Tax on Provident Fund contribution

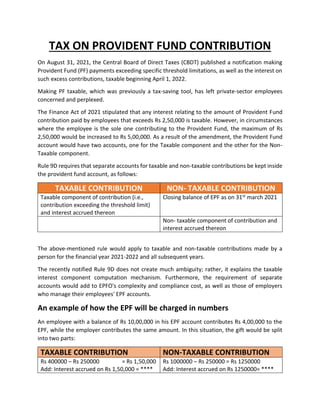

- 1. TAX ON PROVIDENT FUND CONTRIBUTION On August 31, 2021, the Central Board of Direct Taxes (CBDT) published a notification making Provident Fund (PF) payments exceeding specific threshold limitations, as well as the interest on such excess contributions, taxable beginning April 1, 2022. Making PF taxable, which was previously a tax-saving tool, has left private-sector employees concerned and perplexed. The Finance Act of 2021 stipulated that any interest relating to the amount of Provident Fund contribution paid by employees that exceeds Rs 2,50,000 is taxable. However, in circumstances where the employee is the sole one contributing to the Provident Fund, the maximum of Rs 2,50,000 would be increased to Rs 5,00,000. As a result of the amendment, the Provident Fund account would have two accounts, one for the Taxable component and the other for the Non- Taxable component. Rule 9D requires that separate accounts for taxable and non-taxable contributions be kept inside the provident fund account, as follows: TAXABLE CONTRIBUTION NON- TAXABLE CONTRIBUTION Taxable component of contribution (i.e., contribution exceeding the threshold limit) and interest accrued thereon Closing balance of EPF as on 31st march 2021 Non- taxable component of contribution and interest accrued thereon The above-mentioned rule would apply to taxable and non-taxable contributions made by a person for the financial year 2021-2022 and all subsequent years. The recently notified Rule 9D does not create much ambiguity; rather, it explains the taxable interest component computation mechanism. Furthermore, the requirement of separate accounts would add to EPFO's complexity and compliance cost, as well as those of employers who manage their employees' EPF accounts. An example of how the EPF will be charged in numbers An employee with a balance of Rs 10,00,000 in his EPF account contributes Rs 4,00,000 to the EPF, while the employer contributes the same amount. In this situation, the gift would be split into two parts: TAXABLE CONTRIBUTION NON-TAXABLE CONTRIBUTION Rs 400000 – Rs 250000 = Rs 1,50,000 Add: Interest accrued on Rs 1,50,000 = **** Rs 1000000 – Rs 250000 = Rs 1250000 Add: Interest accrued on Rs 1250000= ****

- 2. How do I pay my tax? There are some questions about the employee's responsibility to pay tax versus the payer's responsibility to withhold tax. The employee's responsibility for tax payment differs from the payer's responsibility to withhold tax. Any person making a payment of accumulated EPF balance to any employee, provided the quantum of such payment exceeds Rs 50,000 and the money is payable to tax in the hands of the employee, was already obligated to withhold tax under section 192A of the IT Act. As a result, such a duty to withhold tax is not a result of the CBDT Circular recently issued, but is already enshrined in Section 192A of the IT Act. TDS certificate to be issued by EPFO According to the IT Act, everyone who deducts TDS when making a payment to an assessee is required to issue a TDS certificate to that assessee within a certain time frame. This certificate serves as documentary documentation that the assessee can use to claim TDS credit while filing his tax return. As a result, EPFO will be required to issue TDS Certificates to employees who have tax deducted or withheld. How to Save Taxes? Before making investments, EPF subscribers who contribute more than the threshold limit should examine their investment strategy in light of the taxation of the excess contribution and consider other alternative investment choices.