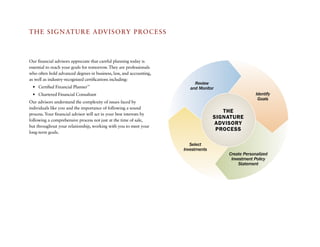

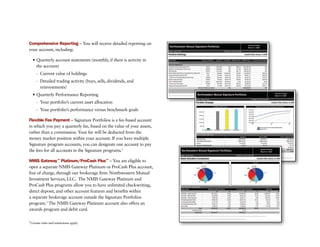

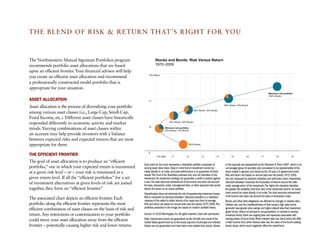

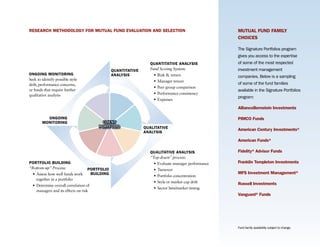

This document describes the Northwestern Mutual Signature Portfolios program. It is a mutual fund wrap solution that provides professionally constructed portfolios using independent research to select funds. Clients work with a financial advisor to identify goals and risk tolerance to create a personalized asset allocation and investment policy statement. The portfolio is then systematically rebalanced to maintain the intended allocation. The program aims to give clients objective investment guidance and diversified portfolios managed for them for an annual asset-based fee rather than per-trade commissions.