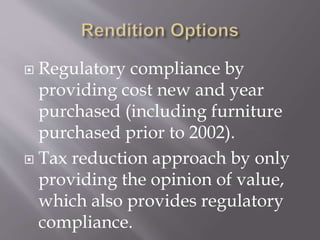

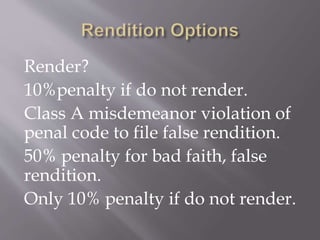

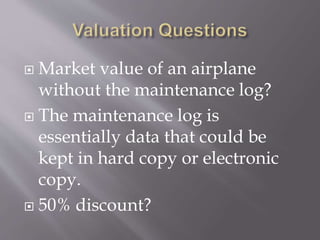

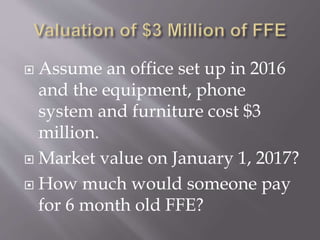

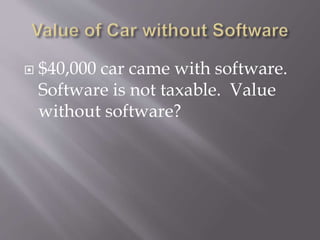

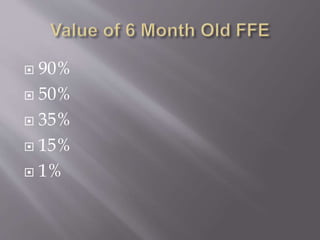

This document discusses guidelines for property tax rendition in Texas. It addresses what types of property are taxable, how they should be valued at market rate on January 1st, and options for rendition including providing cost and year of acquisition or only an opinion of value. It notes penalties for failure to render or filing false rendition, and offers advice on establishing reasonable valuations, pursuing appeals, and potential valuation discounts.