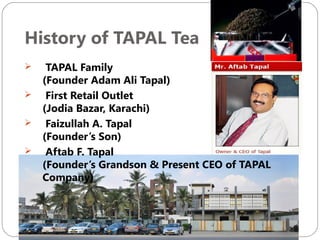

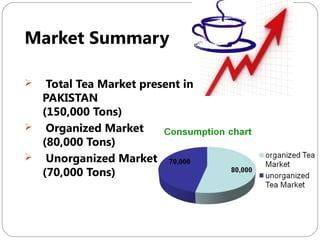

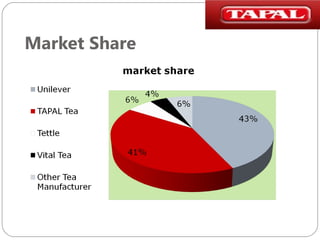

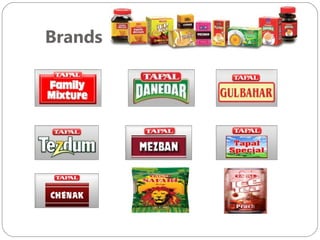

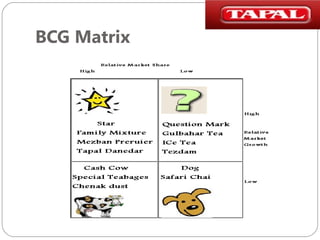

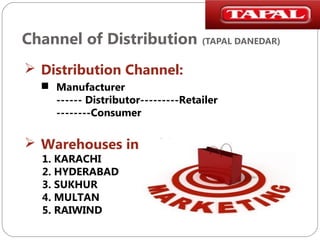

Sajjad Hussain presents on the marketing strategies of Tapal, a Pakistani tea company. Tapal has a long history in Pakistan dating back to its founder Adam Ali Tapal. The presentation analyzes Tapal's industry, market share, strengths as the first Pakistani tea to achieve ISO certification. It also examines Tapal's brands, target markets, major competitors like Unilever, and provides a SWOT analysis and overview of Tapal's marketing mix focusing on its popular Danedar brand.