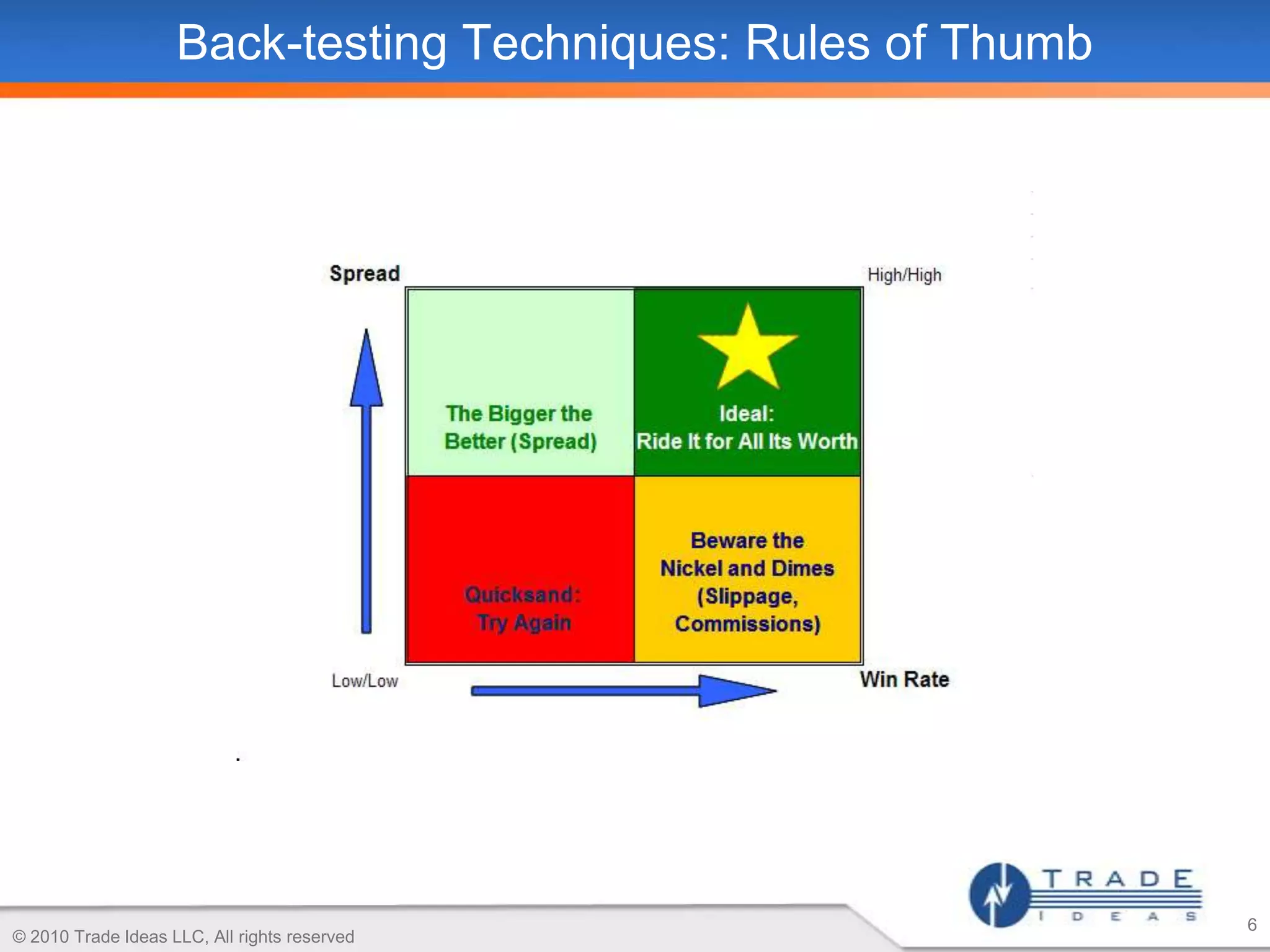

The document discusses scanning for stock trading ideas using themes to develop winning strategies. It describes how technology can help traders by managing risk, maintaining discipline, creating information leverage, and promoting independent thinking. It provides examples of real-time strategy scans like stocks up over $1 in the last 5 minutes on high volume. The document also notes the technology can be used not just for stock traders but also to see unusual options volume and ratios. It concludes with recommendations for modeling and back-testing techniques like modifying existing strategies, clearly defining patterns, and separating bullish and bearish strategies.