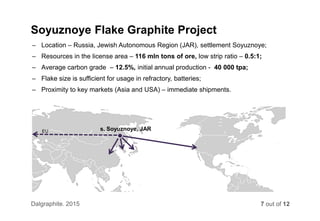

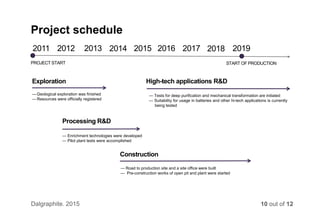

The document summarizes information about the Soyuznoye Graphite Project in Russia. It describes the project's large graphite resource of 116 million tons located in the Jewish Autonomous Region. Once operational, the mine is expected to initially produce 40,000 tons of flake graphite per year. The project has completed geological exploration, resource registration, and pilot plant testing. Construction is ongoing with production targeted to start in 2019.