Taxation

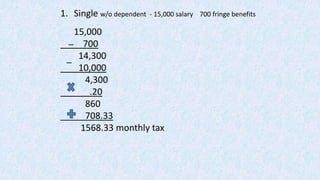

- 1. 1. Single w/o dependent - 15,000 salary 700 fringe benefits 15,000 700 14,300 10,000 4,300 .20 860 708.33 1568.33 monthly tax

- 2. 2. Married w/ 2 children – 18,500 salary 875 fringe benefits 18,500 875 17625 14167 3458 .20 691.6 708.33 1399.93

- 3. 3. Married w/ 4 children – 9000 salary 700 –fringe benefits 9000 700 8300 = 150 monthly tax

- 4. 4. Married w/ 3 children,2 in the GS & 1 is 24yrs.old = 25,000 salary 950 fringe benefits 25,000 950 24,050 20,000 4,050 .25 1012.50 1875.00 2887.50 monthly tax

- 6. P4.712 trillion as of last April from previous month’s P4.705 trillion

- 8. Buwis Kita ng Pamahalaan Pangungutang Tulong mula sa ibang bansa Kita ng Negosyo Pagbebenta ng Ari-arian

- 14. BUWIS sapilitang kontribusyon na sinisingil ng pamahalaan sa mga taong naghahanapbuhay at sa mga kompanya.

- 15. TEORYA NG PAGBUBUWIS Ability to Pay Principle Benefit Theory Equal Distribusyon Theory

- 16. Mga Uri ng Buwis 1. Batay sa Antas ng Buwis a. Progresibo- tumataas ang proporsyon ng buwis na ibinabayad ng indibidwal habang lumalaki ang kanyang kita at dumarami ang kanyang pag-aari. kita at yaman = buwis bilang % ng kita at yaman

- 17. b. Regresibo – habang tumataas ang kita ay siya namang bumababa ang proporsyon ng buwis sa kita na sinisingil. kita at yaman = buwis bilang % ng kita at yaman kita at yaman = buwis bilang % ng kita at yaman c. Proporsyonal- hindi nagbabago ang buwis kahit magbago ang halaga binubuwisan. kita at yaman = parehong antas ng buwis

- 18. 2. Batay sa Pagbabayad a. Tuwiran (direct) hal. Income tax, property tax , immigration tax, inheritance tax b. Di-tuwiran ( indirect) hal. Sales tax, EVAT

- 19. 3. Ayon sa Layunin a. Buwis sa Hanapbuhay b. Community Tax ( Sedula ) 4. Buwis sa Kita 5. Buwis sa Ari-arian 6. Excise Tax a. Specific Tax- ( batay sa bigat ng produkto) b. Ad Valorem Tax( batay sa presyo ) 7. Regulatory Tax- maisaayos ang pagbili at paggamit ng mga produkto ( taripa) 8. Value Added Tax/ EVAT/ RVAT

- 20. VAT- ( Value Added Tax) - E.O. #. 273 - Pres. Corazon Aquino - Jan. 1, 1988 - buwis na ipinapataw sa produkto at serbisyo. - 10 %

- 21. SAKOP NG VAT PROCESSED FOODS VAT SERBISYO NG BARBERO, BEAUTICIAN, SECURITY GUARD KAGAMITANG PAMBAHAY PRODUKTONG PANGKABUHAYAN CONTRACTORS, BROKERS , MILLERS MGA GAMIT SA PAARALAN

- 22. • EVAT ( EXPANDED VALUE ADDED TAX) R.A. 7716 PRES. FIDEL RAMOS JAN.1, 1996 10%

- 23. SAKOP NG EVAT IMPORTED NA KARNE PROPERTY RIGHTS PRANGKISA NG TELEPONO,TELEBISYON AIR FREIGHT, SHIPPING, TRUCKING PAGGAMIT NG CABLE TV SATELLITE TRANSMISSION NONLIFE INSURANCE PAMATAY PESTE SPECIALTY FEEDS SERBISYO NG MGA HOTELS, RESTAURANTS,RESORTS ATBP.

- 24. • RVAT – REFORMED VALUE ADDED TAX R.A. # 9337 PRES. GLORIA MACAPAGAL ARROYO NOV. 2007 12% ELEKTRISIDAD PETROLYO

- 26. Monthly 1 2 3 4 5 6 7 8 Exemption Status 0.00 +0% over 0.00 +5% over 41.67 +10% over 208.33 +15% over 708.33 +20% over 1,875 +25% over 4,166.67 +30% over 10,416.67 A. Table for employees w/o qualified dependent 1. Z 0.0 2. S/ME 50 1 1 0 4,167 833 5,000 2500 6,667 5,833 10,000 11,667 15,883 20,833 25,000 41,667 45,833 B. Table for employees w/ qualified dependent Child(ren) 1.ME1/S1 75 2.ME2/S2 100 3.ME3/S3 125 4.ME4/S4 150 1 1 1 1 6,250 8,333 10,417 12,500 7,083 9,167 11,250 13,333 8,750 10,833 12,917 15,000 12,083 14,167 16,250 18,333 17,917 20,000 22,083 24,167 27,083 29,167 31,250 33,333 47,917 50,000 52,083 54,167

- 27. De minimis- benefits not subject to income tax. 1. Monetized unused vacation leave credits of employees not exceeding 10 days during the year . 2. Medical cash allowance to dependents of employees not exceeding 750.00 per employee per semester or 125 per month 3. Rice subsidy of 1,500 or 1 sack of 50 kg. rice per month amounting to not more than 1,500

- 28. 4. Uniforms and clothing allowance not exceeding 4,000 per annum 5. Actual yearly medical benefits not exceeding 10,000 per annum 6. Laundry allowance not exceeding 300.00 per month

- 29. 7. Employees achievement awards,e.g, for length of service which must be in the form of a tangible personal property other than cash or gift certificate, with an annual monetary value not exceeding 10, 000 received by the under an established written plan which does not discriminate in favour of highly paid employees

- 30. 8. Gifts given during Christmas and major anniversary celebrations not exceeding 5,000 per employee per annum

- 31. 9. Flowers, fruits,books or similar items given to employees under special circumstances,e.g., on account of illness, marriage, birth of a baby etc. 10. Daily meal allowance for overtime work not exceeding 25 % of the basic minimum wage.

- 32. 1. Si Mrs.Daz ay single walang umaasa. Tumatanggap ng P15,000 bilang regular na buwang sahod at P 3000 bilang supplementary na sahod. Magkano ang buwanang buwis ni Mrs.Daz?

- 33. Regular Compensation P 15,000 Gross Benefits supplementary compensation= 3,000 Less: Compensation Level ( Line A-2 Column 5) P 10, 000 Excess : P 5,000 Add: Supplementary Compensation P 3,000 Total : P 8,000 Tax on P10,000 P 708.33 Tax on excess ( P8000 X .20 ) P 1,600.00 Withholding Tax P 2,308.33

- 34. 2. Si Gng. Dimas ay may 3 na anak isa dito ay nagtatrabaho na sa kompanyang pinapasukan niya. Ang regular na sahod ni Gng. Dimas ay 16,400 at may hazard pay na natatangap na 2,000 at overtime pay na 1,000. Magkano ang withholding tax niya?

- 35. Regular Compensation P 16,400 Gross Benefits Hazard Pay 2,000 overtime Pay 1,000 = 3, 000 Total taxable Compensation Income 19,400 Regular Compensation 16, 400 Less: Compensation Level ( Line B-2 Column 5) P 14, 167 Excess : P 2, 233 Add: Supplementary Compensation P 3, 000 Total : P 5, 233 Tax on P14,167 P 708.33 Tax on excess ( P5,233X .20 ) P 1,046.60 Withholding Tax P1,754.93

- 36. Si G.Aquino ay may tatlong dependents, nakakatanggap ng P18,500 bilang regular na sahod kada buwan. Bukod dito ay iba pa siyang natatanggap tulad ng commission na P12,000, transportation allowance na P 3,000, hazard Pay na P3,000, overtime pay na P1,000 at night shift differential na P 1,500.Magkano ang withholding tax?

- 37. Regular Compensation 18,500 Gross benefits commission 12,000 Transpo 3, 000 H.P 3, 000 O.T. 1,000 N.D 1,500 20,500 total taxable income-=39,000 reg.comp. 18,500 less (Line B-2,C5) 16,250 2,250 + 20,500 22,750 Tax on 14,167 = 708.33 tax on excess (24,833 X .20)= 4,550 W.T. 5,258.33

- 38. Si Bb. Corpus ay single ngunit may isang dependent. May regular na sahod na P19, 500. May natatanggap siya na P 1,500 na honorarium bukod dito may natatanggap siya na overtime pay na P2,000. Magkano ang withholding tax?

- 39. . Regular Compensation P19,500 Gross Benefits Honorarium 1500 Overtime Pay 2000 P 3,500 Total Taxable Compensation Income P 23,000 Regular Compensation P19,500 Less: ( Line B-1 column 6 ) P17,917 Excess : P 1,583 Add: Supplementary Compensation P 3,500 Total : P 5,083 Tax on P 17,917 P 1,875.00 Tax on excess ( 5,083 X .25 ) P _1,270.75 Withholding Tax P 3,145.75