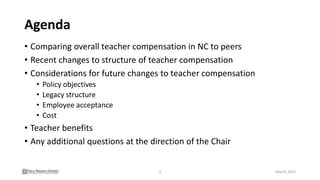

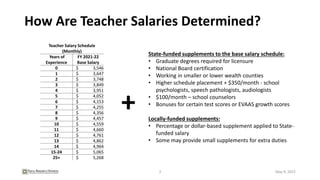

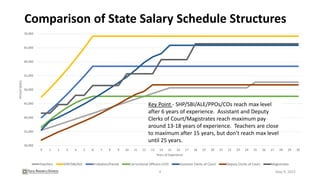

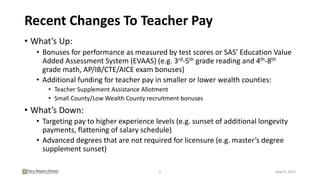

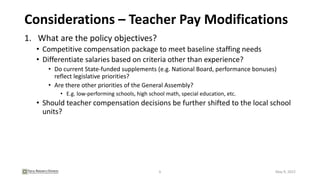

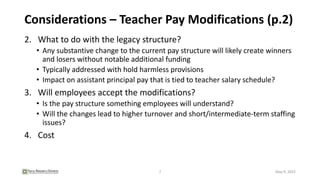

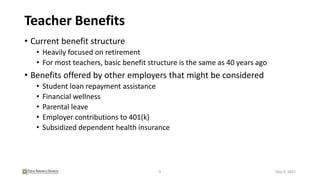

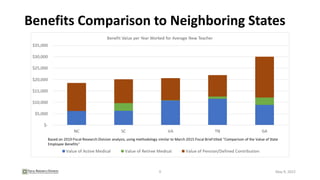

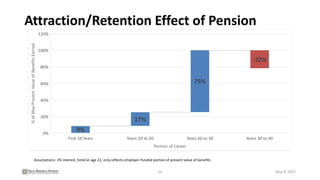

The document discusses teacher compensation and benefits in North Carolina. It compares NC teacher salaries to other states and outlines the current salary schedule structure. Recent changes to teacher pay are noted, including performance bonuses and supplements for certain counties. Considerations for future modifications to compensation include policy objectives, legacy structures, employee acceptance, and costs. Teacher benefits are also examined, noting the current focus on retirement and benefits offered by other employers that could be considered. Questions from the committee are taken at the end.