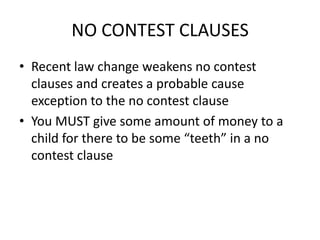

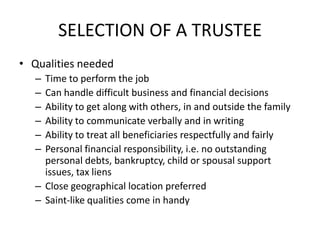

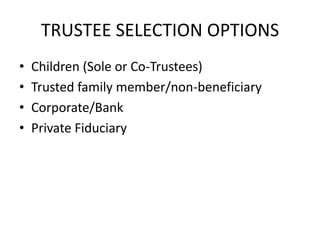

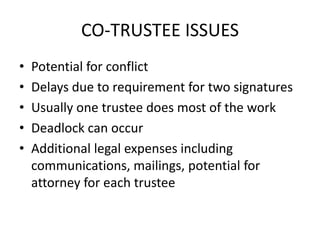

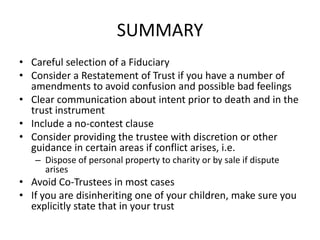

This document discusses strategies for estate planning to avoid conflicts and contests between beneficiaries. It recommends clearly communicating wishes to beneficiaries during life to prevent misunderstandings after death. The document also suggests simplifying the division of estates, carefully selecting trustees to avoid bias or conflicts of interest, including no-contest clauses, and giving trustees discretion in areas likely to cause disputes.