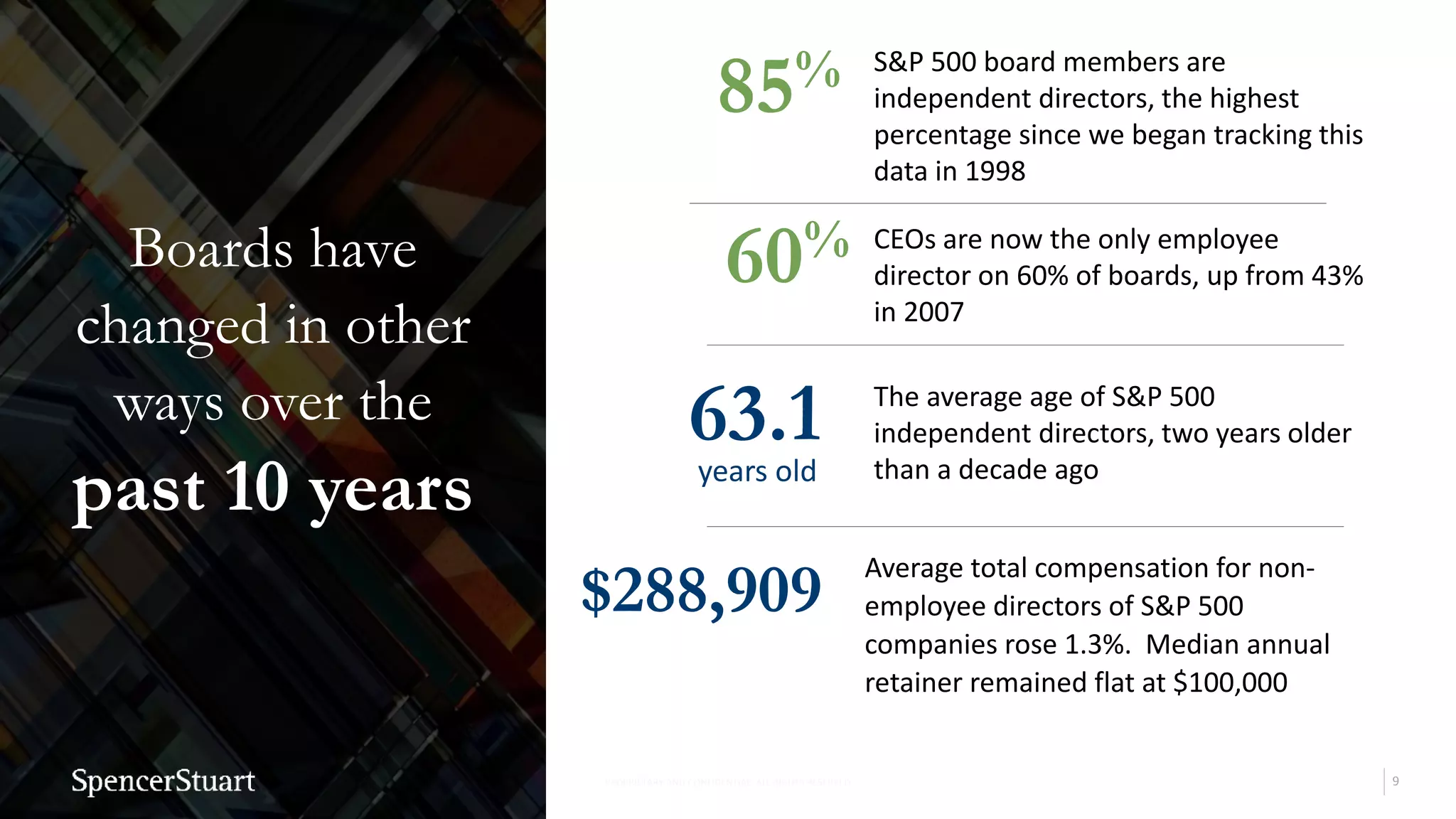

In 2017, there was the highest number of new independent directors elected to S&P 500 boards since 2004, a 15% increase from 2016. For the first time, more than half of the 397 new directors of S&P 500 companies were women and/or minorities. Female representation among new directors reached 36%, the highest in 20 years. Boards are casting a wider net for director candidates as fewer CEOs take on outside board roles, and 45% of new directors are serving on their first outside board. Board leadership is also evolving, with 51% of boards now having separate chair and CEO positions.