Embed presentation

Download to read offline

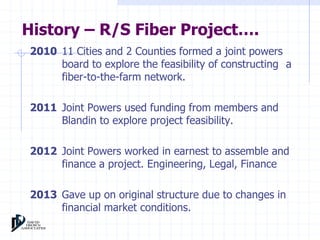

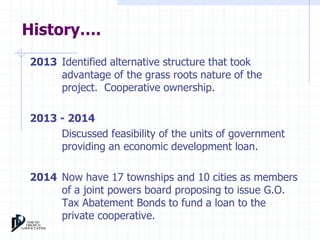

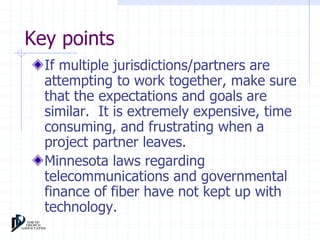

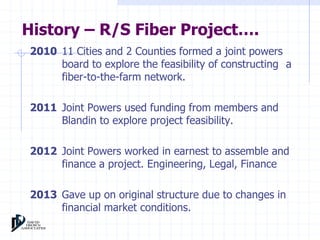

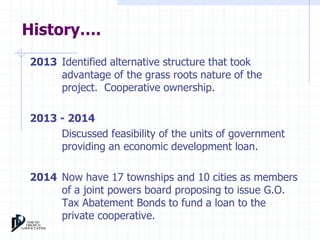

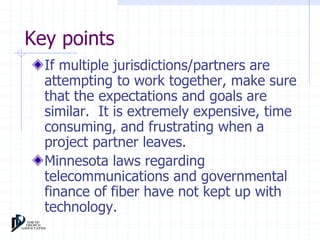

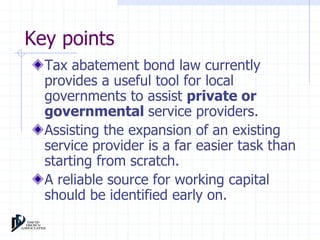

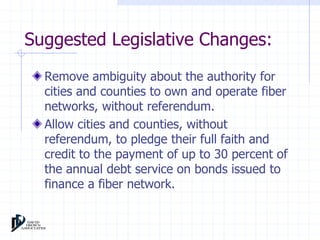

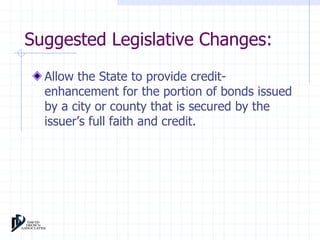

This document discusses the history and challenges of the R/S Fiber Project, a joint effort between 11 cities and 2 counties in Minnesota to build a fiber-to-the-farm network from 2010 to 2014. It initially started as a joint powers board but had to change to a cooperative ownership structure due to financial challenges. It now involves 17 townships and 10 cities issuing bonds to fund a loan to the private cooperative. The document outlines lessons learned around setting clear expectations between partners and having outdated telecommunications laws in Minnesota. It also recommends legislative changes to clarify authority around government-run fiber networks and allow more government support of bonds.