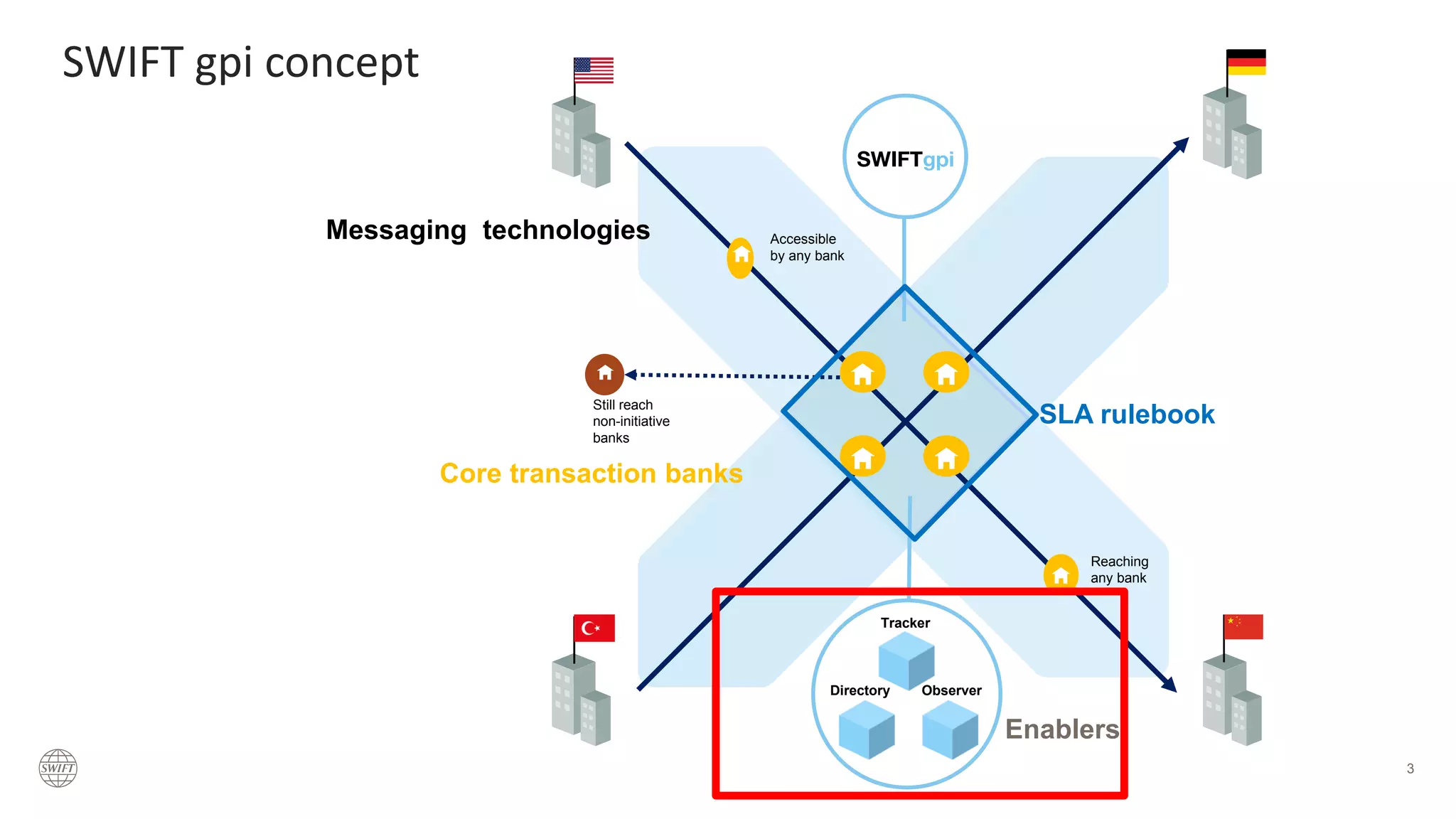

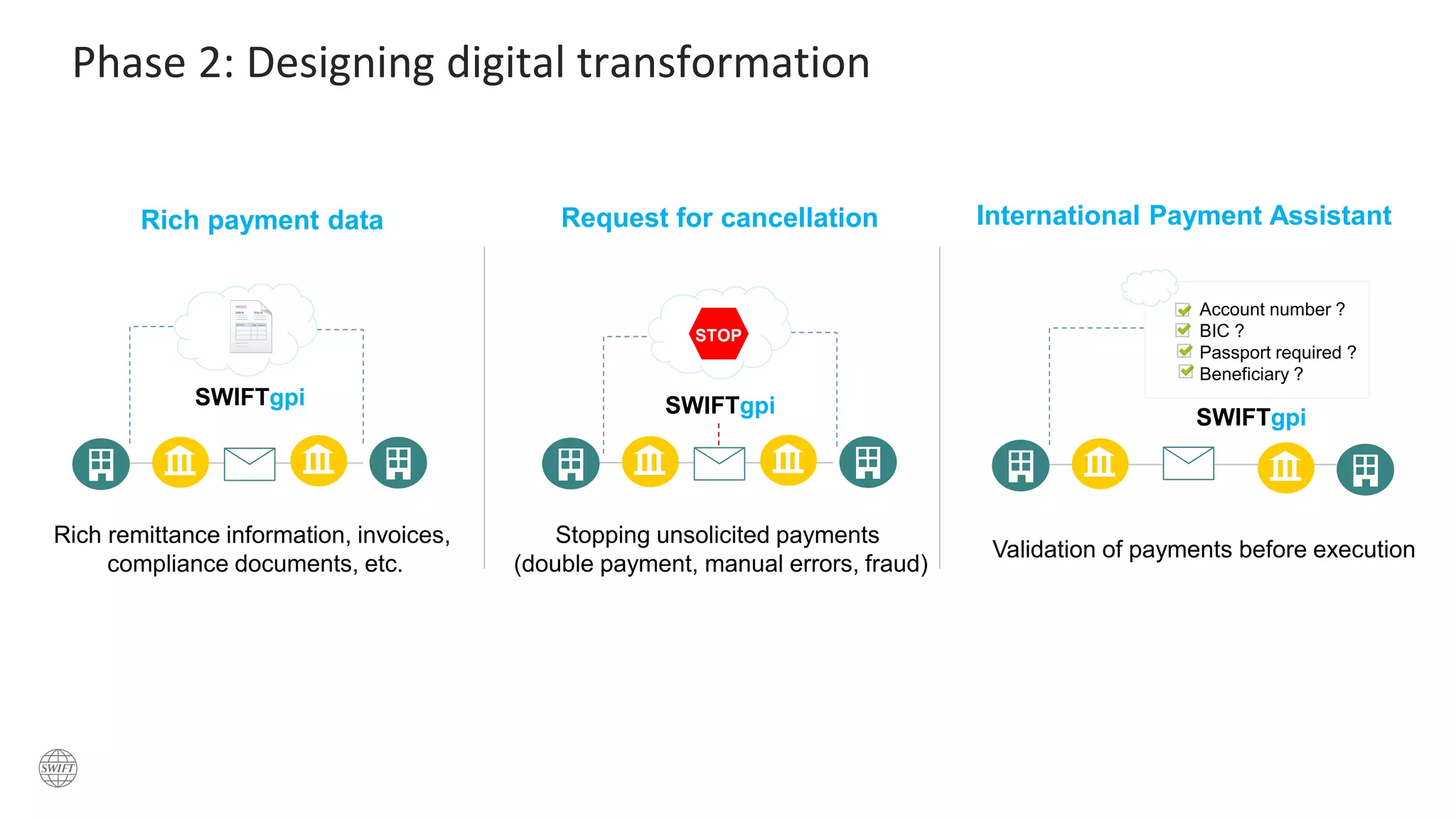

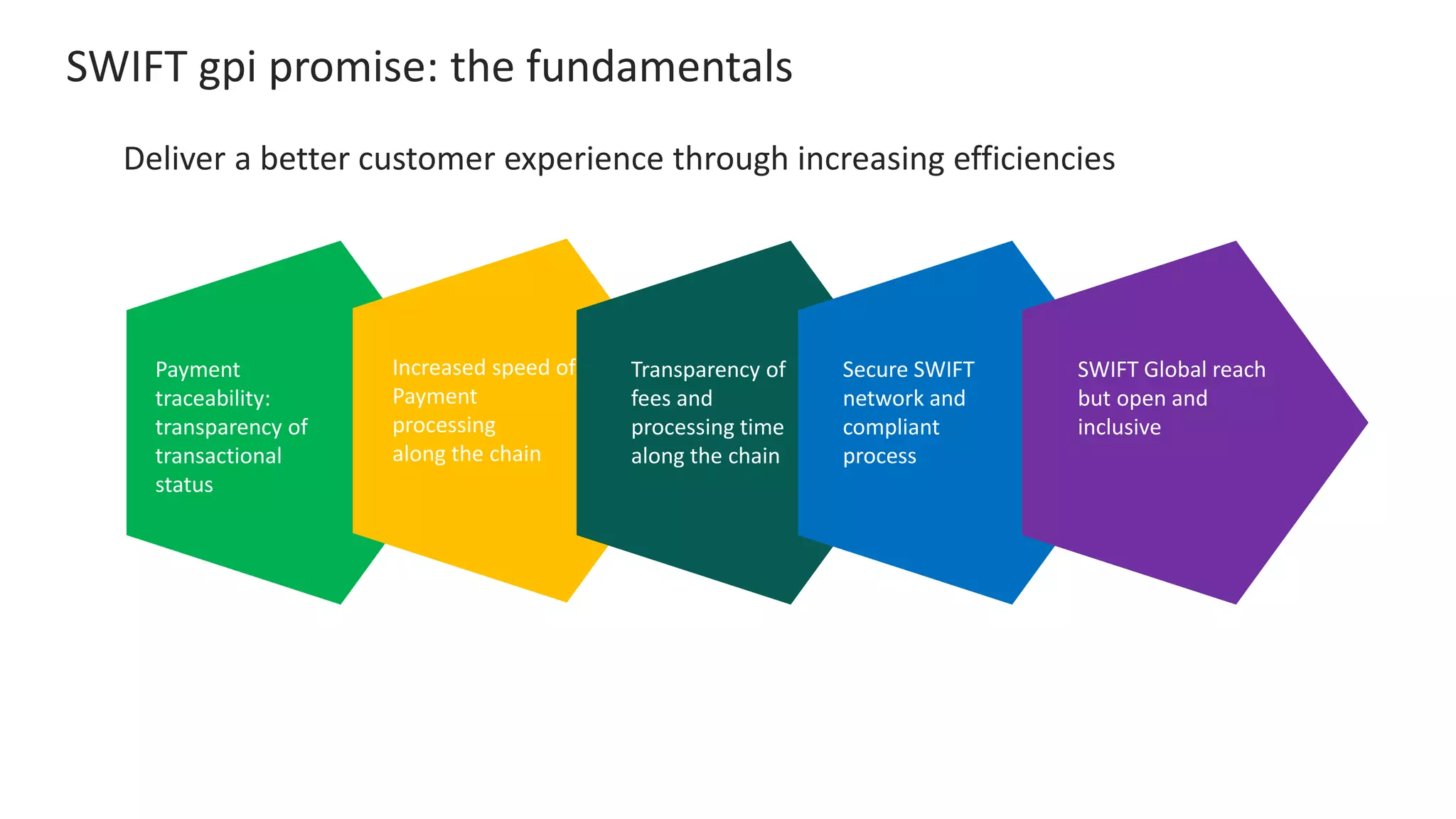

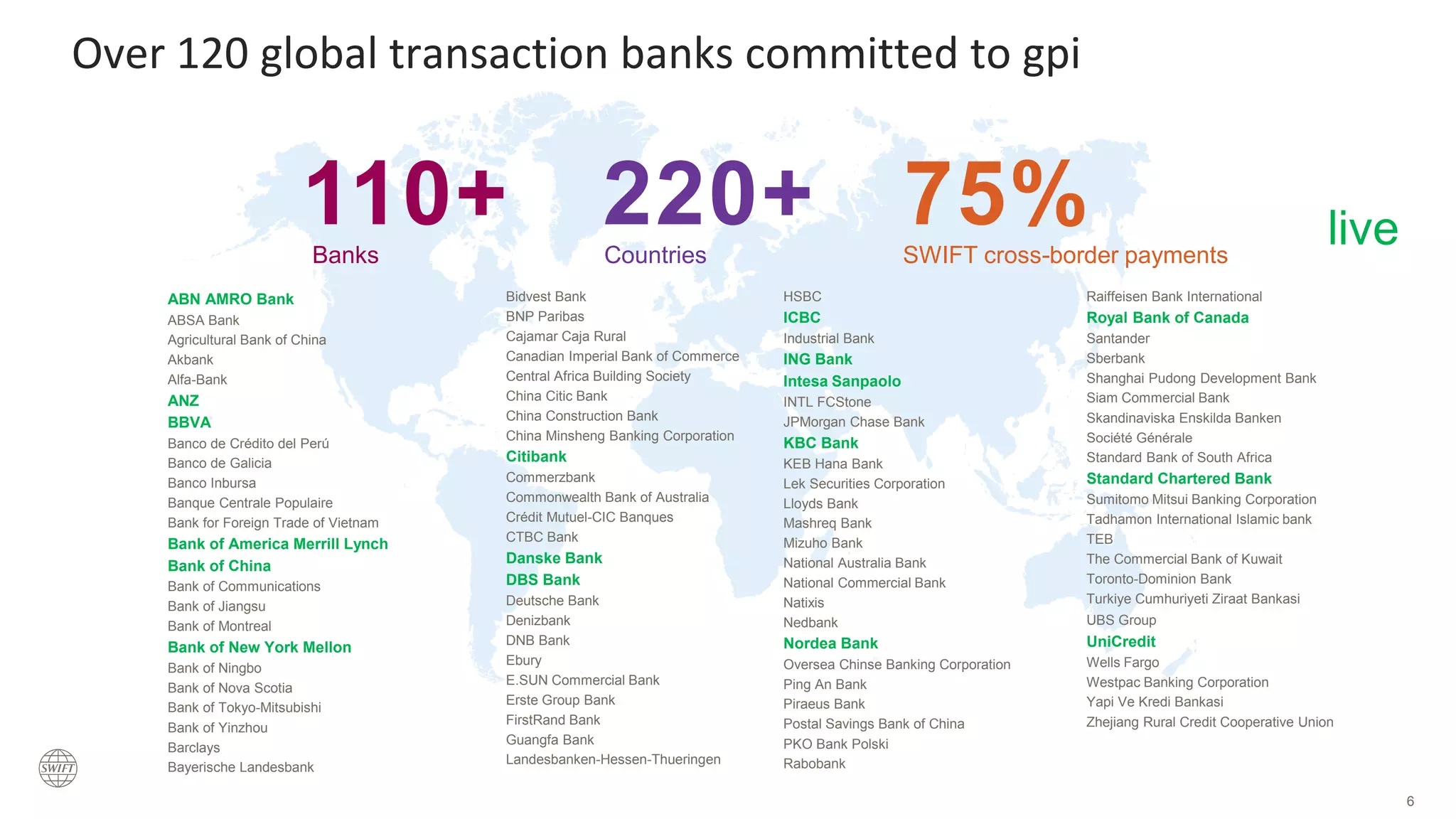

The document outlines SWIFT gpi as a solution for enhancing cross-border payments with features like payment traceability, increased processing speed, and transparency in fees. It emphasizes a call to action for the industry to implement this initiative, ensuring access for non-participating banks and providing rich payment data. Over 120 global transaction banks are committed to adopting SWIFT gpi to improve customer experience and mitigate issues like fraud and payment errors.