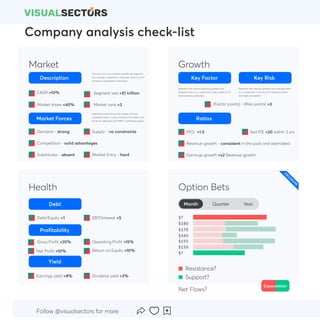

This document provides a checklist for analyzing companies. It lists factors to consider such as supply, demand, competition, market growth, profitability, key risks, and financial ratios. Key steps are to identify the market segment the company operates in, research factors affecting growth and risks, and evaluate if the difference between growth factors and risks is greater than 3. Financial metrics like revenue growth, debt levels, earnings growth, and valuation ratios should also be considered.