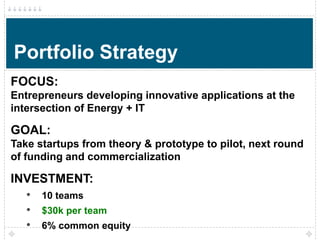

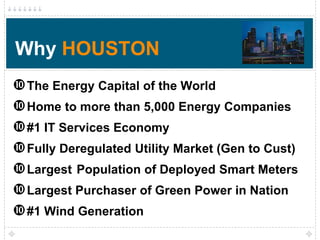

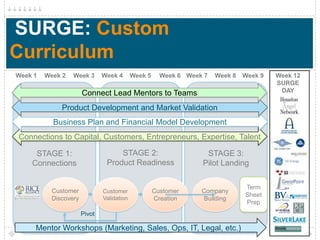

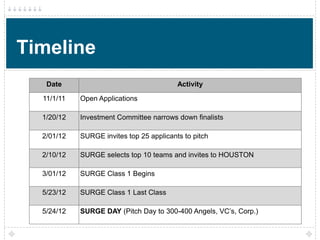

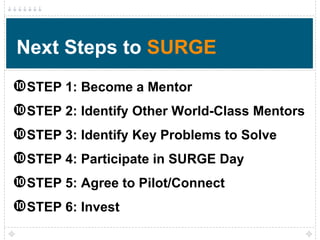

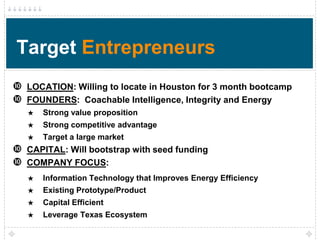

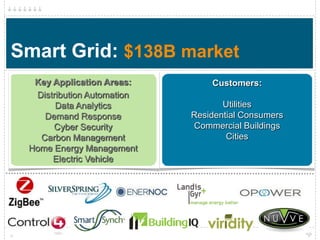

Surge is a mentor-driven seed accelerator in Houston, dedicated to empowering entrepreneurs in the energy software sector through a structured 12-week curriculum and capital investment. The program aims to connect innovative teams with industry expertise and funding, culminating in a pitch day to potential investors. Surge is the first accelerator focused solely on energy IT, tapping into Houston's extensive energy ecosystem to foster startups tackling energy challenges.