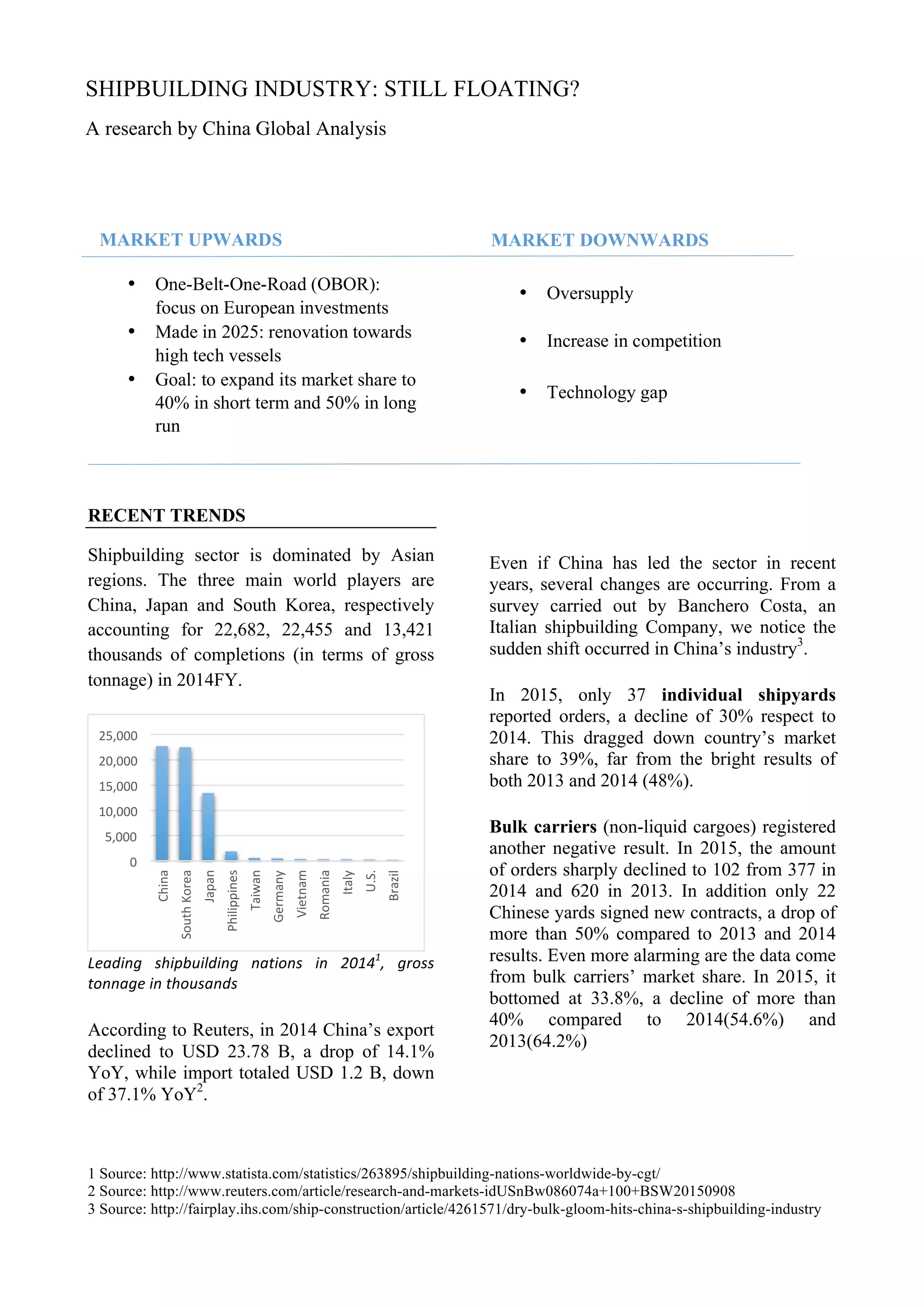

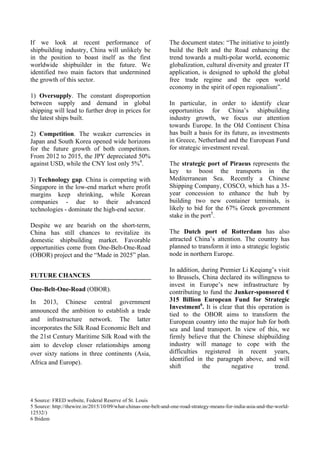

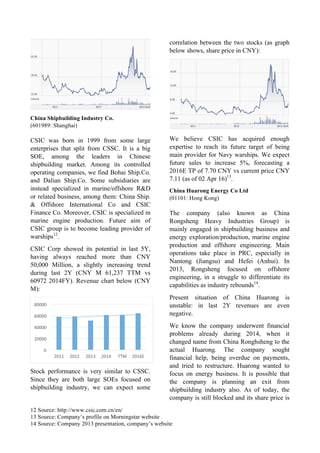

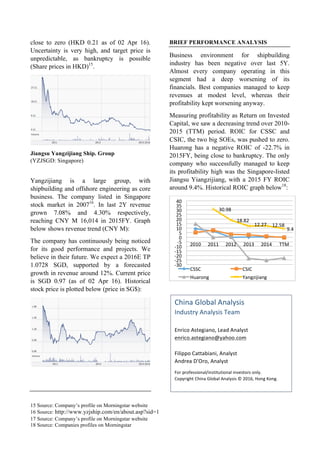

This document summarizes recent trends in the global shipbuilding industry and analyzes the outlook for China. It finds that while China leads in shipbuilding output, its market share and orders have declined in recent years due to overcapacity, increased competition, and a technology gap. However, China's "One Belt, One Road" initiative and "Made in China 2025" plan aim to boost infrastructure investment and technological upgrading, positioning China to regain market share. The document also profiles major Chinese shipbuilders like CSSC and CSIC and finds that while their revenues have grown, profits have been volatile depending on market conditions.