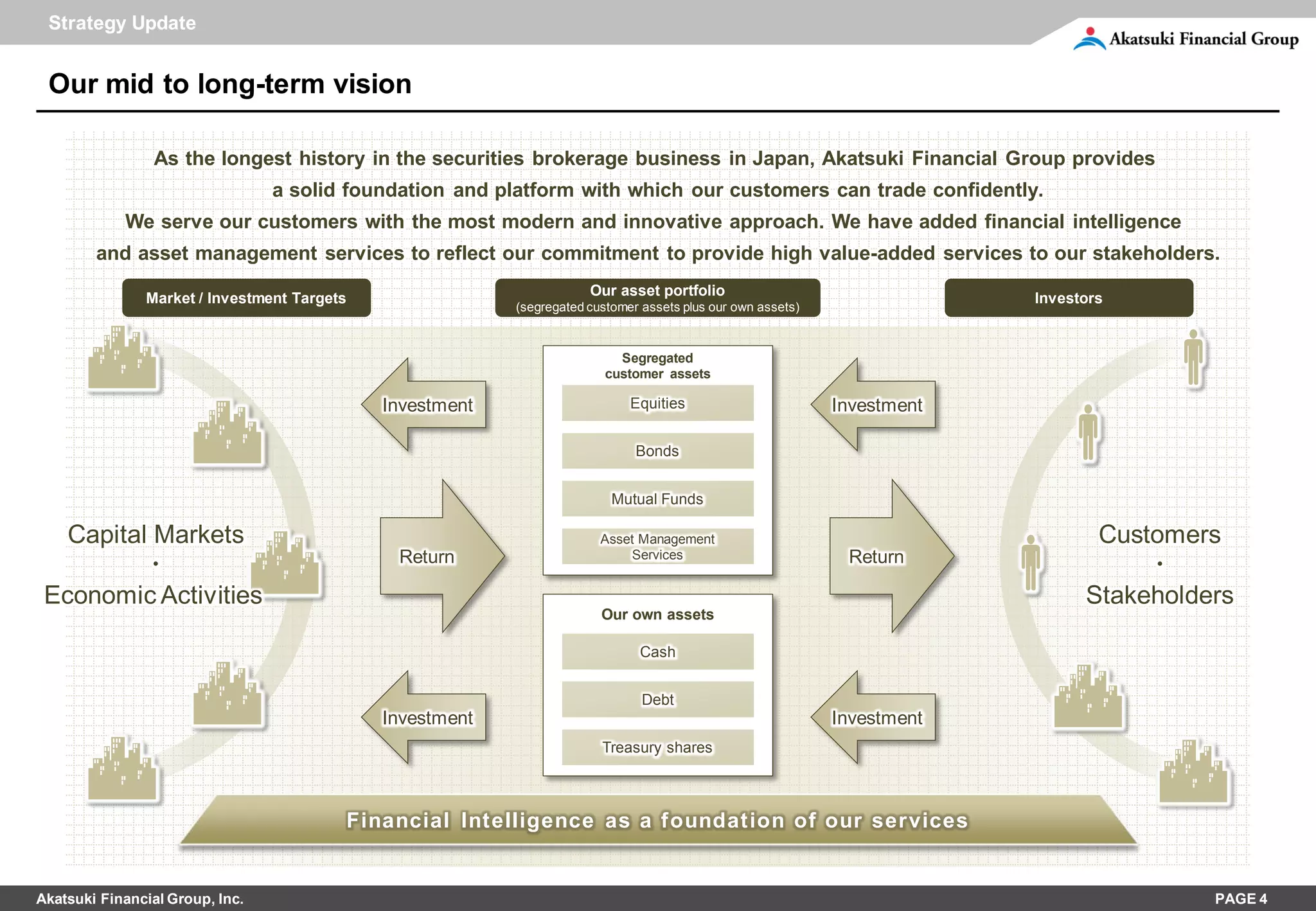

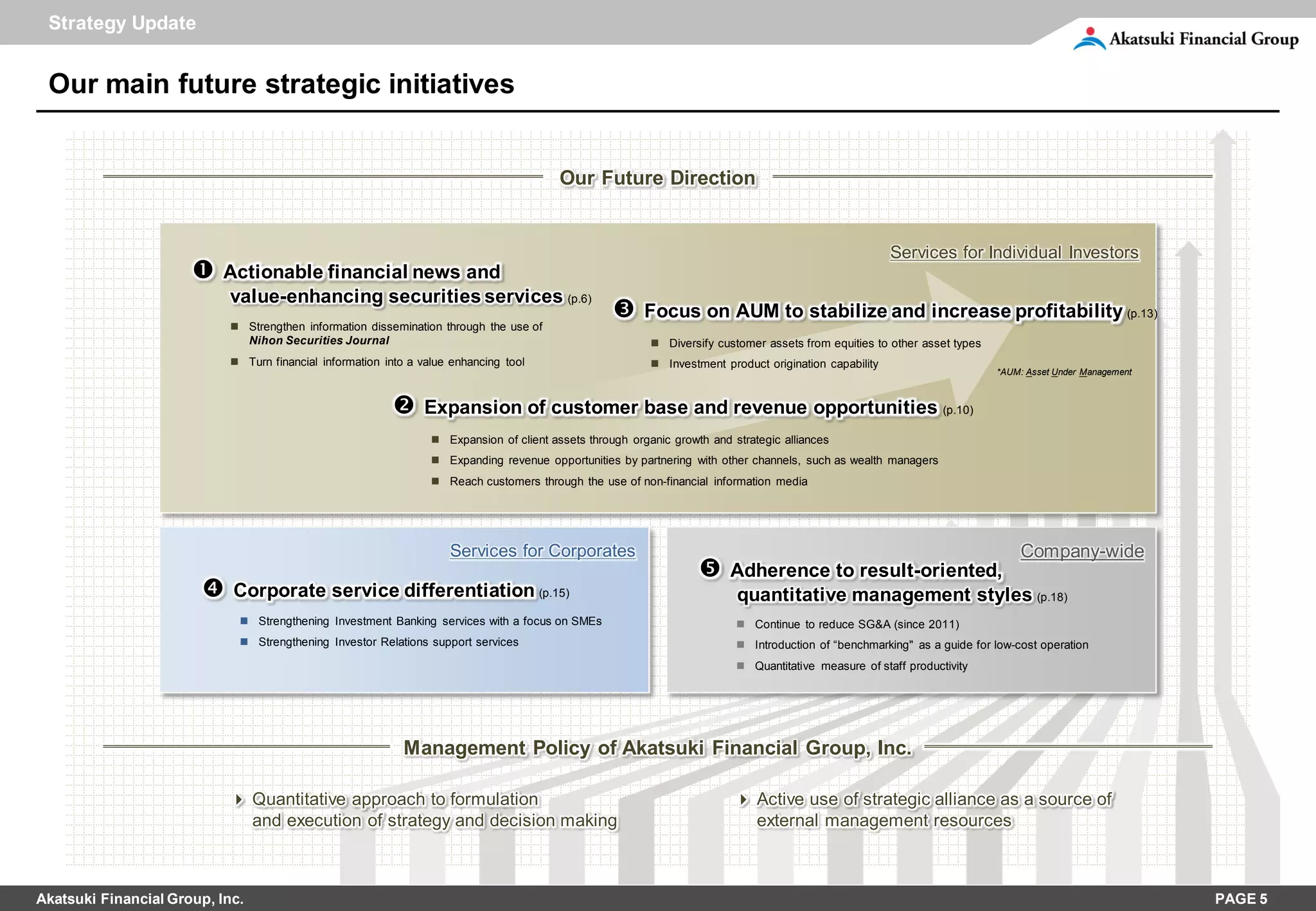

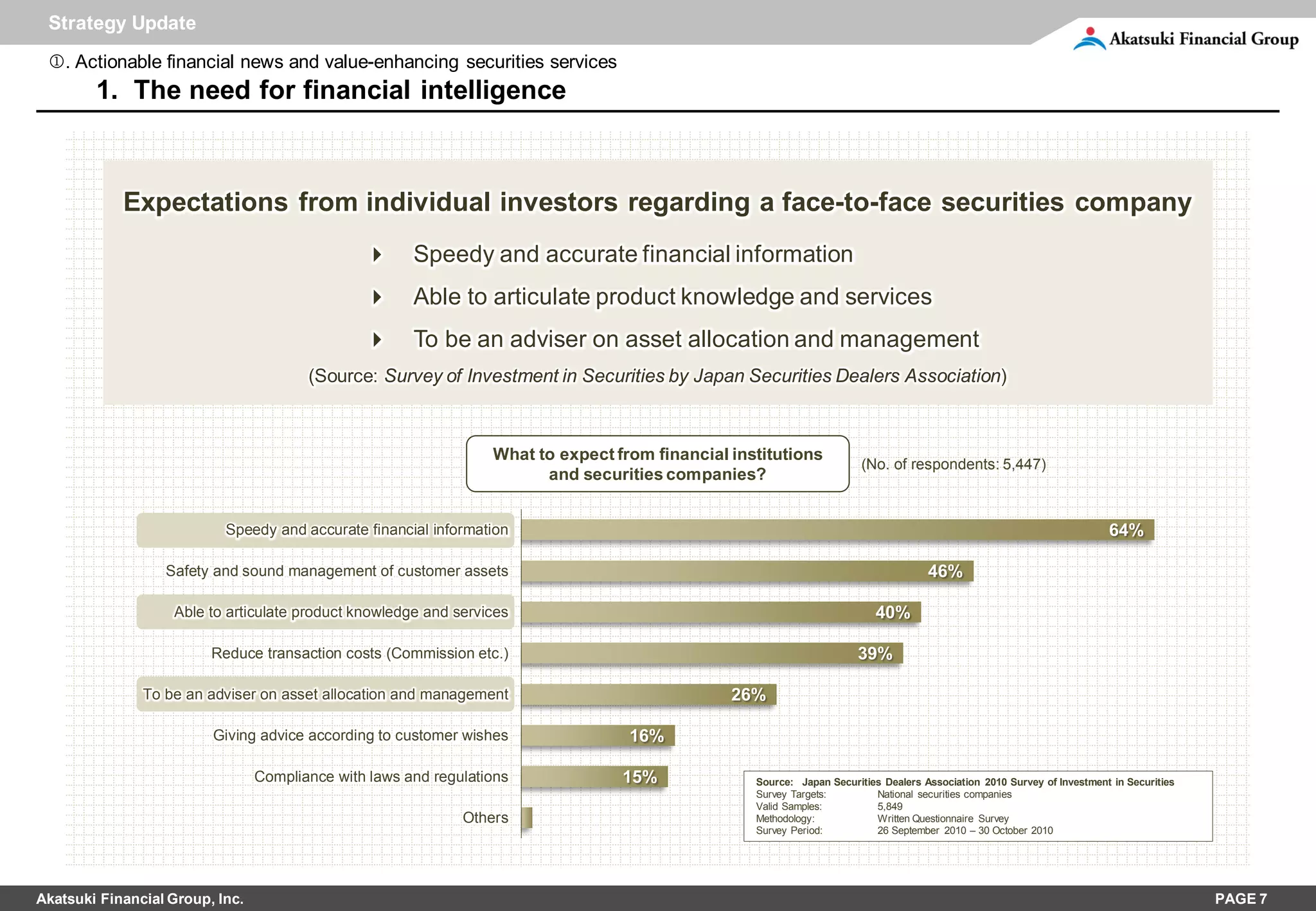

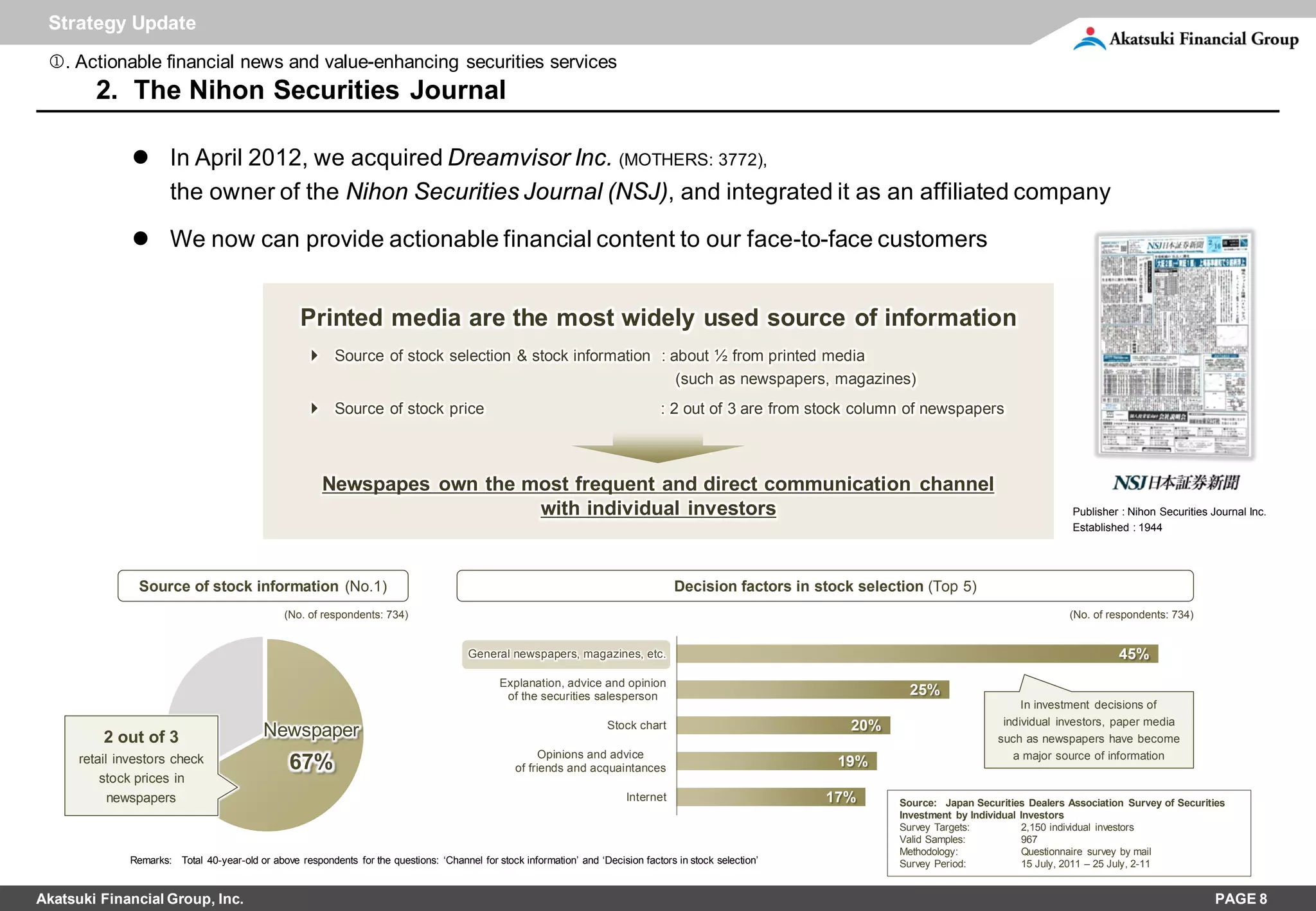

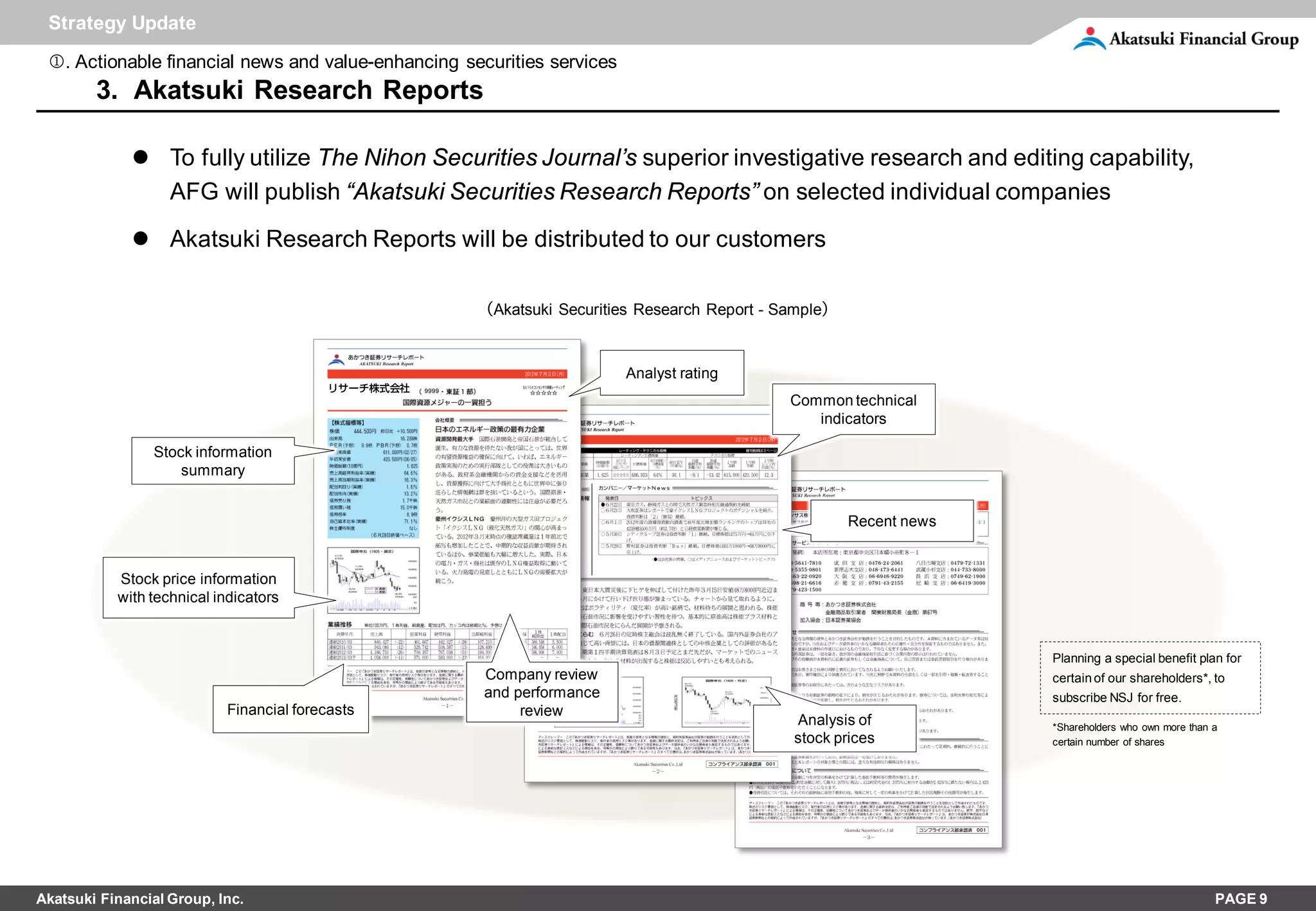

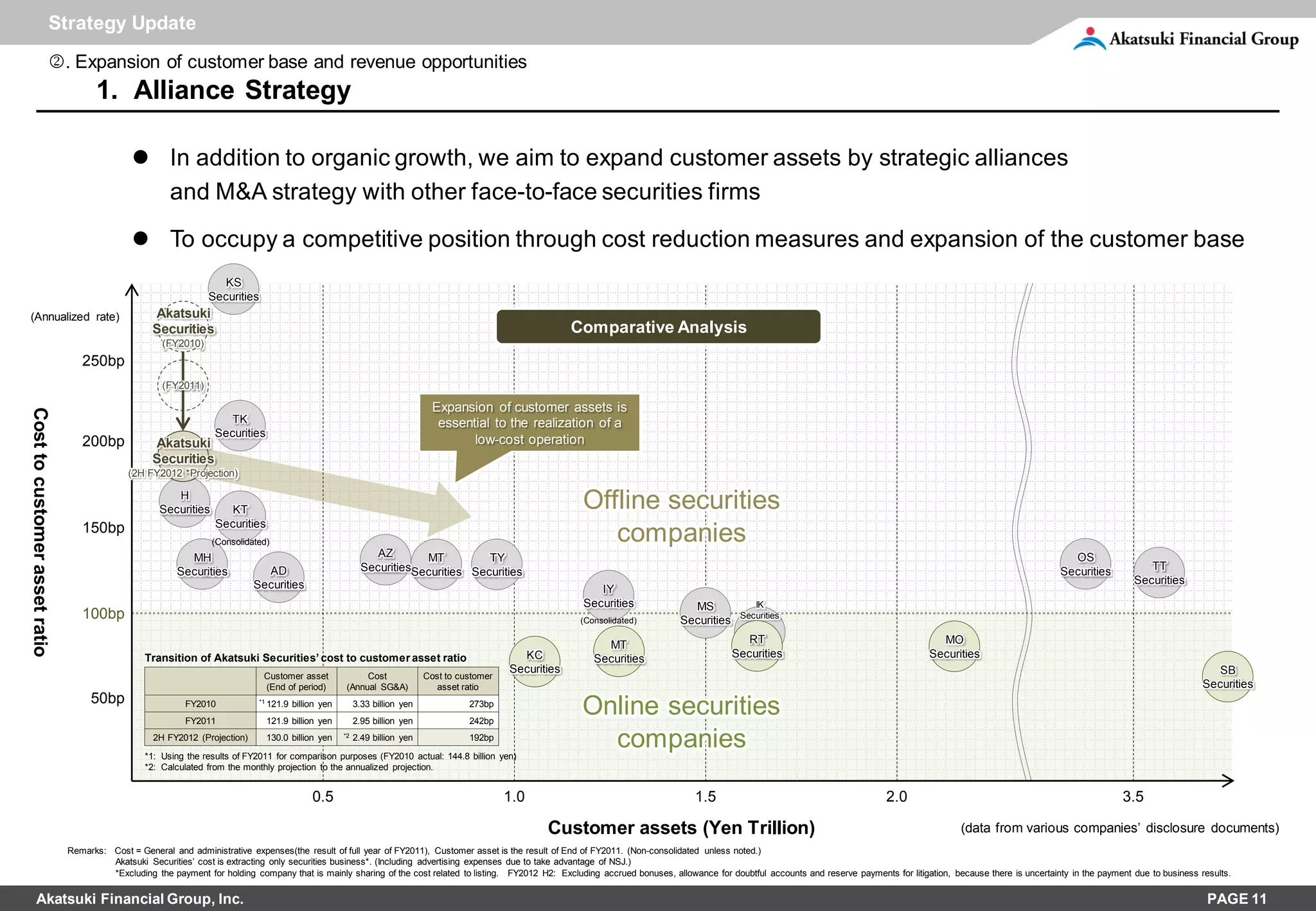

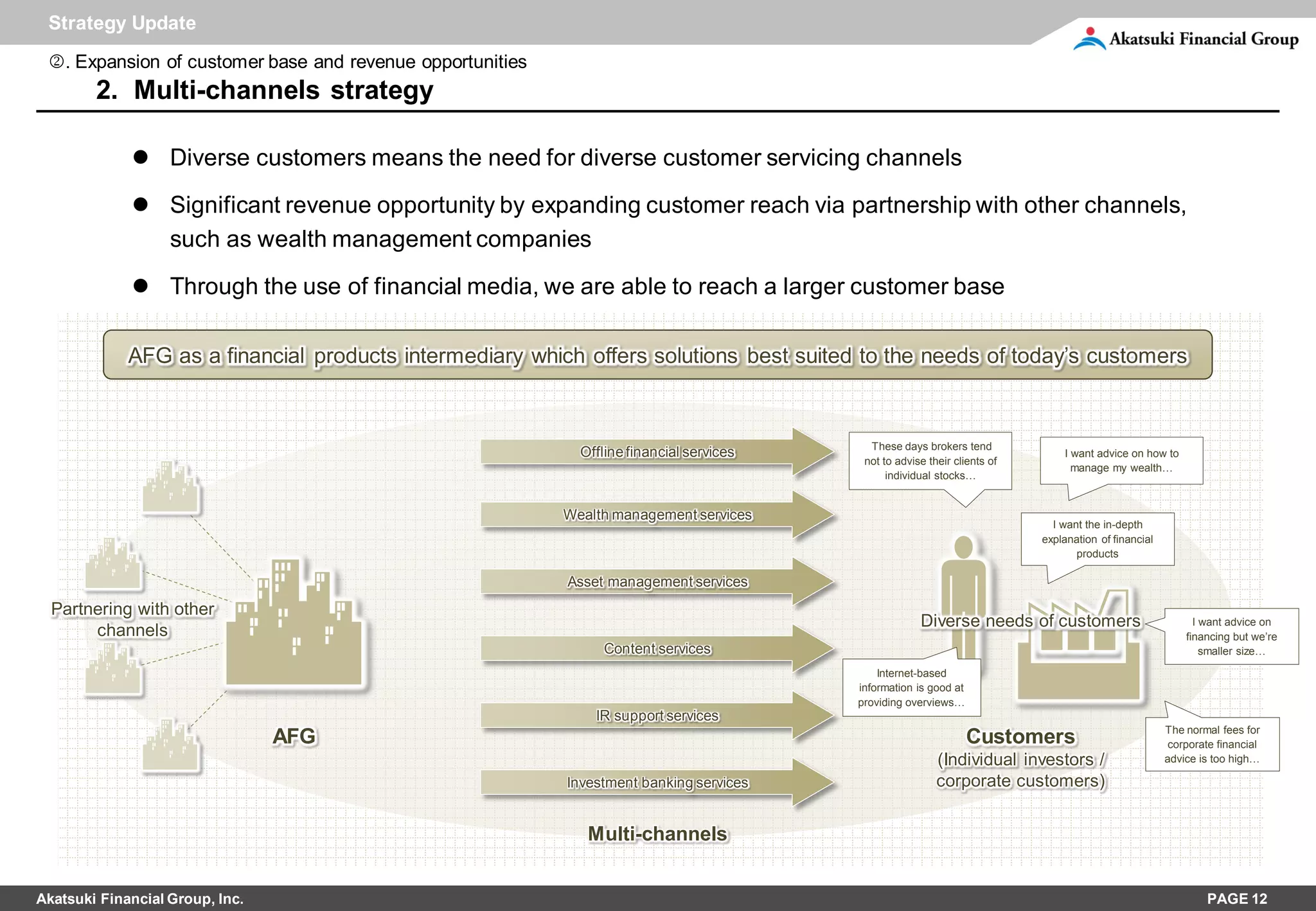

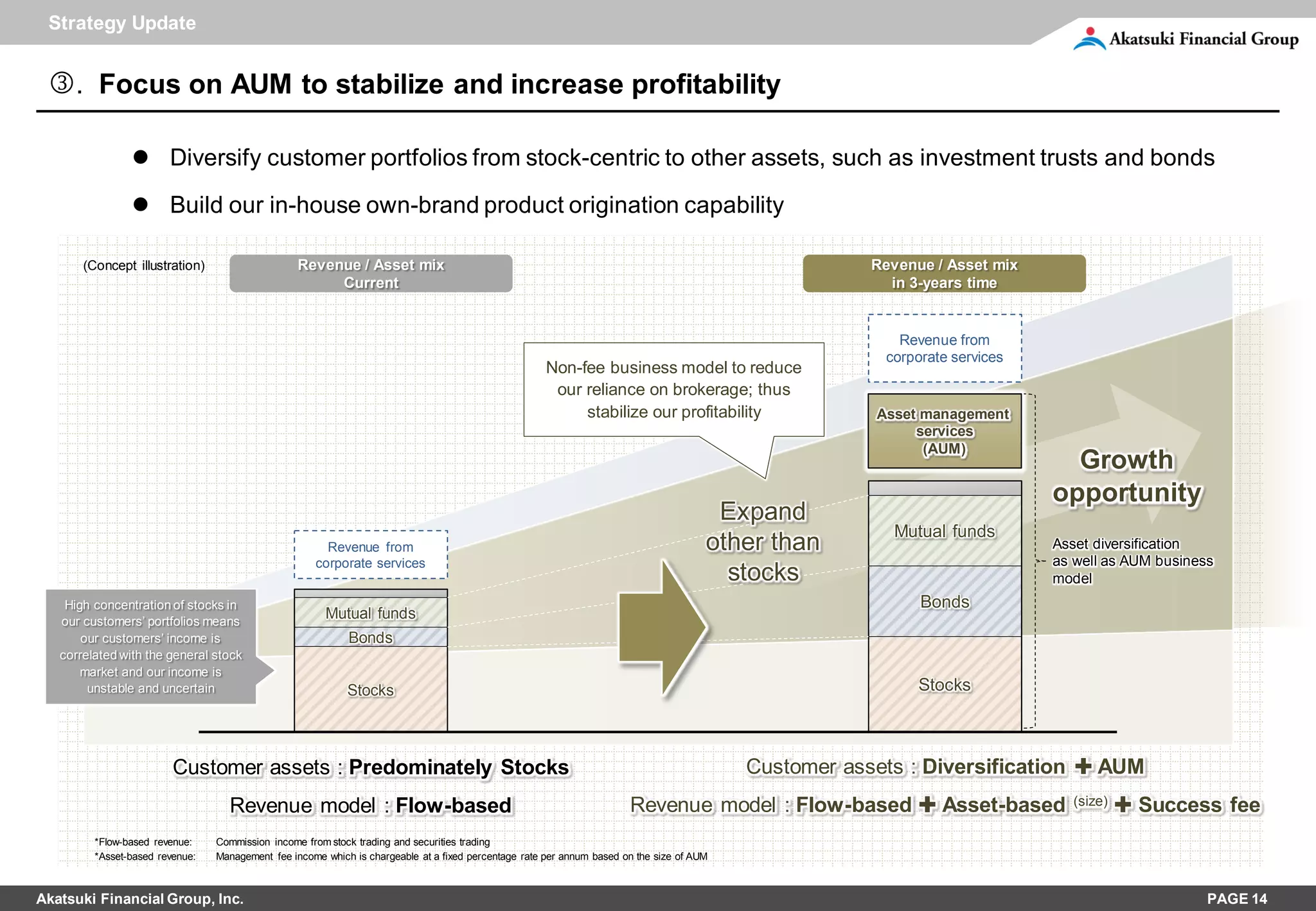

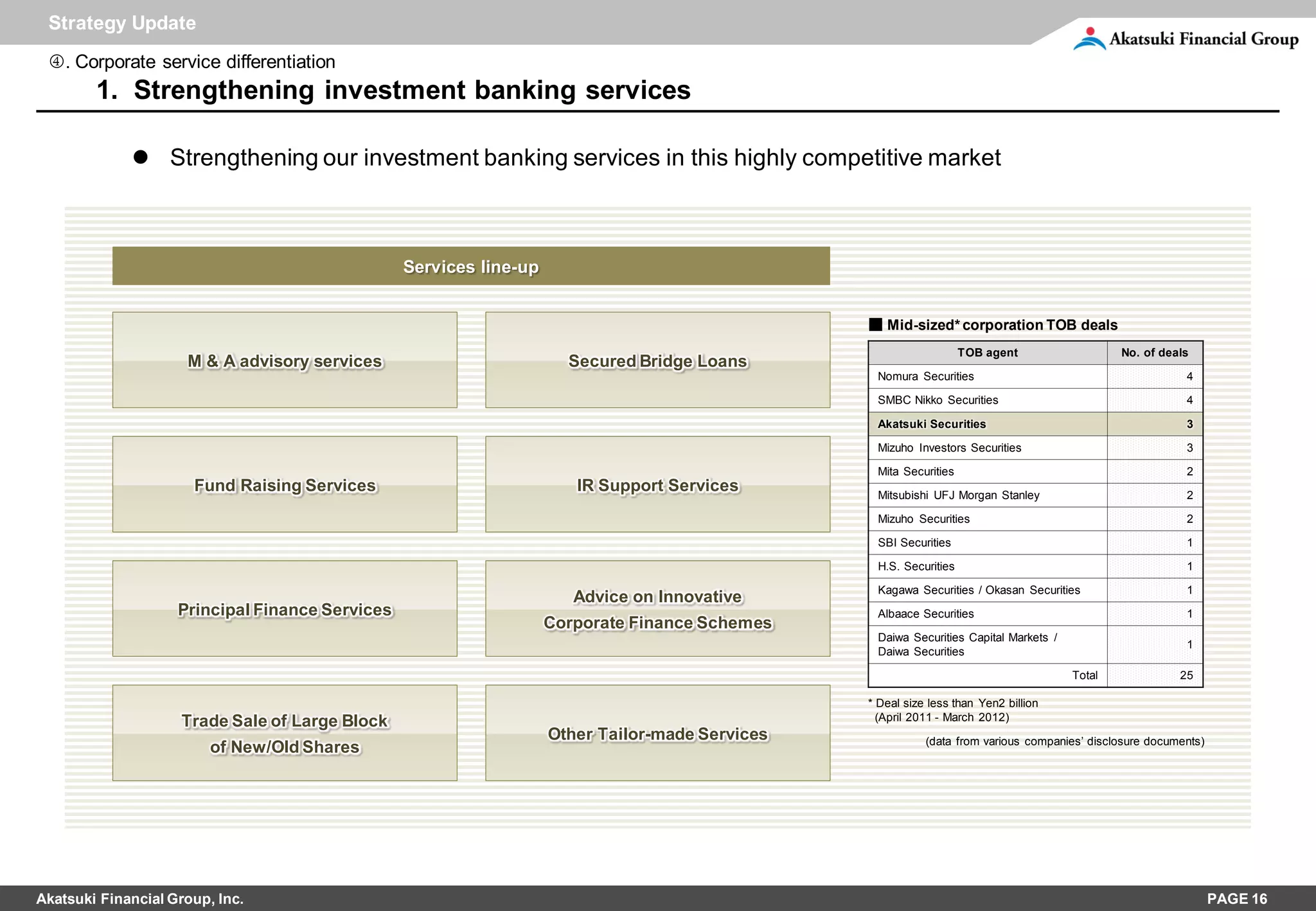

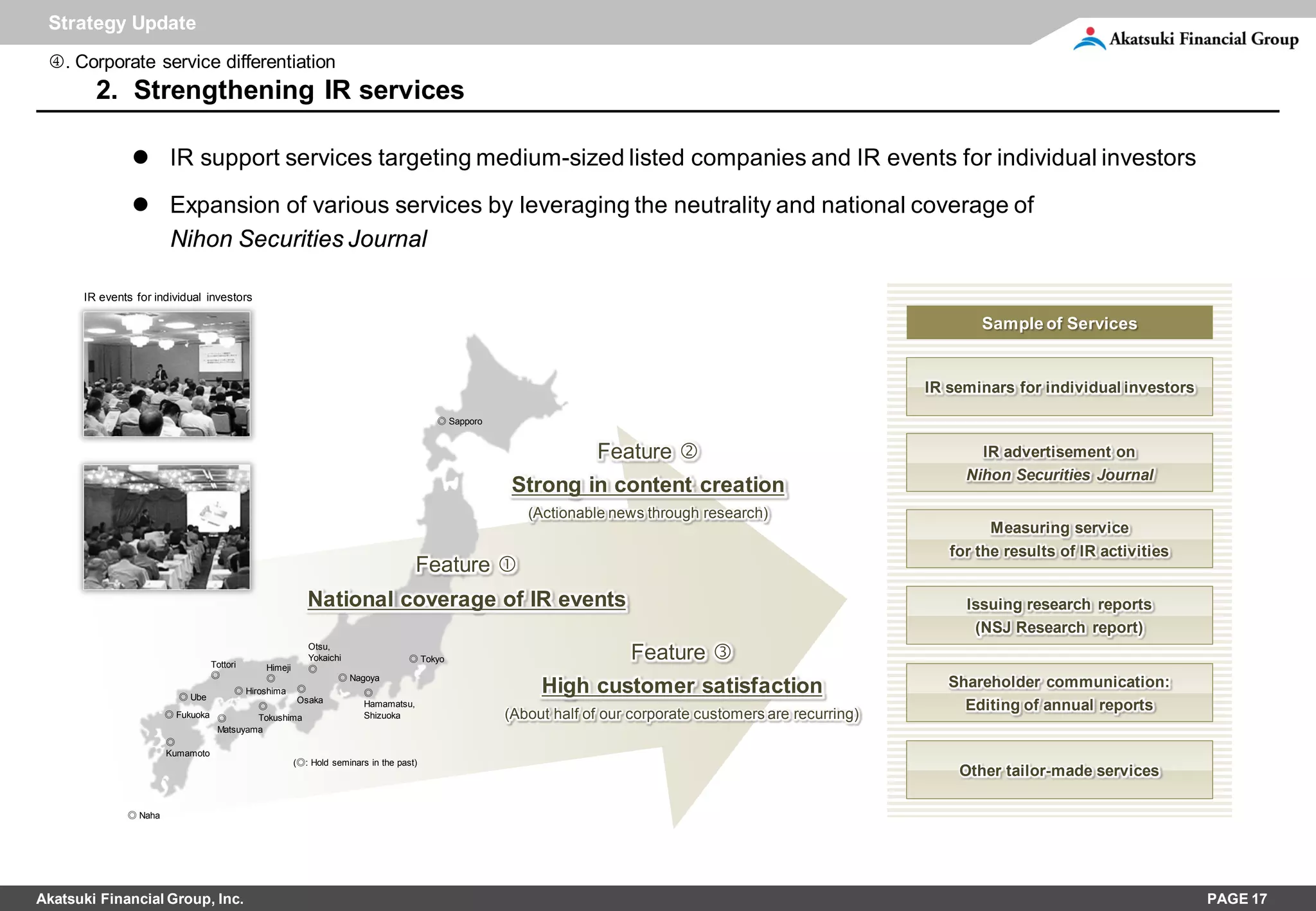

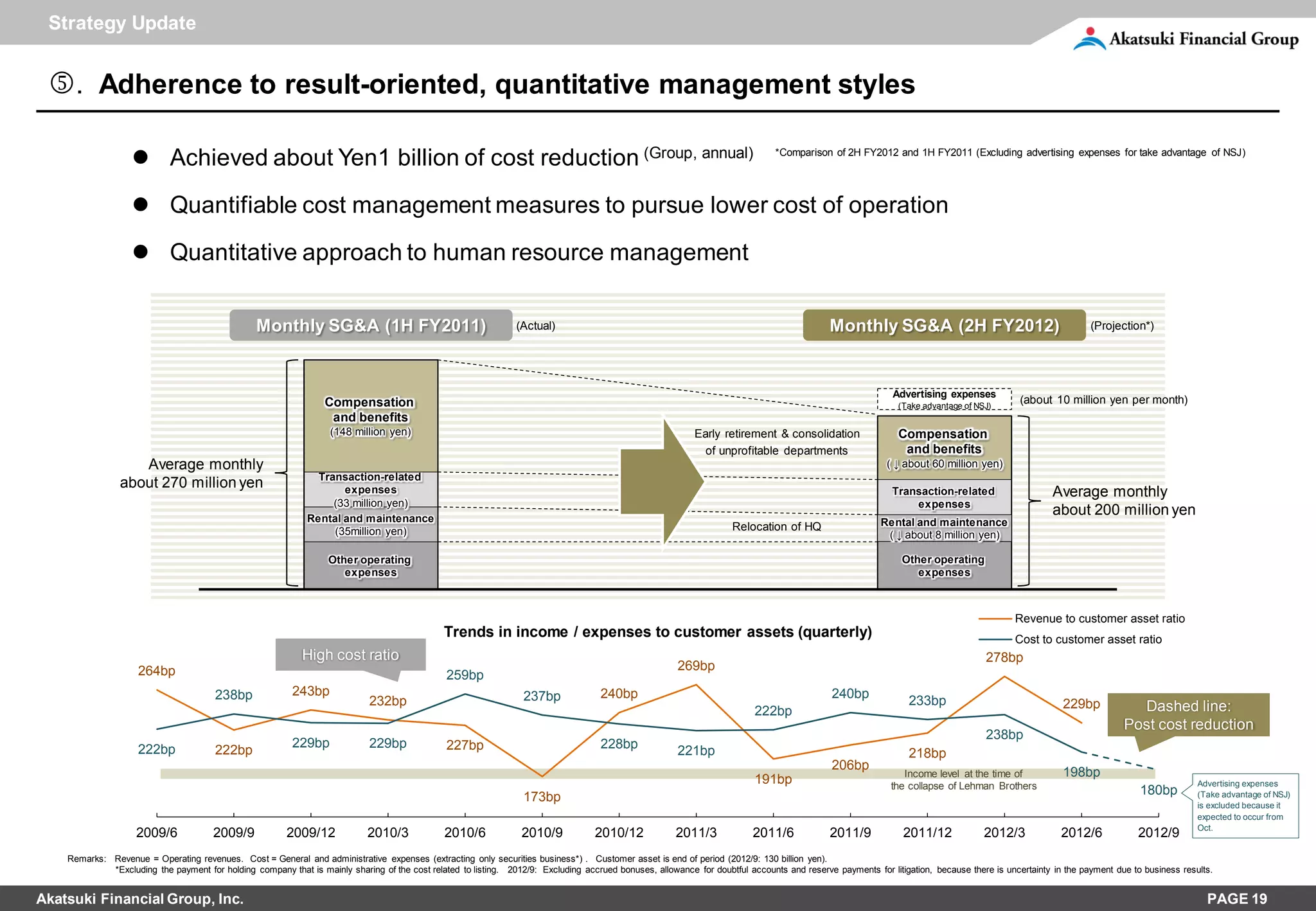

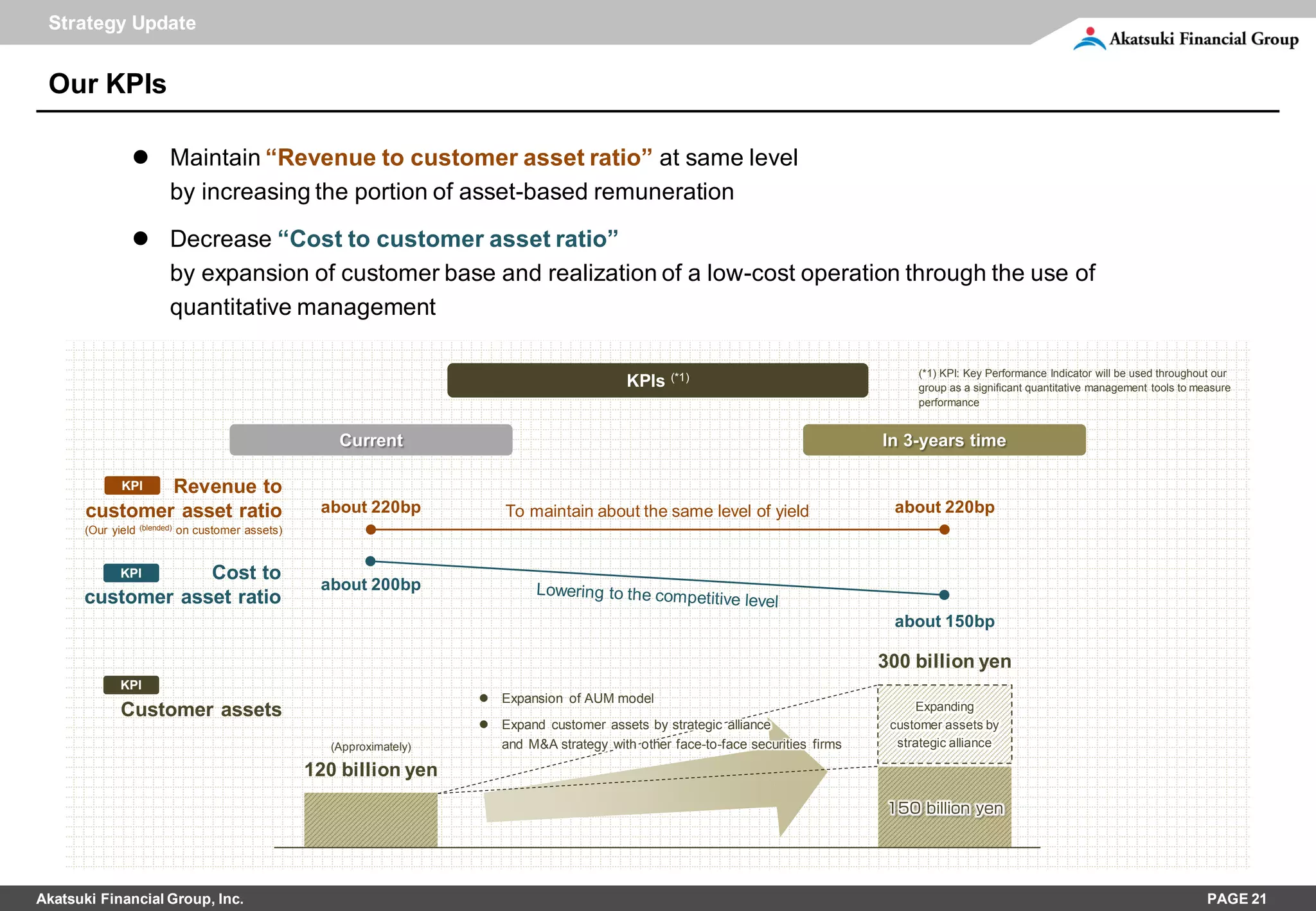

This document outlines Akatsuki Financial Group's mid-to-long term strategy through 5 strategic initiatives: 1) Strengthening information dissemination and turning financial information into a value-enhancing tool for customers. 2) Expanding customer base and revenue opportunities through organic growth, strategic alliances, and partnering with other channels. 3) Diversifying customer assets and originating investment products to stabilize and increase profits. 4) Strengthening investment banking and investor relations services for corporate clients. 5) Continuing to reduce costs and introduce quantitative performance metrics. The overall goal is to provide modern, high value-added services to customers and stakeholders.