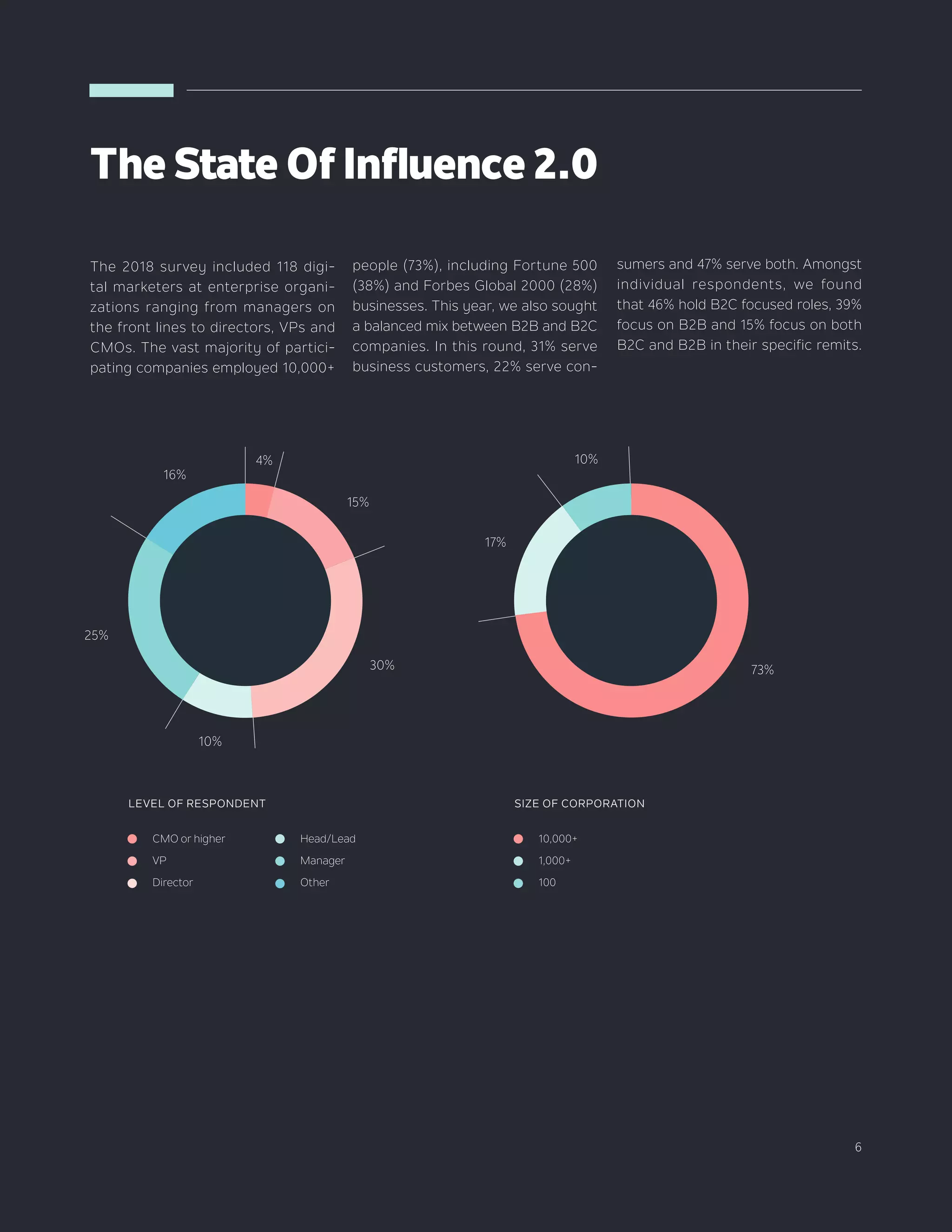

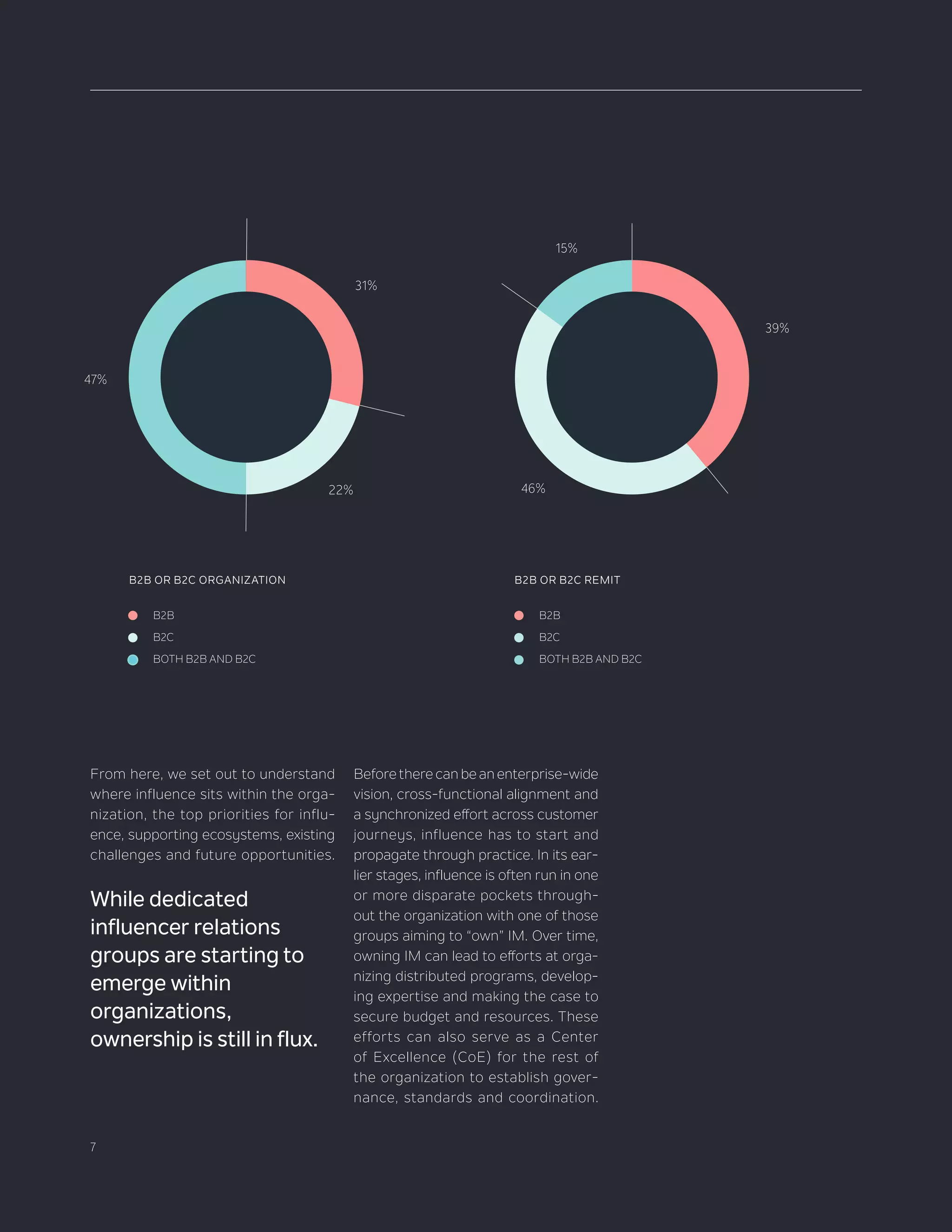

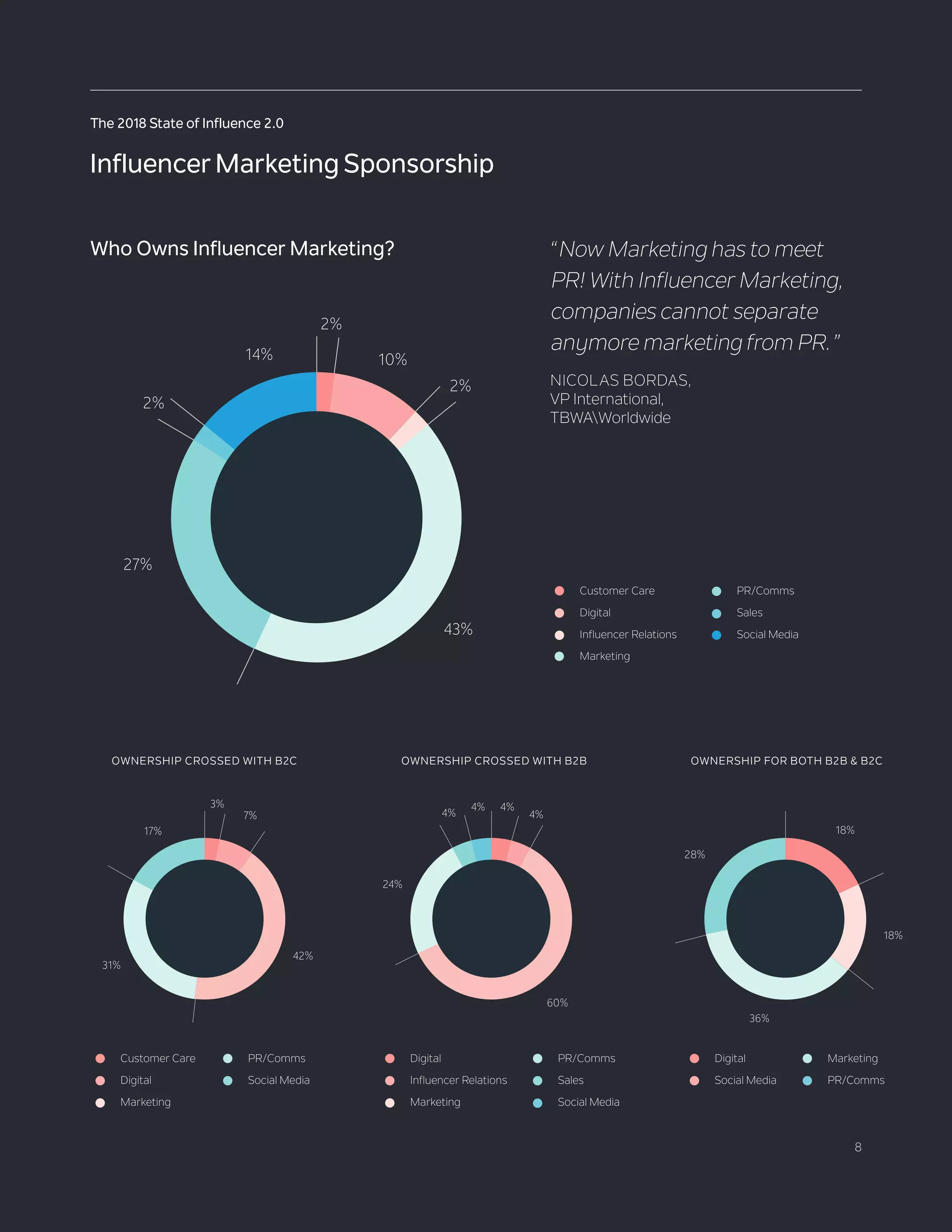

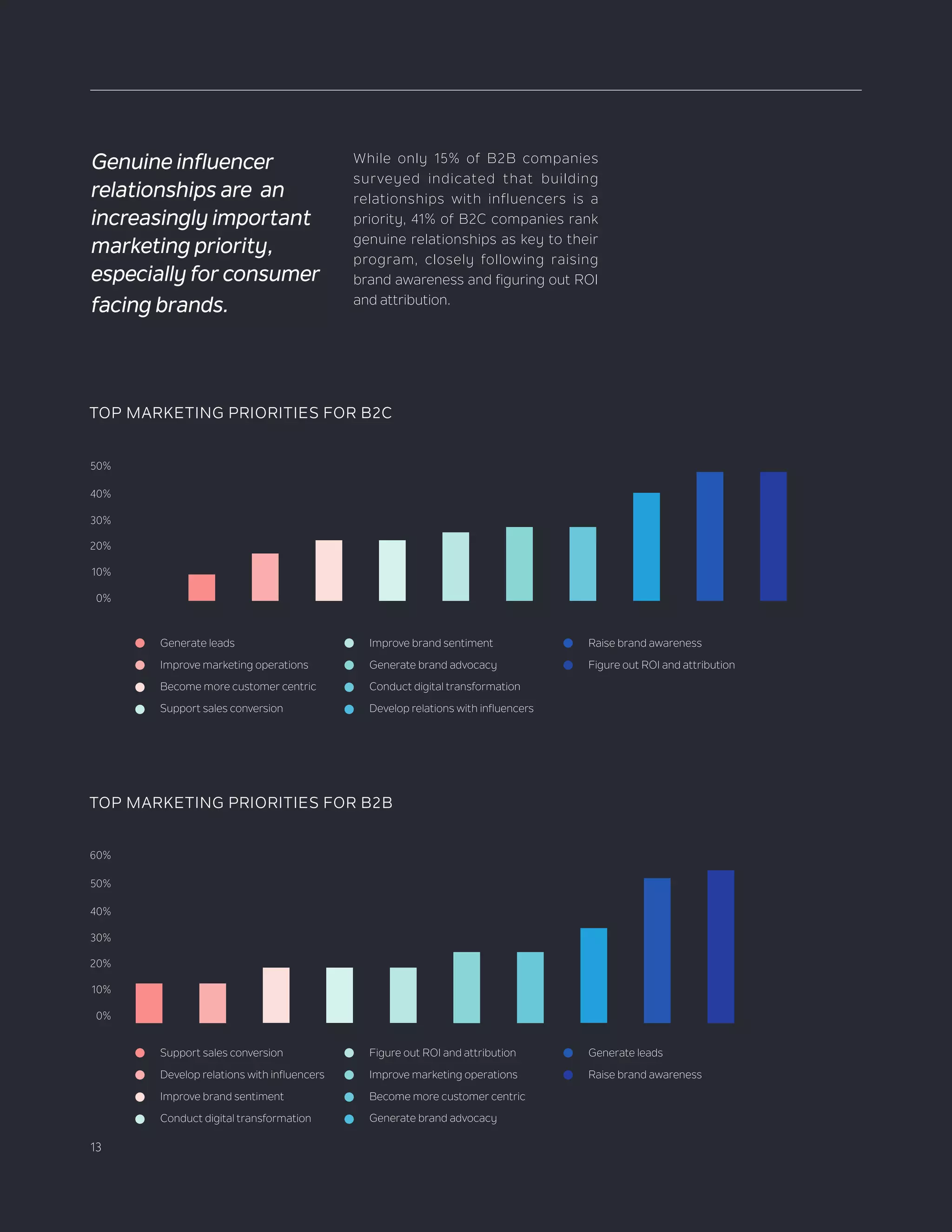

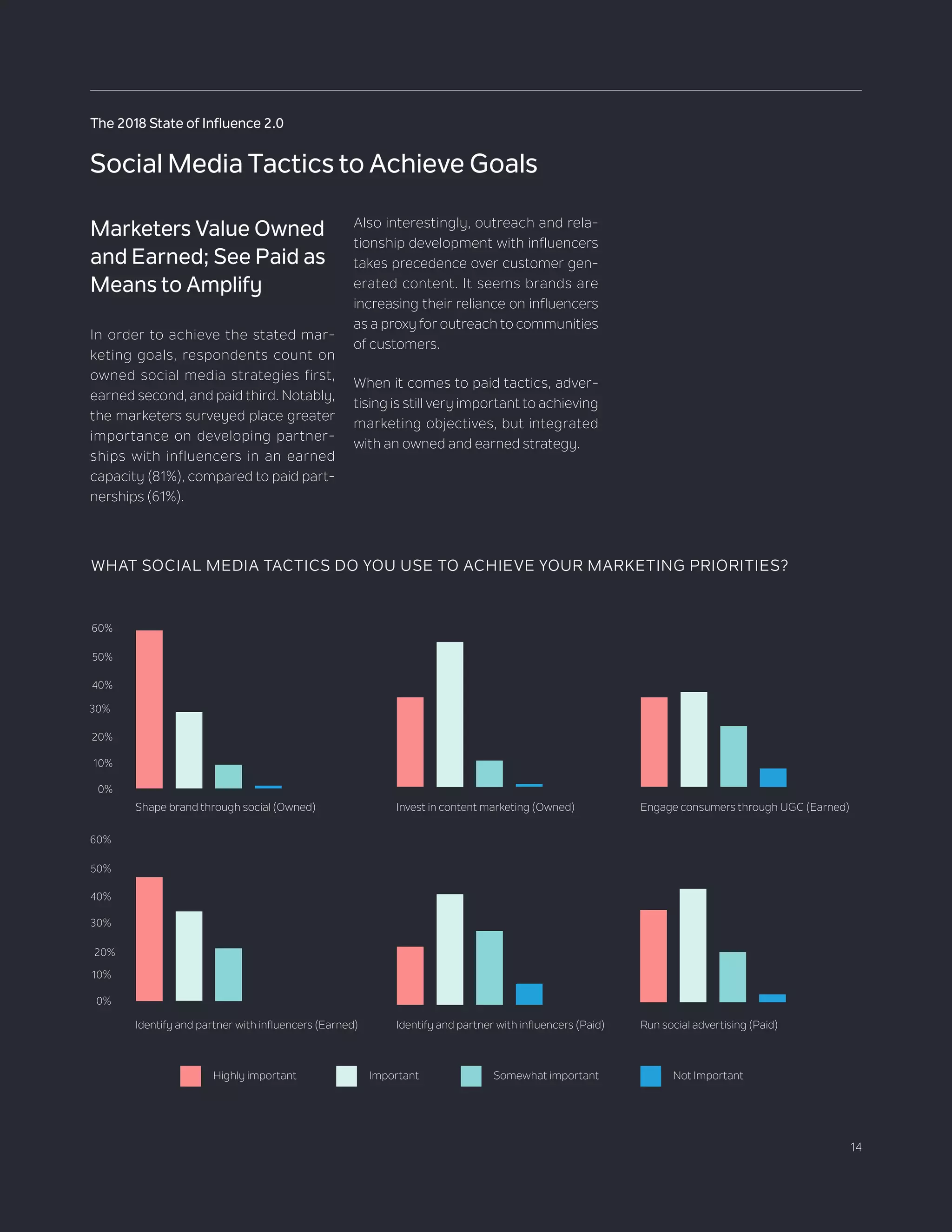

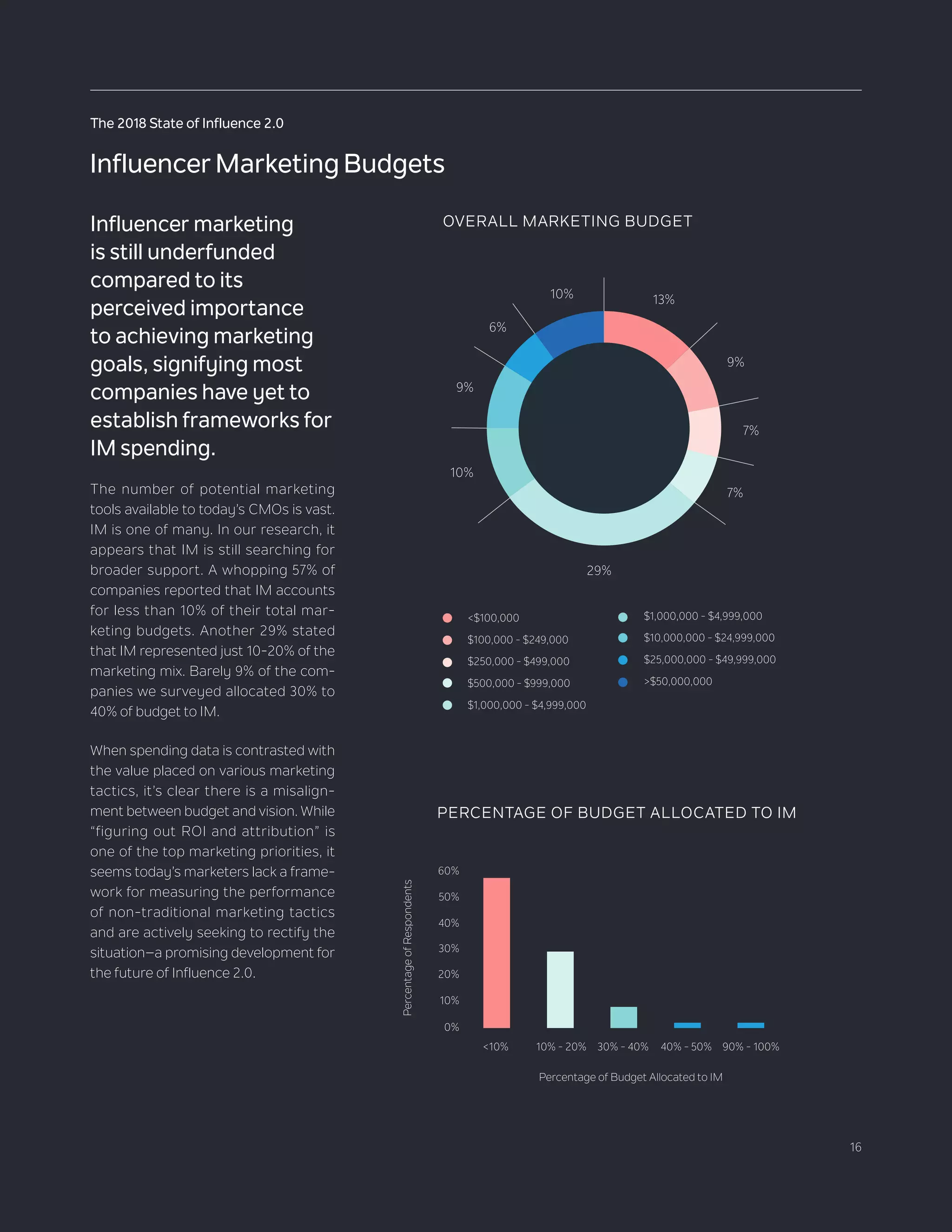

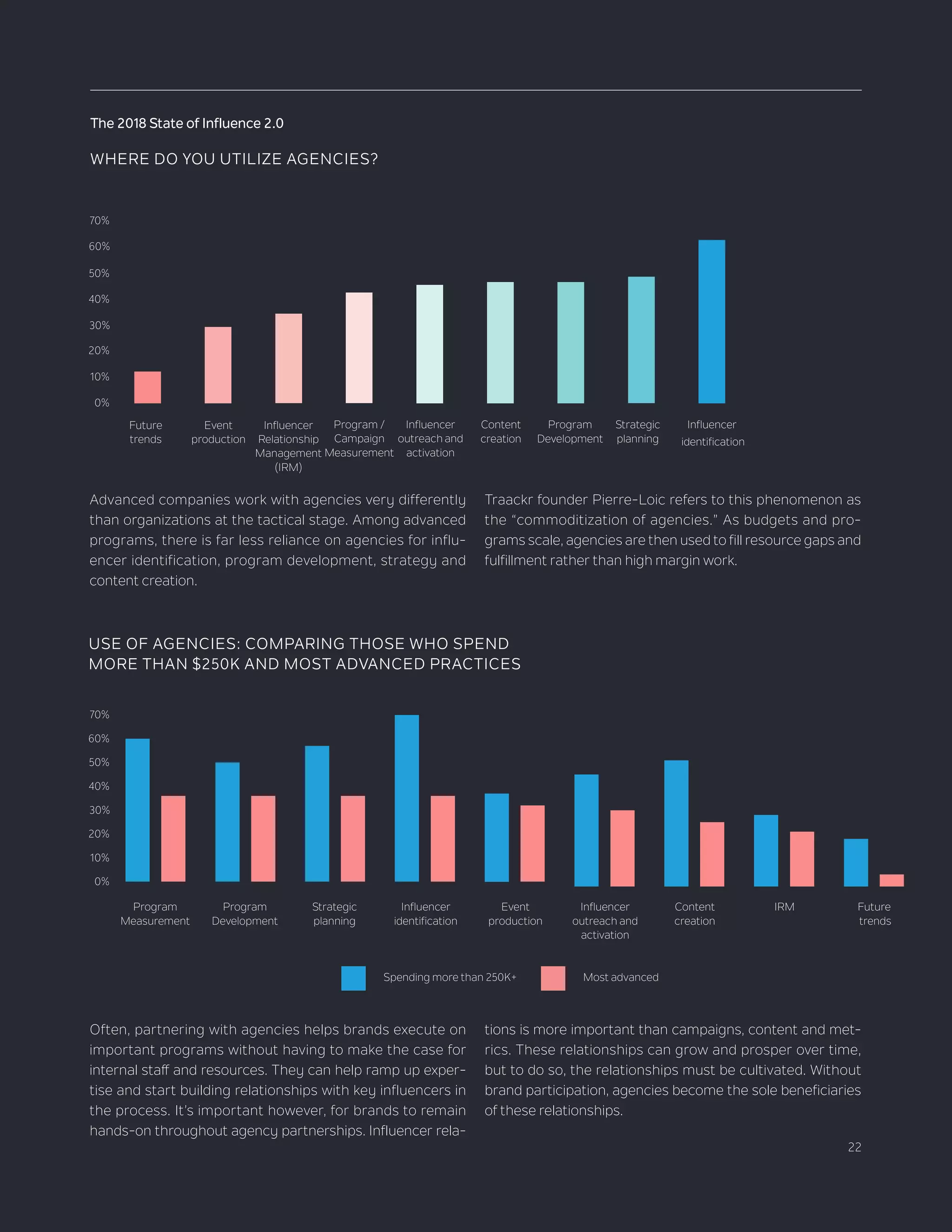

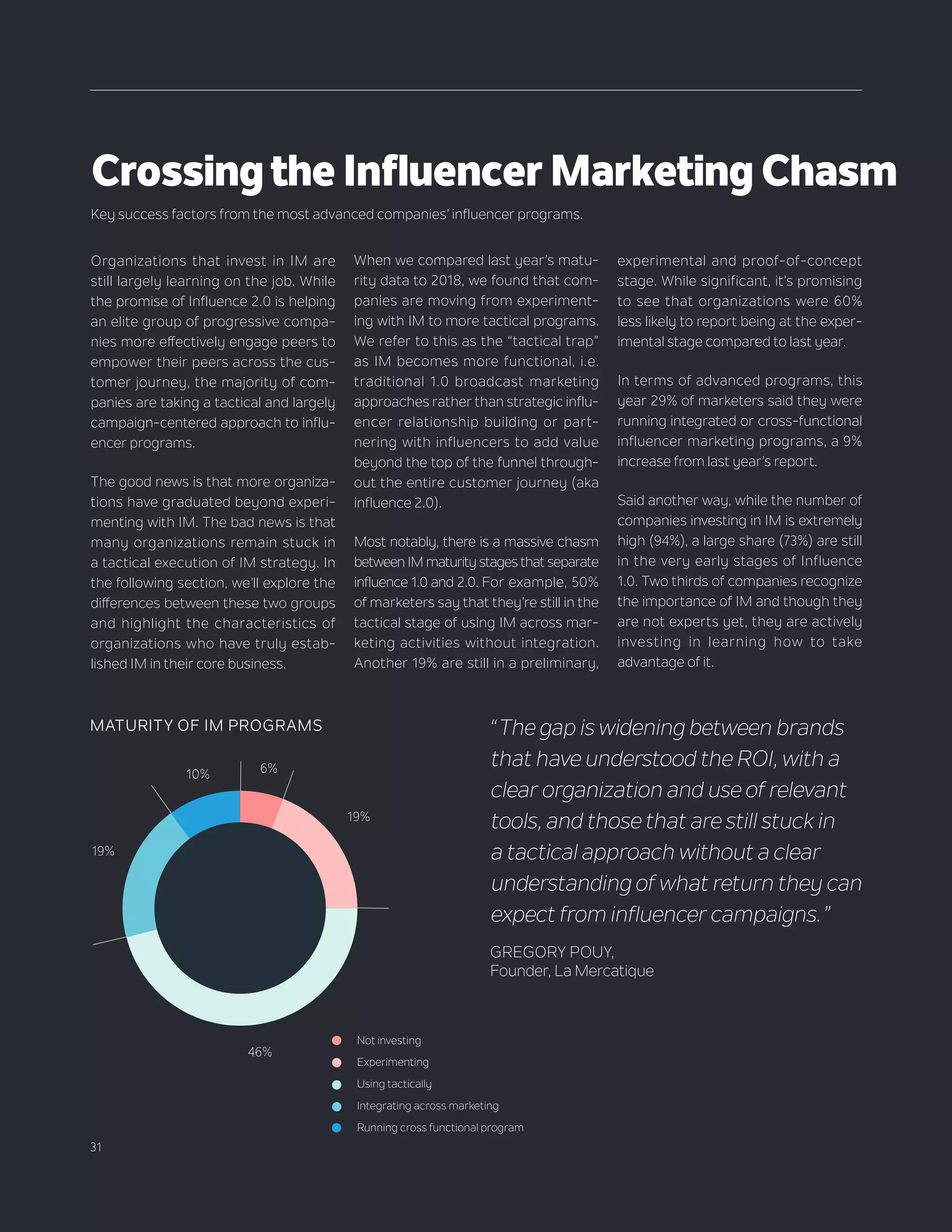

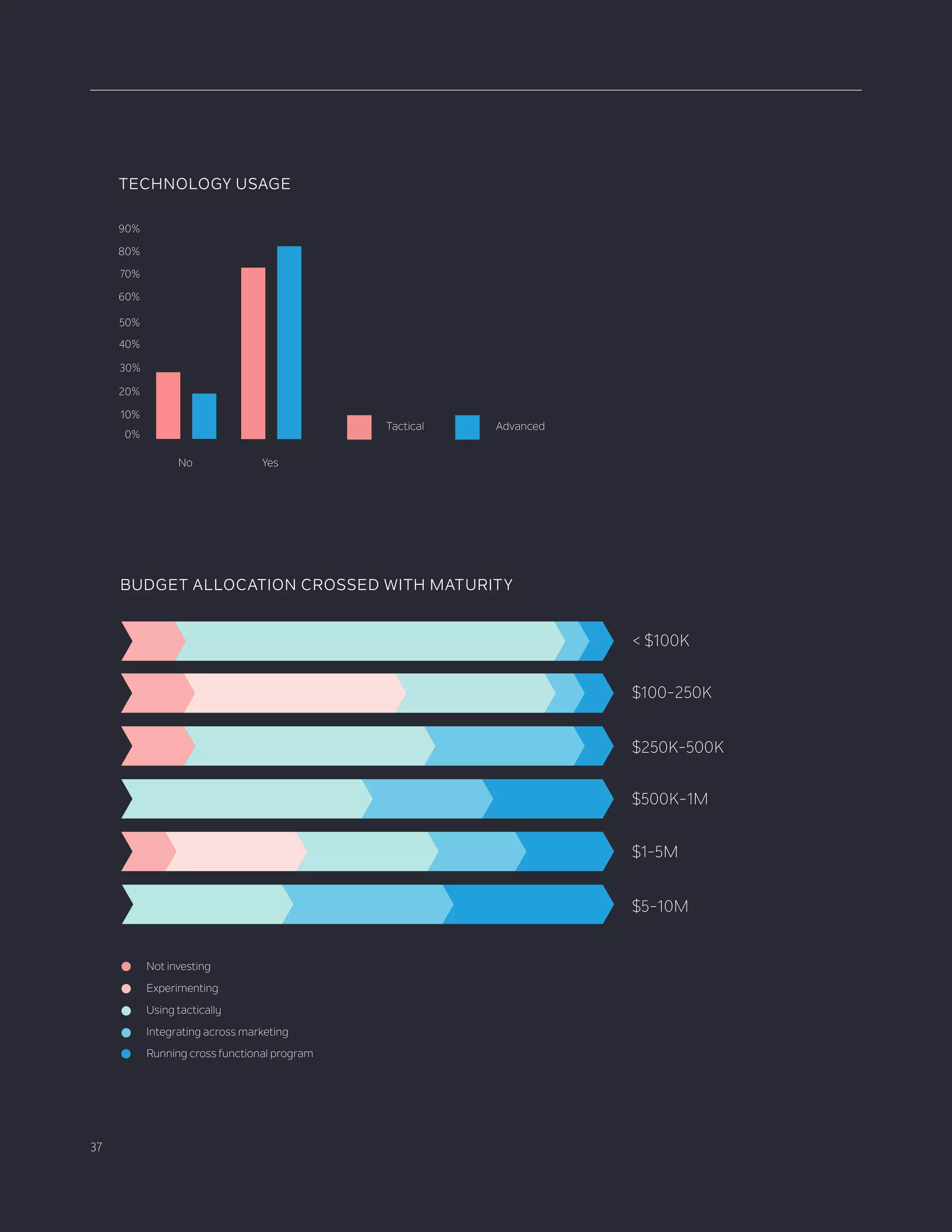

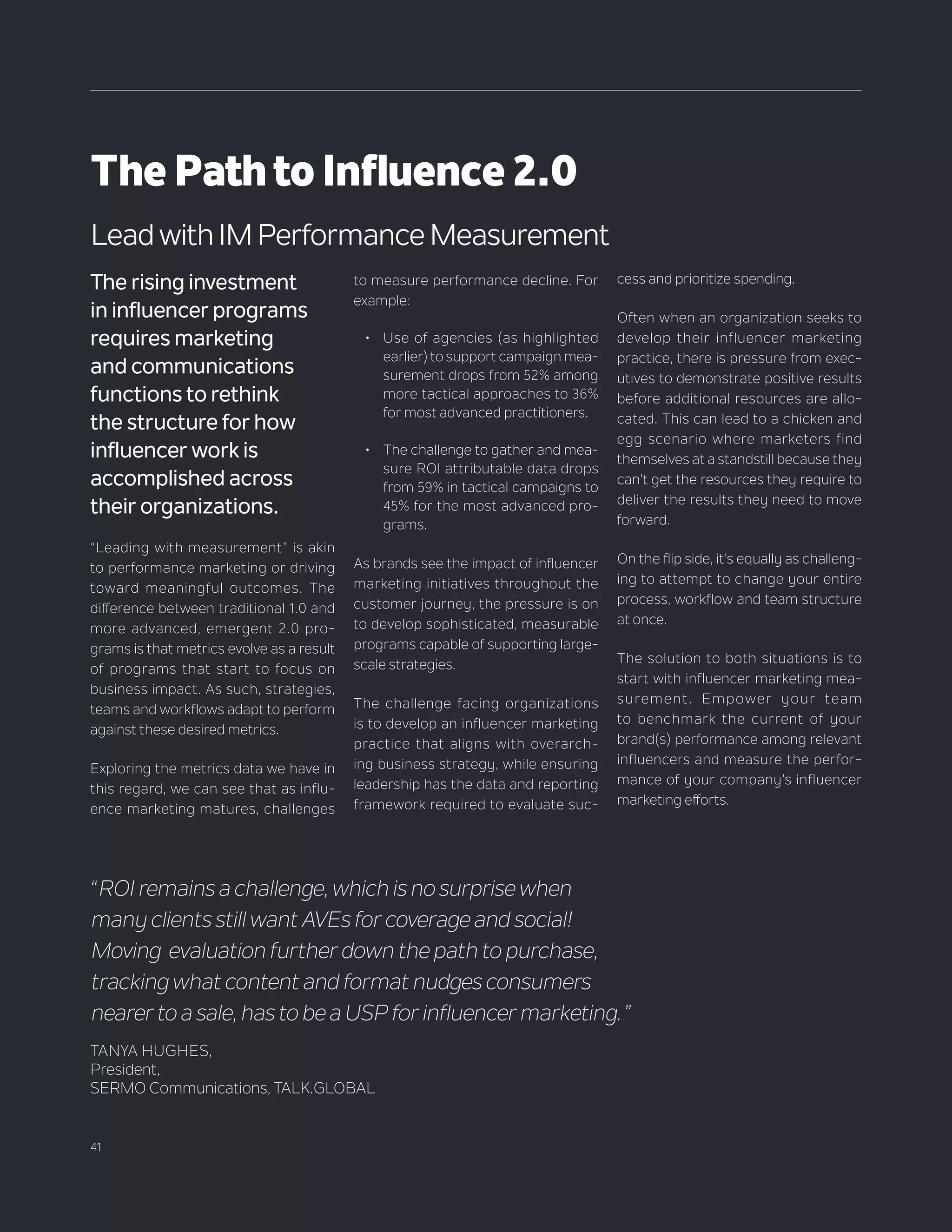

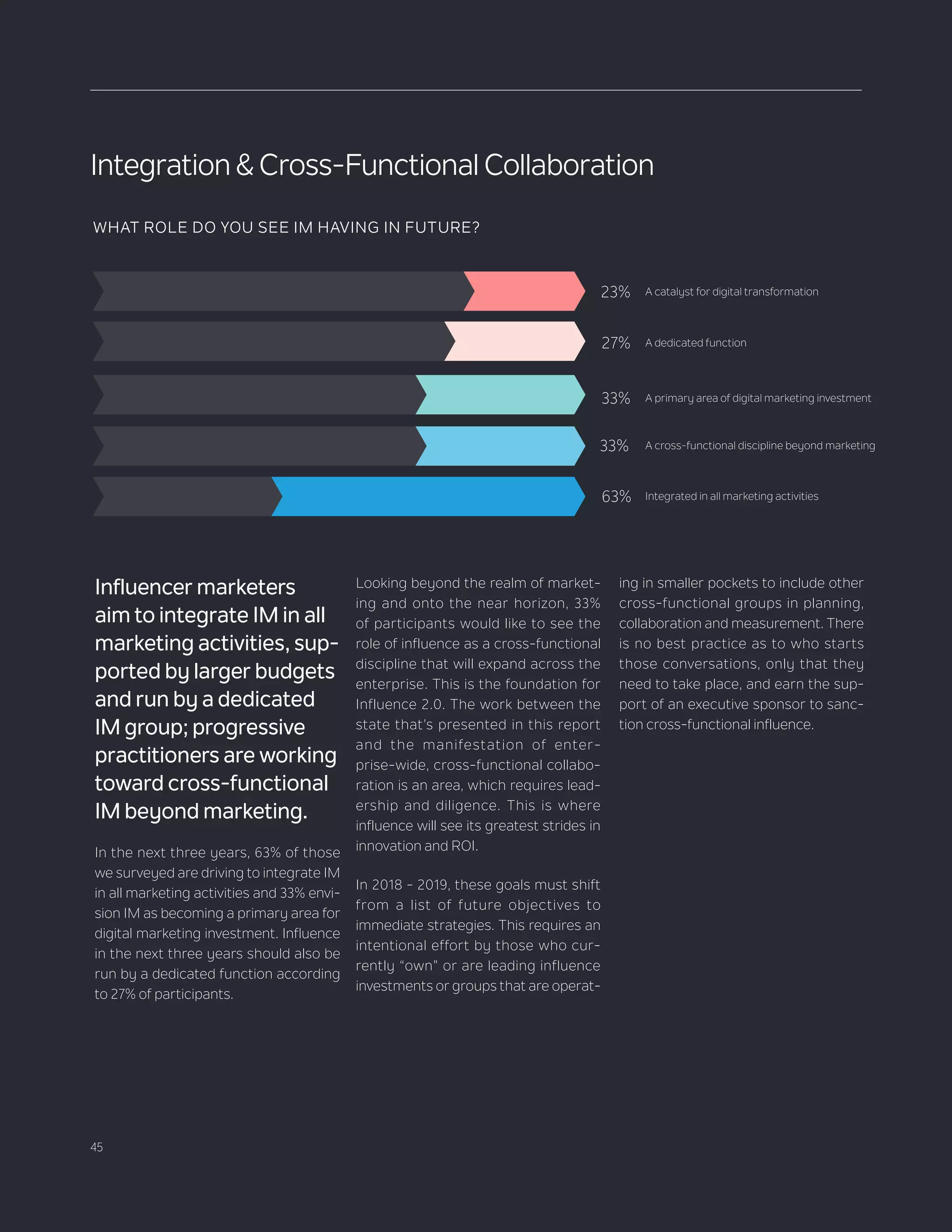

The 2018 State of Influence report highlights the evolving role of influencer marketing, emphasizing a shift towards 'Influence 2.0,' which focuses on peer-to-peer engagement rather than traditional marketing methods. With a survey of over 100 digital marketers, the report reveals that ownership of influence is spreading across organizations and becoming central to business strategies, particularly as brands recognize the importance of trust and authentic engagement. The report underscores diverse marketing priorities, with raising brand awareness as a primary focus, while consumer-facing brands are increasingly integrating influencer relations into their strategies.