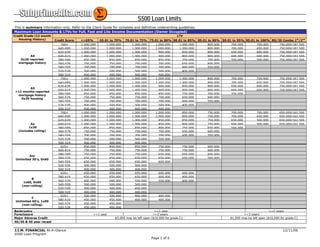

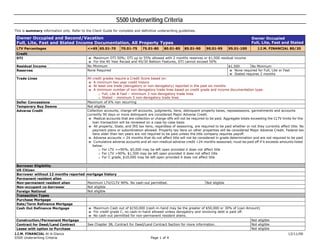

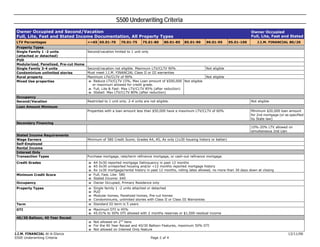

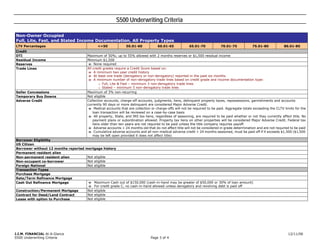

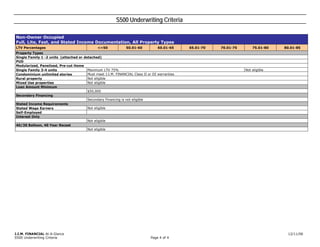

This document provides loan limit and LTV guidelines for different loan programs, including:

- Maximum loan amounts and LTVs for full, fast and lite income documentation for owner-occupied properties depend on credit grade and credit score. Loan limits range from $400,000 to $1,000,000.

- Guidelines for stated income documentation loans include lower loan amounts and LTVs than full documentation loans, with loan limits ranging from $250,000 to $650,000 depending on credit factors.

- Non-owner occupied loans have lower amounts and LTVs compared to owner-occupied, with loan limits between $300,000 and $500,000 based on credit grade and history.