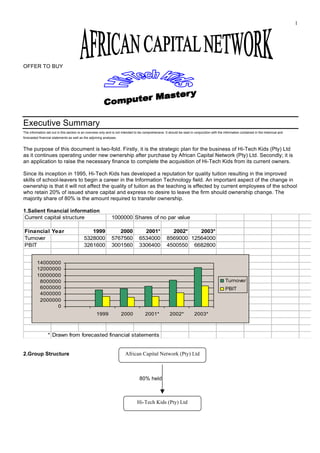

This document provides an executive summary, business description, and financial information for the proposed acquisition of Hi-Tech Kids (Pty) Ltd by African Capital Network (Pty) Ltd. Key details include:

- African Capital Network seeks to acquire 80% of Hi-Tech Kids for R1.75 million to gain a presence in the growing IT training industry for children.

- Minimum capital required is R340,000, to be raised through a bank overdraft and long-term loan secured against land/building assets.

- Hi-Tech Kids has operated profitably since 1995 providing IT training in Roodepoort. It retains staff and 20% ownership under the new structure.

- Financial projections show increasing