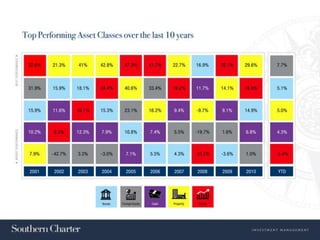

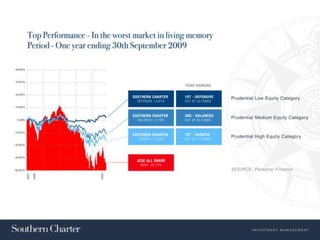

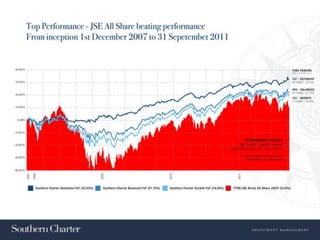

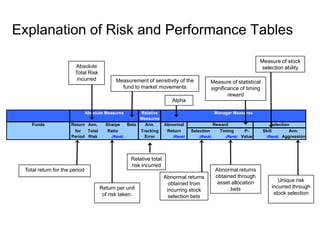

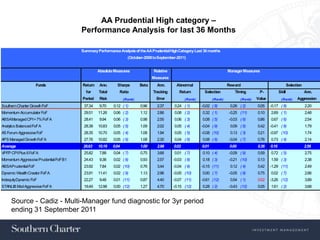

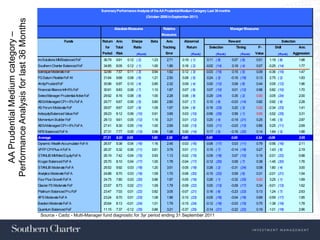

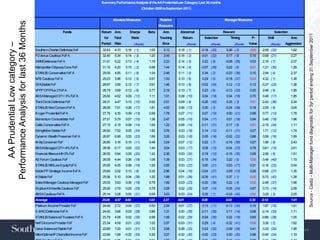

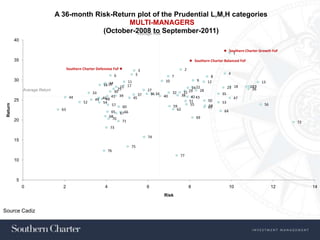

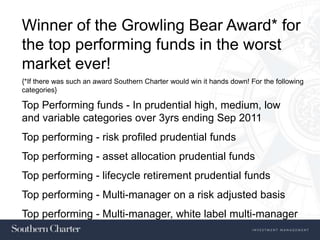

The document analyzes the performance of various multi-manager funds in the AA Prudential High and Medium categories over the last 3 years. It finds that asset allocation was the main driver of returns, explaining 92% of performance, while stock picking contributed 6% and market timing only 2%. For the high category, the top performing fund was Southern Charter Growth FoF, while for the medium category, the top performers were InvSolutions MMBalanced FoF and Southern Charter Balanced FoF. The document provides various metrics to analyze risk-adjusted performance and the contribution of factors like asset allocation, stock picking and market timing.