Chhattisgarh Stamp Duty Rates Guide

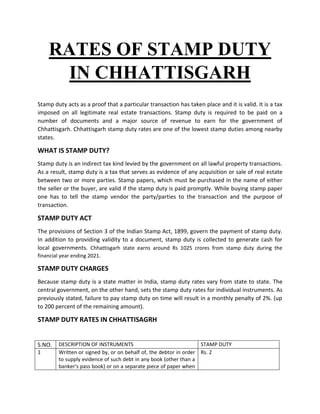

- 1. RATES OF STAMP DUTY IN CHHATTISGARH Stamp duty acts as a proof that a particular transaction has taken place and it is valid. It is a tax imposed on all legitimate real estate transactions. Stamp duty is required to be paid on a number of documents and a major source of revenue to earn for the government of Chhattisgarh. Chhattisgarh stamp duty rates are one of the lowest stamp duties among nearby states. WHAT IS STAMP DUTY? Stamp duty is an indirect tax kind levied by the government on all lawful property transactions. As a result, stamp duty is a tax that serves as evidence of any acquisition or sale of real estate between two or more parties. Stamp papers, which must be purchased in the name of either the seller or the buyer, are valid if the stamp duty is paid promptly. While buying stamp paper one has to tell the stamp vendor the party/parties to the transaction and the purpose of transaction. STAMP DUTY ACT The provisions of Section 3 of the Indian Stamp Act, 1899, govern the payment of stamp duty. In addition to providing validity to a document, stamp duty is collected to generate cash for local governments. Chhattisgarh state earns around Rs 1025 crores from stamp duty during the financial year ending 2021. STAMP DUTY CHARGES Because stamp duty is a state matter in India, stamp duty rates vary from state to state. The central government, on the other hand, sets the stamp duty rates for individual instruments. As previously stated, failure to pay stamp duty on time will result in a monthly penalty of 2%. (up to 200 percent of the remaining amount). STAMP DUTY RATES IN CHHATTISAGRH S.NO. DESCRIPTION OF INSTRUMENTS STAMP DUTY 1 Written or signed by, or on behalf of, the debtor in order to supply evidence of such debt in any book (other than a banker's pass book) or on a separate piece of paper when Rs. 2

- 2. such book or paper is left in the creditor's possession: Provided that such acknowledgement does not contain any promise to pay the debt or any stipulation to remit the debt, or to deliver any goods or other property. 2 A bond provided under section 291, 375, or 376 of the Indian Succession Act, 1925 (39 of 1925), or section 6 of the Government Savings Bank Act,l873 (5 of 1873) are examples of administration bonds The same duty as a Bond (No.l5) for such amount. 3 Adoption Dead: That is, any document (other than a Will) that records an adoption or grants or purports to provide authorization to adopt. Rs.500 (w.e.f. 25 april 1997) 4 Affidavit, which includes an affirmation or declaration in the instance of those who are permitted by law to affirm or declare rather than swear. EXEMPTIONS: Affidavit or written declaration when made – (a) as a condition of enrollment under the Army Act, 1950 (XLVI of 1950) or the Air Force Act, 1950 (XLVI of 1950) (b) For the sole purpose of enabling any person to receive any pension or charitable allowance; or (c) For the sole purpose of being filed or utilised in any Court or before any officer of any Court. EXEMPTIONS: (1) "An affidavit signed by a member of a Schedule Caste or Schedule Tribe" (Notification no 780-202-6-R-76 dated 02.11.1976) (2) Affidavit filed with a Commission of Inquiry established by the Government of India or a State Government under the Commission of Inquiry Act of 1952.” (Notification no.767-1094-VI-R dated 18.10.1977) Rs. 5 (w.e.f. 15.10.1990) 5 Agreement or memorandum of agreement: (a) It relates to the sale of a bill of exchange, a government security, or a share in an incorporation company or other legal entity. = Rs. 1 for every 10,000 rupees or fraction thereof in the value of a bill of exchange, security, or

- 3. (aa) If the contract is for the construction of a building on a piece of land by someone other than the owner or lessee of the land, and it states that after construction, the building will be held jointly or severally by that other person and the owner or lessee of the land, as the case may be, or that it will be sold jointly or severally by them, or that a portion of it will be held jointly or severly by them. (b) If not otherwise provided for. Exemptions:- Agreement or memorandum of an agreement – (i) solely for or relating to the sale of commodities or products, and not a note or memorandum chargeable under no 43. (ii) submitted to the Central Government in the form of tenders for or relating to any Loan Agreement to Lease, see Lease (No. 35) share. = 2% of the land's market value. = Rs. 50 The M.P. Amendment Act, 19 of 1989, appears to have left exemptions out of the statute. 6 Any instrument evidencing an agreement pertaining to the deposit of title deeds, pawn or pledge, or any other agreement relating to - 1. the deposit of title deeds or other evidence of ownership to any property (other than a marketable security), or 2. the pawn, or pledge or moveable property, if such deposit, pawn, or pledge is provided as security for the repayment of money advanced or to be advanced by way of loan or a current or future debt – (a) if the loan or debt is repayable on demand or within three months of the date of the agreement's document. (b) if the loan or debt is repayable within three months of the instrument's date of issuance. * “0.5 percent of the sum secured by such deed, up to a maximum of 50,000 rupees” [Notice no. 69, issued July 23, 2003, was amended. = * 2% of the amount of loan or debt -Half the duty payable under sub- clause (a) of this article

- 4. * "0.1 percent of the amount secured by such deed" [Amended by notification no. 12 dated February 28, 2004]. EXPLANATION: for the purpose of clause (1) of this article, notwithstanding anything contained in any judgment, decree or order of any Court or order of any authority, any letter, note, memorandum or writing relating to the deposit of title deeds whether written or made either before or at the time when or after the deposit of title deeds is affected, and whether it is in respect of the security for the first loan or any additional loan or loans taken subsequently, shall in the absence of any separate agreement or memorandum of agreement relating to deposit of such title deeds, be deemed to be an instrument evidencing an agreement relating to the deposit of title deeds. EXEMPTIONS: Instrument of pawn or pledge of agricultural produce if unattested" 7 Appointment in the exercise of a power- whether of trustees or of movable or immovable property, made by any writing other than a will. Rs. 100 8 Appraisal or valuation — a determination made without a court order in the course of a suit; (a) if the amount is less than Rs. 10,000/- b) In all other circumstances Exemptions: (A) Appraisal or value performed solely for the benefit of one party and not binding on the parties in any way, either by agreement or by operation of law. (B) Crop appraisal for the purpose of determining the amount of rent to be paid to a landlord. The same duty as a Bond (No.l5) for such amount. Rs. 100 9 Apprenticeship Deed - Every writing relating to the service or tutoring of any apprentice, clerk, or servant placed with any master to learn any profession, trade, or occupation, excluding articles and clerkships (No. 11). Exemption - An apprenticeship instrument signed by a Magistrate under the Apprentices Act of 1961 (LII of 1961) -Rs. 15

- 5. or by which a person is apprenticed by or at the charge of a public charity. 10 Articles of association of a company, (a) In the case of a firm with no share capital. (b) Where the company's share capital is nominal. EXEMPTION: Articles of any association not formed for profit and registered under Section 25 of the Companies Act, 1956 are exempt ( No 1 of 1956). Rs. 1000 0.15% of such nominal share capital subject to a minimum of Rs.1000, and a maximum of Rs.5 lakh. 11 Articles of clerkship or contract requiring a person to first serve as a clerk before being admitted as an attorney in a High Court. Assignment,See conveyance (No. 23), transfer (No. 62), and transfer or lease (No. 63). Attorney,See power of attorney ( No. 48), See Adoption-Deed (No. 3) for authority to adopt Rs. 350 12 Award, that is, any written decision by an arbitrator or umpire on a reference made other than by an order of the court in the course of a dispute, that is not an award directing a partition: (a) where the award is for less than Rs. 10,000/- (b) when the award is for more than Rs. 10,000/- (i) on the first Rs. 10,000; (ii) on every additional Rs. 10,000/- or part thereof in excess of Rs. 10,000/- The same duty as a Bond (No. l5) for such amount. The same duty as a Bond (No. l5) for such amount. Rs. 10 13 - - 14 - - 15 BOND- (As defined in section 2(5), a bond is one that is not a debenture and is not otherwise provided for by this Act or the Court Fees Act of 1870.) (VII of 1870). On the amount or value secured:

- 6. Provided that if the amount or value is not a multiple of ten rupees, it shall be rounded off to the nearest multiple of ten rupees, with amounts greater than five rupees being counted as ten rupees and amounts less than five rupees being ignored. EXEMPTION: Bond, when undertaken by any individual for the purpose of ensuring that the local income received from private subscriptions to a charitable dispensary, hospital, or any other object of public use does not fall below a certain sum per mensem. See Administration Bond (No. 2), Bottomry Bond (No. 16), Customs Bond (No. 26), Indemnity Bond (No. 34), Respondentia Bond (No. 56), Security Bond (No. 57) 2% of such amount or value 16 Bottomry Bond, any instrument by which the master of a seagoing ship borrows money on the ship's security to enable him to preserve the ship or continue her voyage. 17 17-A 17-B Cancellation- If attested and not otherwise provided for, an instrument of (including any instrument by which an instrument previously executed is cancelled). See also Release (No. 55), Revocation of Settlement (No. 58B), Surrender of lease (No. 61), Revocation of trust (No. 64-B) The State Bar Council of Chhattisgarh granted a “certificate of enrolment” under section 22 of the Advocates Act, 1991 (No.25 of 1991). Certificate of practise as a notary, public issued under subsection (l) of section 5 of the Notaries Act, l952 (No.53 of l952), or endorsement of renewal of such certificate issued under subsection (2) of the said section. Rs. 100 Rs. 250 Rs. 500 18 A certificate of sale is given to the purchaser of any property sold by public auction by a civil or Revenue Court, or by a Collector or other Revenue Officer (in respect of each property put up as a distinct lot and sold). The same duty as a conveyance. No.23) for a market value equal to the amount of purchase money only. provided that if the total amount of duty payable is not a multiple of 50 paise, it shall be rounded off to the nearest rupee, half of a rupee

- 7. or over being counted as one rupee and less than half of a rupee being disregarded. 19 Certificate or other document evidencing the holder's or any other person's right or title to any shares, scrip, or stock in or of any incorporated business or other body corporate, or the right or title to become the proprietor of such shares, scrip, or stock. Rs. 2 20 20-A Charter Party- Any instrument (excluding an agreement for the employment of a tug-steamer) by which a vessel or some specified principal component thereof is hired for the charterer's defined purposes, whether or not it includes a penalty provision. Clearance List- (a) if the transaction involves the acquisition or sale of Government securities through a stock exchange's clearing house. (b) if relates to the purchase or sale of a share, scrip, stock, bond, debenture, debenture-stock, or other marketable security of a like type in or of an incorporated business or other body corporate, filed to a stock exchange clearing house. Rs. 3 One rupee for every Rs. 10,000 or part thereof in respect of each of the entries in such list on the value of securities calculated at the making price or the contract price, as the case may be, subject to a maximum of Rs. 1000. One rupee for every Rs. 10,000 or part thereof in respect of each of the entries in such list on the value of securities calculated at the making price or the contract price, as the case may be. 21 - - 22 Composition deed- any instrument executed by a debtor in which he conveys his property for the benefit of his creditors, or where payment of composition or dividend on their debts is secured to the creditors, or where provision is made for the debtor's business to continue for the benefit of his creditors, under the supervision of inspectors or under letters of license. Rs. 50 23 Conveyance- Any conveyance that is not a transfer charged or exempted under No. 62, regardless of the 5% of such market value. provided that if total amount of

- 8. market value of the property being conveyed. Exemptions- Assignment of Copyright under the Copy-right Act,1957 (No.14 of 1957), Section 18, Co- partnership deed, See Partnership (No. 46). Explanation- For the purposes of this article, where the possession of any immovable property is transferred to the purchaser before or after the execution of such agreement without the execution of the conveyance in respect thereof, such agreement to sell shall be deemed to be a conveyance and stamp duty shall be levied in accordance with the provisions of this article: Provided that the provisions of section 47-A apply mutatis mutandis to such agreement that is deemed to be a conveyance as aforesaid in the same way that they apply to a conveyance under that section: Further, where a conveyance is executed in pursuance to such agreement of sale, the stamp duty, if any, already paid and recovered on the agreement of sale that is deemed to be a conveyance shall be adjusted towards the total duty leviable on the conveyance, up to a maximum of Rs. 10. the duty payable is not a multiple of fifty paise, it shall be rounded off to the nearest rupee, half of a rupee and over being counted as one rupee and less than half a rupee being disregarded. provided further that, where an instrument relates to the amalgamation or reconstruction of companies under order of the High Court under section 394 read with section 391 of the Companies Act,1956(1 of 1956) or under order of the Reserve Bank of India under section 44-A of the Banking Regulation Act,1949 (10 of 1949) the duty chargeable shall not exceed an amount equal to 5% of the marker value of the immovable property transferred which is located within the State of Chhattisgarh or an amount equal to 0.7% of the aggregate of the market value of the shares issued or allotted in exchange or otherwise and the amount of consideration paid for such transfer, whichever is higher. 24 Copy or Extract- It is certified to be a true copy or extract by or by order of any public officer and is not payable under the law related to court fees in effect at the time. Exemption: (a) A copy of any paper that a public officer is required by law to make or give for record in office or for any other public purpose. (b) A copy of any registry related to births, baptisms, namings, dedications, marriages, divorces, deaths, or burials, or an excerpt from one. Rs. 10 25 Any instrument for which the necessary duty has been paid has a counterpart or duplicate-

- 9. (a) If the duty on the original instrument is not more than four rupees. (b) In any other case…. Exemption: When a cultivator is awarded a duty-free lease, this is the counterpart of the lease. The same duty as is payable on original. Rs. 6 26 Customs bond – (a) if the amount is less than Rs. 5,000/- (b) if the amount is more than Rs. 5,000/- see also (Bond No. l5) and sections 8 and 55 - Declaration of any trust, see Trust (No. 64) Same duty as a bond (No.l5) for such amount, subject to the maximum of Rs. 50/- Rs. 100 27 (A) Declaration under the Prakoshtha Swamitva Adhiniyam of Chhattisgarh. (B) A document that amends or corrects a previously registered deed but does not make any major changes. Explanation- A material alteration, for the purposes of this article, is one that changes the parties' rights, obligations, or legal standing as determined from the document in its original state, or otherwise changes the legal effect of the instrument as originally performed. Rs. 10,000 Rs. 1000 28 Delivery Order- Any instrument entitling any person named therein, or his assigns, or the holder thereof, to the delivery of any goods, lying in a dock of port, or in any warehouse in which goods are stored or deposited on rent or hire, or upon a wharf, such instrument being signed by or on behalf of the owner of such goods, upon the sale or transfer of the property therein, when such goods exceed in value twenty rupees. Deposit of Title - Deeds, see Agreement relating to Deposit of Title Deeds, Pawn or Pledge (No.6). Dissolution of partnership, See partnership (No. 46). Rs. 2 29 Divorce is an instrument of, that is, any instrument that allows a person to dissolve his marriage. Rs. 100

- 10. Dower, instrument of, See settlement (No. 58) Duplicate, see Counterpart (No.25) 30 - - 31 Exchange of property - Instrument of Extract, see copy (No.24) The same duty as a conveyance (No.23) for a market value equal to the market value of the property of greater value which is the subject matter of exchange. 32 Further charge - Instrument of, that is, any instrument imposing a further charge on mortgaged property – (a) When the original mortgage is one of the types listed in Article No. 40, clause (a) (that is, with possession). (b) If the mortgage is one of the types mentioned in Article No. 4o's clause (b) (that is, without possession). (i) If possession of the property is given or agreed to be given under the instrument of additional charge at the moment of execution. (ii) If possession is not so given.... The same duty as a conveyance (No.23) for a market value equal to the amount of the further charge secured by such instrument. The same duty as a conveyance (No.23) for a market value equal to the total amount of the charge (including) the original mortgage and any further charge already made) less the duty already paid on such original mortgage and further charge. The same duty as a Bond (No. l5) for the amount of the further charge secured by such instrument. 33 Gift - Instrument of, not being a settlement (No. 58) or will or Transfer (No. 62) (a) When the donee is not a family member of the donor; The same duty as a conveyance (No.23) for a market value equal to the market value of the property which is the subject matter of gift;

- 11. (b) When the donee is a member of the donor's family; Explanation: The donor's father, mother, husband or wife, son, daughter, daughter-in-law, brother, sister, and grandchildren, including son's son and daughter and daughter's son and daughter, are considered family for this reason. At the rate of half percent of the market value of the property which is the subject matter of the gift. 34 Indemnity Bond.. Inspectorships-deed, See Composition Deed (No. 22). The same duty as a security Bond (No.57) for the same amount. 35 Lease, including under-lease or sub-lease and any agreement to let or sub-let- (a) Where by such lease the rent is fixed and no premium is paid or delivered- (i) If the lease purports to be for a period of less than a year. (ii) If the lease claims to be for a period of not less than one year but not more than five years. (iii) When the lease purports to be for a term of more than five but less than 10 years. (iv) When the lease purports to be for a term of more than ten years but less than twenty years. (v) When the lease purports to be for a term of more than twenty years but less than thirty years. (vi) Where the lease purports to be for a term of more than thirty years but less than 100 years; The same duty as a Bond (No. 15) for the whole amount payable or deliverable under such lease. The same duty as a Bond (No. 15) for the amount or value of average annual rent reserved. The same duty as a conveyance (No.23) for a market value equal to the amount or value of one and half times the average annual rent reserved. The same duty as a conveyance (No.23) for a market value equal to three times the amount or value of the average annual rent reserved. The same duty as a conveyance (No.23) for a market value equal to five times the amount of value of the average annual rent reserved. The same duty as a conveyance (No.23) for a market value

- 12. (vii) Where the lease purports to be for a term of more than 100 years or in perpetuity; (viii) Where the lease purports to be for no definite term. (aa) if the mining lease is granted through an auction; (i) If the lease purports to be for a period of less than 1 year. (ii) If the lease purports to be for a period of not less than one year and not more than five years. (iii) When the lease purports to be for a term of more than five but less than 10 years. (iv) When the lease purports to be for a term of more than ten years but less than twenty. (v) When the lease purports to be for a term of more than twenty years but less than thirty. equal to eight times the amount or value of the average annual rent reserved. The same duty as a conveyance (no.23) for a market value equal to one fourth of the whole amount of rent which would be paid or delivered in respect of the first twelve and half years of the lease. first 50 years of lease. The same duty as a conveyance (No. 23) for a market value equal to three times to amount or value of the average annual rent which would be paid or delivered for the first ten years, if lease continued so long. The same duty as a Bond (No. 15) for the whole amount payable or deliverable under such lease. The same duty as a Bond (No. 15) for the amount or value of average annual royalty reserved The same duty as a conveyance (No.23) for a market value equal to the amount or value of one and half times the average annual royalty reserved. The same duty as a conveyance (No.23) for a market value equal to three times the amount or value of the average annual royalty reserved. The same duty as a conveyance (No.23) for a market value equal to five times the amount of value of the average annual royalty reserved. The same duty as a conveyance

- 13. (vi) If the lease purports to be for a term of more than thirty years but less than one hundred. (vii) If the lease purports to be for a term of more than one hundred years or indefinitely. (viii) If the lease does not appear to be for a specific period of time. Explanation: If a mining licence is granted through an auction, no stamp duty is payable on any payment other than royalty. (b) When the lease is issued in exchange for a fee, premium, or money advance, and no rent is set aside. (c). If the lease is granted in exchange for a fee or premium, or for money paid in advance of the rent reserved. (No.23) for a market value equal to eight times the amount or value of the average annual royalty reserved. The same duty as a conveyance (no.23) for a market value equal to one fourth of the whole amount of royalty which would be paid or delivered in respect of the first twelve and half years of the lease. The same duty as a conveyance (No. 23) for a market value equal to three times the amount or value of the average annual royalty which would be paid or delivered for the first ten years, if lease continued so long. The same duty as a conveyance (No.23) for a market value equal to the amount or value of such fine or premium or advance as set forth in the lease. The same duty as a conveyance (No.23) for a market value equal to the amount or value of such fine or premium or advance as set forth in the lease, in addition to the duty which would have been payable on such lease, if no fine or premium or advance had been paid or delivered : Provided that, in any case when an agreement to lease is stamped with the advalorem stamp required for a lease and a lease in pursuance of such

- 14. Exemption - When a definite term is expressed and such term does not exceed one year or when the average annual rent reserved does not exceed one hundred rupees, a cultivator may execute a lease for the purposes of cultivation (including a lease of trees for the production of food or drink) without paying or delivering any fine or premium. Explanation - When a lessee agrees to pay any recurring charge, such as Government revenue, the landlord's share of cesses, or the owner's share of municipal rates or taxes, which is legally recoverable from the lessor, the amount thus agreed to be paid is assumed to be part of the rent. agreement is subsequently executed, the duty on such lease shall not exceed ten rupees. 36 Letter of allotment of shares in any firm or proposed company, or in relation to any debt that the company or proposed company would raise. Rs. 2 37 - - 38 A letter of license is an agreement between a debtor and his creditor that the later will suspend their claims for a certain period of time and enable the debtor to conduct business at his own discretion. Rs. 50 39 Memorandum of Association of a company- (a) If accompanied by articles of Association under section-l7 of the Indian companies Act, l9l3 (VII of l9l3), or section 26, 27 and 28 of the companies Act, l956 (1 of l956). (b) If not so accompanied. Exemption - memorandum of any association not formed for profit and registered under section 26 of the Indian Companies Act,1913 (VII of 1913) or section 25 of the Companies Act,1956 (1 of 1956). Rs. 500 The same duty as leviable on articles of Association under Article 10, according to the share capital of the company. 40 Mortgage deed, not being an agreement relating to Deposit of Title Deeds, pawn or pledge (No. 6) Bond (No. l5), Mortgage of a crop (No. 4l) Respondentia Bond (No. 56) or security Bond (No. 57):

- 15. (a) when the mortgagor gives or agrees to give possession of the property or any part of the property covered by the deed; (b) if possession is not provided or agreed to be given in the manner stated. Explanation: A mortgagor who issues a power of attorney to the mortgagee to collect rent or a lease of the property mortgaged or a portion thereof is regarded to give possession within the meaning of this article. (c) Where the principal or primary security is duly stamped, a collateral, auxiliary, extra, or substituted security or by way of further assurance for the above-mentioned purpose – For every Rs. 1000/- or part thereof secured. Exemption- (1) Instruments, executed by persons taking advances under the Land Improvement Loans Act,1883 (XIX of 1883) or the Agriculturists Loans Act, 1884 (XII of 1884) or by their sureties as security for the repayment of such advances. (2) Letter of Hypothecation accompanying a bill of exchange. The same duty as a conveyance (No.23) for a market value equal to the amount secured by such deed. The same duty as a Bond (No.l5) for the amount secured by such deed. Rs. 3 41 Mortgage of a crop, including any document demonstrating an agreement to secure the repayment of a loan based on a crop mortgage, whether or not the crop is in existence at the time of the mortgage: (a) When the loan must be repaid within three months of the instrument's date: - For every sum secured not exceeding Rs. 200/-. - and for every Rs. 200/- or part thereof secured in excess of Rs. 200. (b) If the loan is repayable in more than three months but not more than eighteen months from the instrument's date of issue: - For every sum secured not exceeding Rs. 100/- - and for sum secured not exceeding Rs. 100 - and for every Rs. 100/- or part thereof secured in excess of Rs. 100 Re. 1 Re. 1 Re. 1 Re. 1 Re. 1 42 Any instrument, endorsement, note attestation, Rs. 10

- 16. certificate, or entry, other than a protest (No.5o), made or signed by a notary public in the performance of his responsibilities or by any other person legitimately acting as a notary public, is referred to as a “notarial act”. [see the protest of Bill or Note (no.50)] 43 Note or Memorandum delivered by a Broker or Agent to his principle informing him of a purchase or sale on his account: (a) of any commodities worth more than one hundred rupees. (b) of any stock or marketable security with a market worth of more than one hundred rupees. Rs. 2 Subject to a maximum of Rs.50, Re. 1 for every Rs. 10,000/- or part thereof of the value of the stock or security. 44 Note of protest, by the master of as ship see also protest by the master of a ship (No. 51) Rs. 2 45 Partition - an instrument of [as described in Section 2 clause (15)] (a) Where the property involved in the partition has been converted for non-agricultural purposes or is intended for non-agricultural use (b) Where the property involved in the partition is agricultural land; Provided further that there is no dispute or case pending in any court regarding the land to be partitioned; (c) When the stamps required for an instrument of partition are stamped on a final order for effecting a partition issued by any revenue authority or Civil Court, or an award by an arbitrator directing a partition, and an instrument of partition is subsequently executed in accordance with such order or award. Rs. 2000 for each shareholder Rs. 100 for each shareholder. No stamp duty chargeable Rs. 10 46 Partnership - (1) Partnership Instrument - (a) If there is no share or contribution in the Rs. 1000

- 17. partnership, or if the contribution (paid in cash) does not exceed Rupees 50000/-. (b) Where the cash portion of the contribution exceeds Rupees 50000/-. (c) Where such a share contribution is made in the form of property (rather than cash) OR where a partner provides a share of his immovable property to the partnership firm for the purpose of colony development. (2) Dissolution of partnership or retirement of a partner. (a) Any immovable property brought in as a partner's share of contribution in the partnership is taken as his share by a partner other than a partner who brought in such property as his share of contribution in the partnership on dissolution or retirement of that partner. (b) In any other case. 2% of the share contributed subject to a maximum of Rs. 5000 2% of market value of such property. The same duty as Conveyance (No. 23) on the market value of such property. Rs. 550 47 - - 48 Power of Attorney, [As defined by section 1(21)] not being a proxy (no. 52) (a) When executed solely for the purpose of obtaining the registration of one or more documents in connection with a single transaction or admitting the execution of one or more of those documents; (b) In cases or processes brought under the provincial small causes court act, l887(IX of, 1887), or any other law relating to Small Cause Courts in effect in any region of the state; (c) When authorizing one or more people to operate in a single transaction in a situation other than that described in subsection (a); (d)When authorizing one or more people to participate jointly in a single transaction and separately in multiple transactions, or in general; (e)When authorising more than five, but not more then Rs. 10 Rs. 10 Rs. 20 Rs. 100 Rs. 150

- 18. ten persons to act jointly and severally in more than on transaction or generally; (f) When given for consideration and authorising the attorney to sell or transfer any immovable property. (f-1) When granted without compensation and authorising the agent to sell, gift, exchange, or permanently alienate any immovable property in Chhattisgarh. (a) For a period of not more than two years following the date of execution; (b) For a duration of more than two years from the date of execution, or when it is irrevocable or does not purport to be for a certain amount of time; (c) When granted to the executants' father, mother, wife or husband, son, daughter, brother or sister, and when it does not profess to be for a certain period of time. (d) In any other case. "Explanation 1 - When more than one person belongs to the same firm, they are treated as one person for the purposes of this article." "Explanation 2 - Where duty has been paid on a power of attorney under (f) and (f-1) and a conveyance relating to that property is executed in accordance with that power of attorney between the executants of the power of attorney and the person in whose favour it is executed, the duty on conveyance shall be the duty calculated on the market value of the property less the duty paid on the power of attorney." The same duty as a conveyance under the article 23 on the market value of the property. Rs. 1000 The same duty as Conveyance (No.23) on the market value of such property. Rs. 1000 Rs. 20 for each person authorised. N.B. - The term " registration" includes every operation incidental to registration under the Registration Act.1908 (XVI of 1908). 49 - - 50 Any declaration in writing made by a Notary Public or other person legitimately acting as such attesting the dishonour of a bill of exchange or promissory note is known as a “protest of bill or note.” Rs. 3

- 19. 51 Protest by the Master of a Ship, i.e., any declaration of the particulars of her voyage drawn up by him with a view to the adjustment of losses or the calculation of averages, and any declaration in writing made by him against the charters or the consignees for not loading or unloading the ship, when such declaration is attested or certified by a Notary public or other lawfully constituted person. [see also Note of protest by the Master of a ship (No. 44)] Rs. 3 52 - - 53 - - 54 Reconveyance of Mortgaged Property- (a) If the consideration for which the property was mortgaged does not exceed Rs. 1000/-; (b) In any other case The same duty as a conveyance (No.23) for the market value equal to the amount of the consideration, as set forth in the reconveyance. Rs. 100 55 Any instrument (other than a release as defined in section 23-A) by which a person renounces a claim against another person or against any specified property is referred to as a “Release”. (a) When they are not members of family; (b) When they are members of family. Explanation- For the purposes of this article, a person's family includes his or her father, mother, husband or wife, son, daughter, daughter-in-law, brother, sister, and grandchildren, including son's and daughter's sons and daughters. The same duty as a Bond (No.l5) for the amount of consideration or market value of the property, whichever is higher, on the share over which the claim is relinquished. Half percent of the consideration or the market value of the property, whichever is higher, on the share over which the claim is relinquished.

- 20. 56 Any instrument securing a loan on cargo laden or to be laden on board a ship and making repayment reliant on the cargo arriving at the port of destination is known as a respondentia bond. Revocation of any Trust or Settlement- See Settlement (No.58), Trust (No.64) The same duty as a Bond (No.l5) for the amount of the loan secured. 57 Security Bond or Mortgage Deed- signed by a surety to secure the due performance of a contract or as security for the due execution of an office, or to account for money or other property received as a result thereof: (a) if the amount secured is less than Rs. 5000/-; (b) In any other cases.. Exemptions - When a bond or other document is executed, (a)................ (b) by any person for the purpose of ensuring that the local revenue received from private subscriptions to a charitable dispensary, hospital, or any other object or public utility does not fall below a certain amount per mensum; (c) by persons taking advances under the Land Improvement Loans Act,1883 (XIX of 1883), or the Agriculturists Loans Act,1884 (XII of 1884), or their sureties, as security for the repayment of such advances; (d) by government officers or their sureties to secure the proper execution of an office or the proper accounting for money or other property received by virtue thereof. The same duty as a Bond (No. 15) for the amount secured. Rs. 250 58 Settlement- A- Instrument of (including a deed of dower) Exemption Deed or dower executed on the occasion of a marriage between Hohammadans. The same duty as a bond as (No.l5) for a sum equal to the amount of market value of the property settled. Provided that, where an agreement to settle is stamped with the stamp required for an instrument of settlement, and an instrument of settlement in pursuance of such agreement is

- 21. B- Revocation of - See also Trust (No.64). subsequently executed, the duty on such instrument shall not exceed ten rupees. The same duty as a Bond (No.15) for a sum equal to the amount or value of the property concerned as set forth in the instrument of revocation, but not exceeding fifty rupees. 59 Share warrants, to bearer issued under the Indian Companies Act, 1913 (VII of l913) or the Companies Act, l956 (l to l956). Exemptions- Share warrants issued by a company in accordance with Section 43 of the Indian Companies Act, 1913 (VII of 1913), or Section 114 of the Companies Act, 1956 (1 of 1956), have effect only upon payment to the Collector of Stamp Revenue of - (a) One and a half percent of the company's total subscribed capital, or (b) if any firm that has fully paid the duty or composition issues an addition to its subscribed capital, one and a half percent of the extra capital issued. One and half times the duty payable on a conveyance (No.23), for a market value equal to the nominal amount of the shares specified in the warrant. 60 Shipping order, for or relating to the conveyance of goods on board of any vessel. Re. 1 61 Surrender of lease – (a) When the duty with which the lease is chargeable does not exceed fifteen rupees. (b) In any other case..... Exemption - Surrender of lease, when such lease is exempted from duty. The duty with which such lease is chargeable. Rs. 100 62 Transfer – (Whether with or without consideration) (a) ............ (b) of debentures being marketable securities whether the debenture is liable to duty or not One half of the duty payable on a conveyance (No.23) for a

- 22. except debenture provided for by section-8 ; (c) of any interest in a bond, mortgage deed, or insurance policy: (i) If the duty on the bond, mortgage deed, or insurance policy is less than five rupees; (ii) In any other case. (d) of any property under section 22 of the Administrator General's Act, 1963; (e) of any trust property, without consideration from one trustee to another or from a trustee to a beneficiary. Exemptions - Transfers by endorsement :- (a) of a bill of exchange, cheque or promissory note (b) of a bill of lading, delivery order, warrant for goods, or other mercantile documents of title to goods; (c) of a policy of insurance; (d) of securities of the Central Government. See also section 8. consideration equal to the face value of the debenture. The duty with which such bond, mortgage deed or policy of insurance is chargeable. Rs. 20 Rs. 30 The sum of Rs.15 or any other amount that may be imposed under clauses (b) and (c) of this article. 63 Transfer of Lease - by way of assignment and not by way of under lease. Exemption- Transfer of any lease exempt from duty. The same duty as a conveyance (No.23) on the market value of the property which is the subject matter or transfer. 64 Trust - A- Declaration of - of, or concerning, any property when made by any writing, not being a Will; B- Revocation of or concerning, any property when made by any instrument other than a will; Exemption- Charitable and religious trusts including WAKF ALAL The same duty as a bond (No.l5) for a sum equal to the amount or value of the property concerned, as set forth in the instrument but not exceeding five hundred. The same duty as Bond (No.l5) for a sum equal to the amount or value of the property concerned, as set forth in the instrument but not exceeding two hundred fifty rupees.

- 23. AULAD. 65 Warrant for goods, That is, any instrument establishing the title of any person listed therein, or his assigns, or the holder thereof, to any goods lying in or upon any port, warehouse, or wharf, with such instrument being signed or certified by or on behalf of the person in whose custody such goods may be. Rs. 2