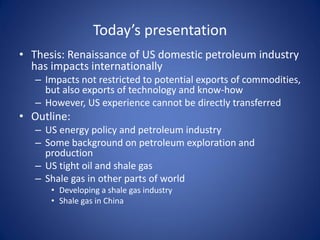

This document summarizes the US petroleum renaissance and its implications for world markets and Asia. The US experience with tight oil and shale gas development has disrupted predictions of peak oil and increased US energy independence. While US exports of petroleum commodities face restrictions, exports of technology and expertise in horizontal drilling and hydraulic fracturing are impacting global natural gas markets. Countries like China possess large shale resources but face challenges developing their industries due to geological complexity and differences from the US model of private ownership and competition. National oil companies will play a key role in China's ability to overcome innovation barriers.