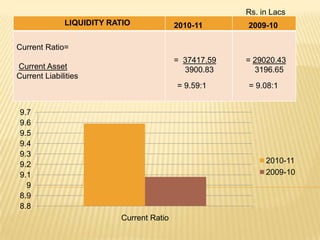

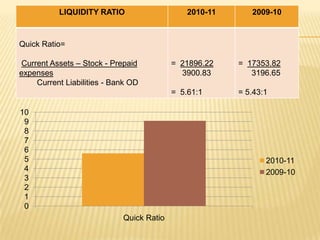

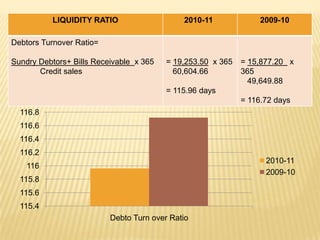

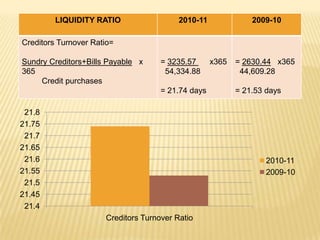

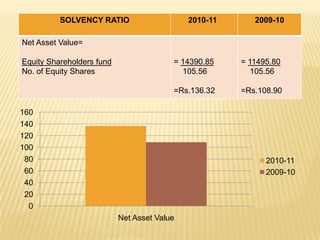

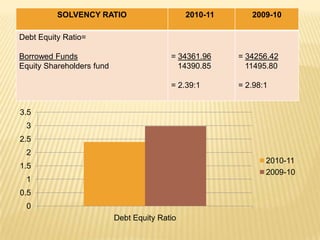

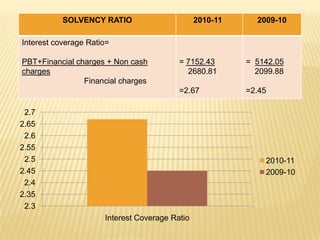

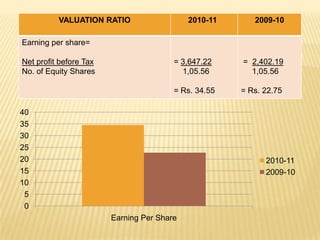

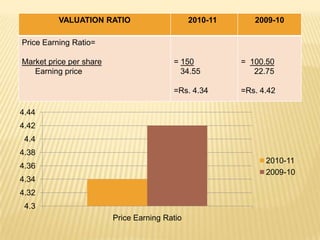

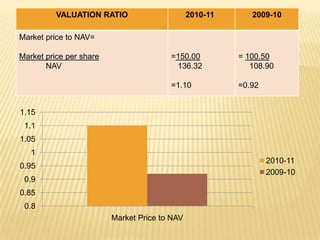

The document provides financial information for Sharon Bio-Medicine Ltd for the years 2010-11 and 2009-10. It includes various liquidity, solvency, and valuation ratios calculated for the company. The current ratio improved from 9.08:1 in 2009-10 to 9.59:1 in 2010-11. The net asset value per share increased from Rs. 108.90 to Rs. 136.32 over the same period. The market capitalization grew from Rs. 10,608.78 lacs to Rs. 15,834 lacs between 2009-10 and 2010-11.