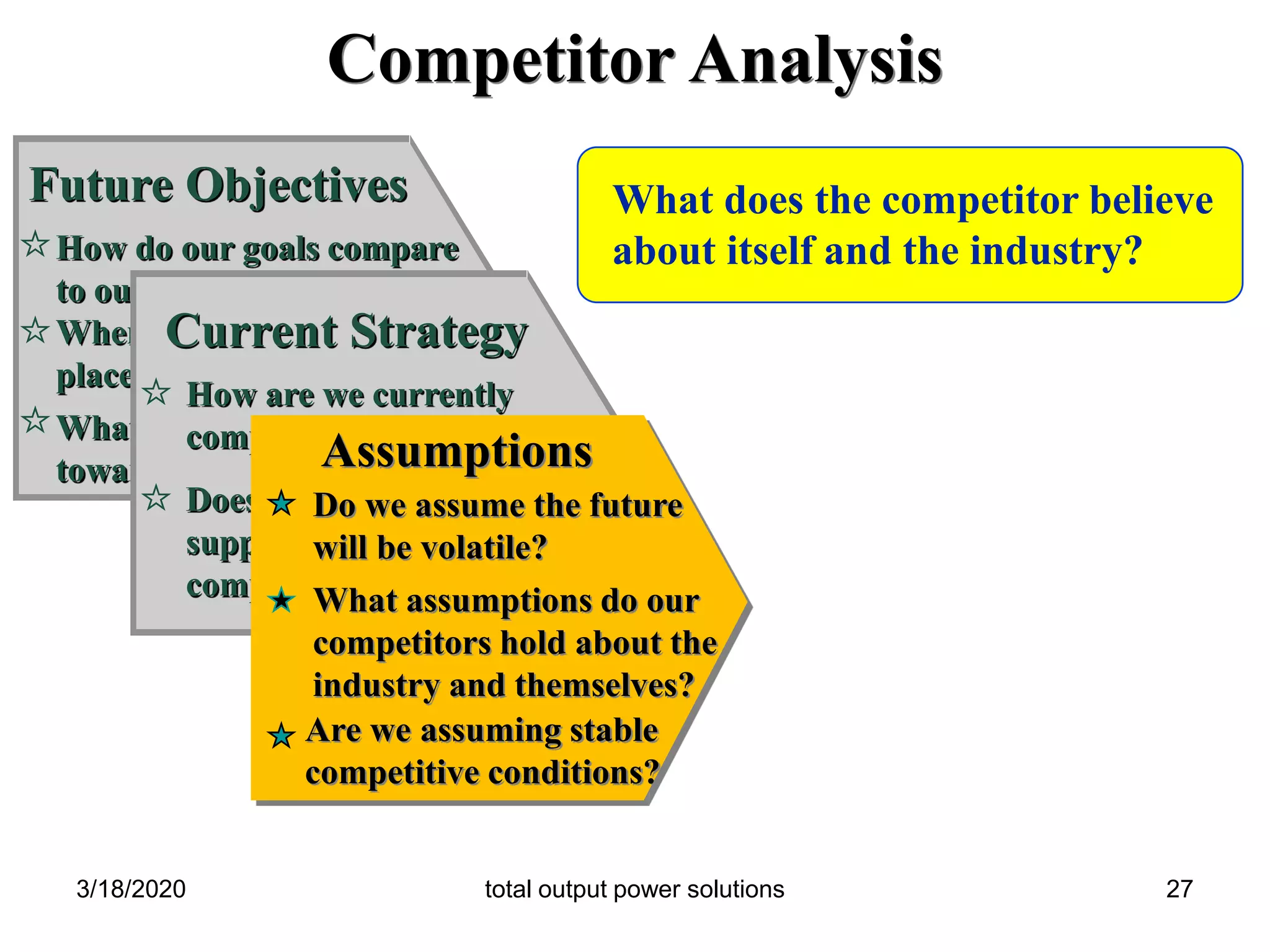

This document discusses various strategic planning tools including SWOT analysis, Porter's five forces analysis, competitor analysis, and resource gap analysis. SWOT analysis involves analyzing internal strengths and weaknesses as well as external opportunities and threats. Porter's five forces model examines the competitive environment through analyzing the threat of new entrants, bargaining power of suppliers and buyers, threat of substitutes, and rivalry among existing competitors. Competitor analysis assesses a competitor's objectives, strategies, assumptions, capabilities, and potential responses. Resource gap analysis identifies performance gaps between business requirements and current capabilities to determine investment needs.