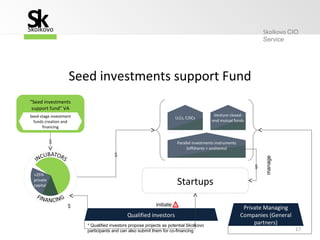

The document outlines the application process and criteria for obtaining Skolkovo residence status in Russia. It discusses the qualifications needed for investors, the application procedures, and the types of applicants. It also describes the functions of the Skolkovo CIO Service, which develops and maintains the project workflow and matches qualified investors with innovative projects. Finally, it introduces several early investment instruments established by Skolkovo, including funds focused on infrastructure development, technology clusters, seed investments, and venture investments.