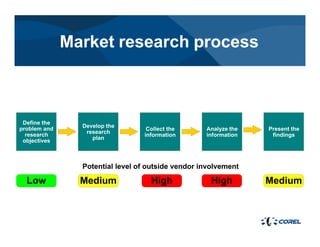

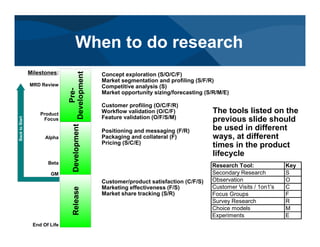

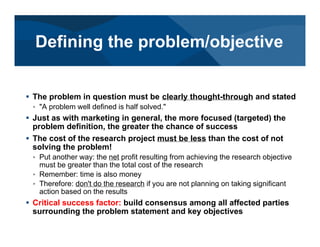

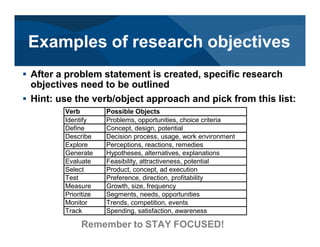

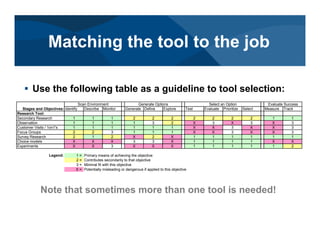

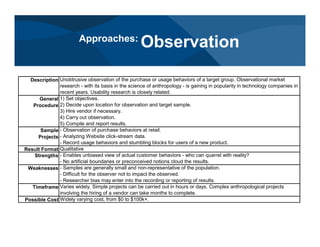

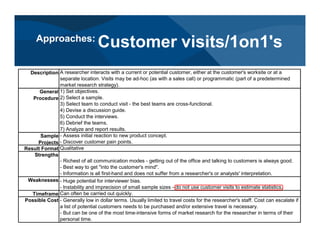

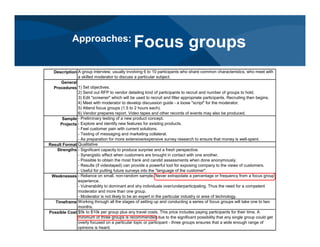

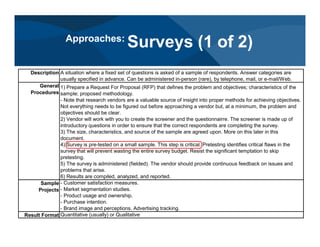

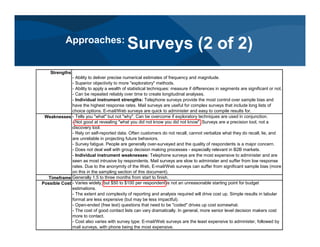

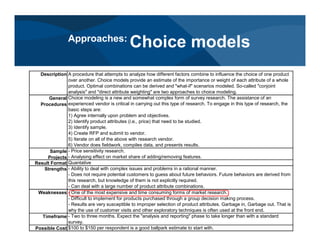

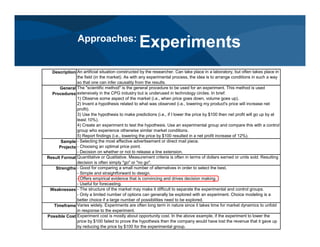

The document provides an overview of market research approaches and best practices. It defines market research and discusses secondary and primary research sources. It outlines the typical market research process and describes when different research tools should be used at various stages of the product lifecycle. Finally, it provides details on key research approaches like observation, customer interviews, focus groups, surveys, choice models, and experiments.