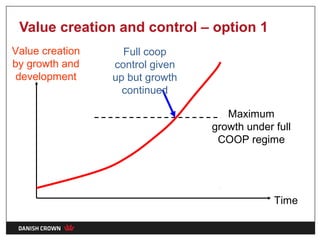

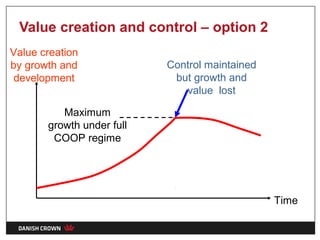

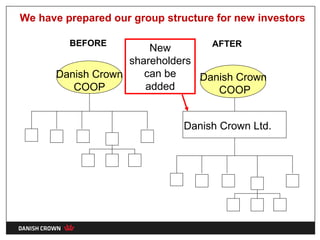

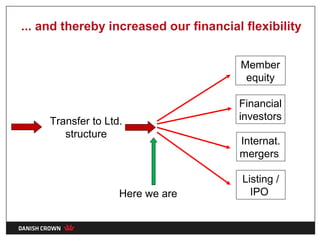

Danish Crown is a cooperative owned by farmers that supplies pork globally. It has been successful using a lean cooperative model for 125 years. However, to continue international growth, it will need more equity than farmers can provide. It has prepared a new group structure to allow new non-farmer shareholders while maintaining cooperative control. This will provide more financial flexibility to pursue mergers, listings, and investments beyond relying solely on member equity.