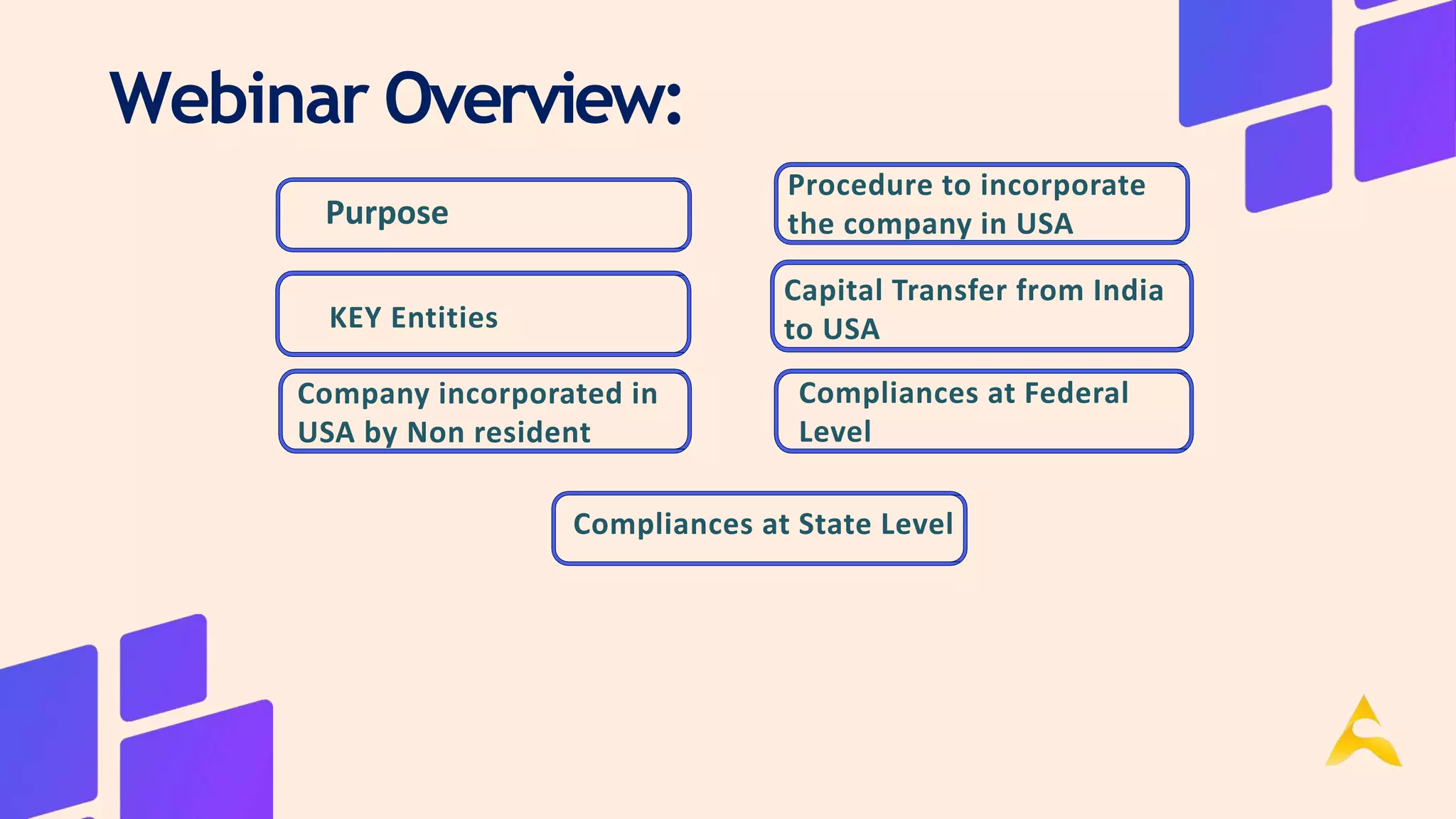

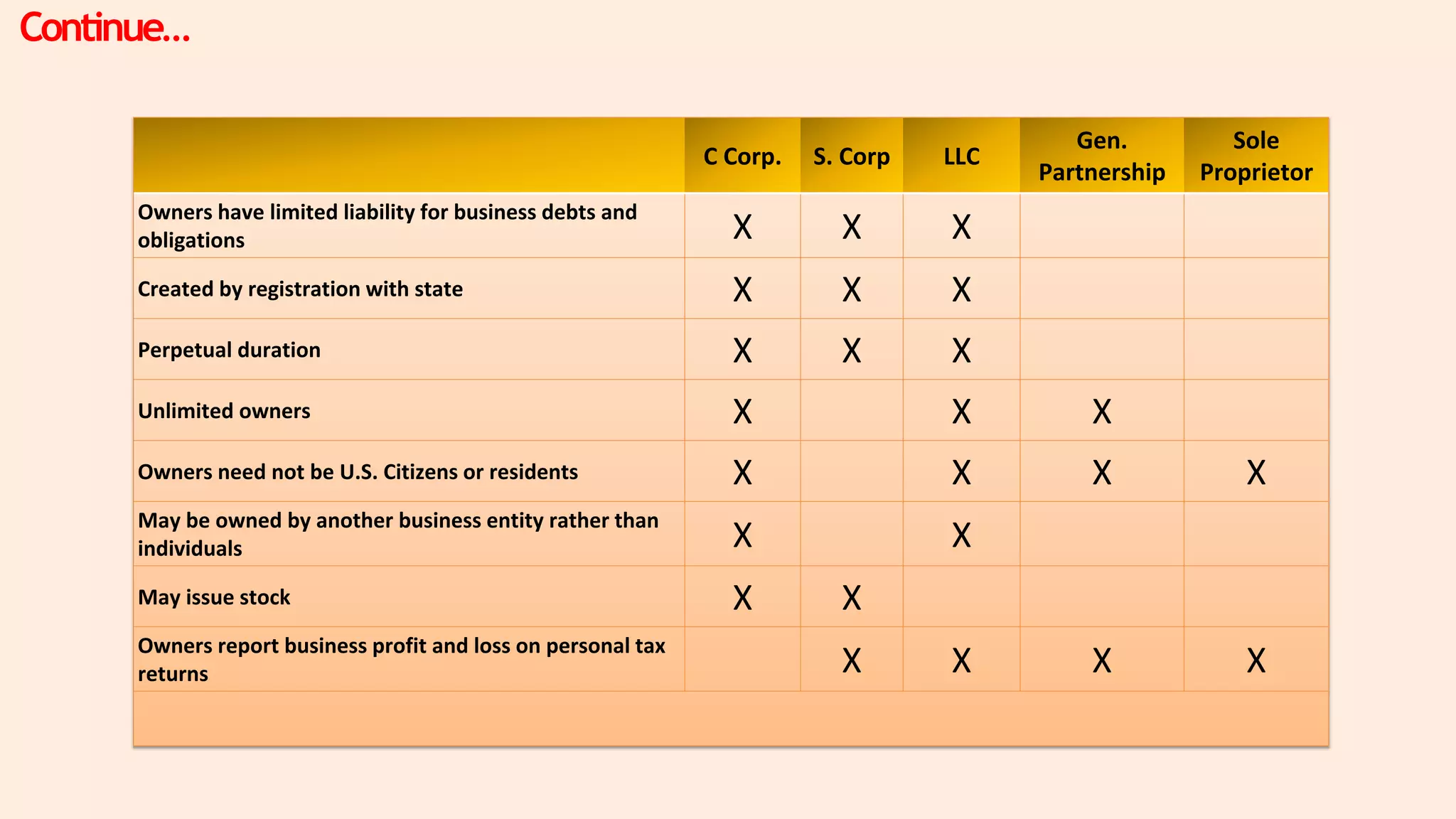

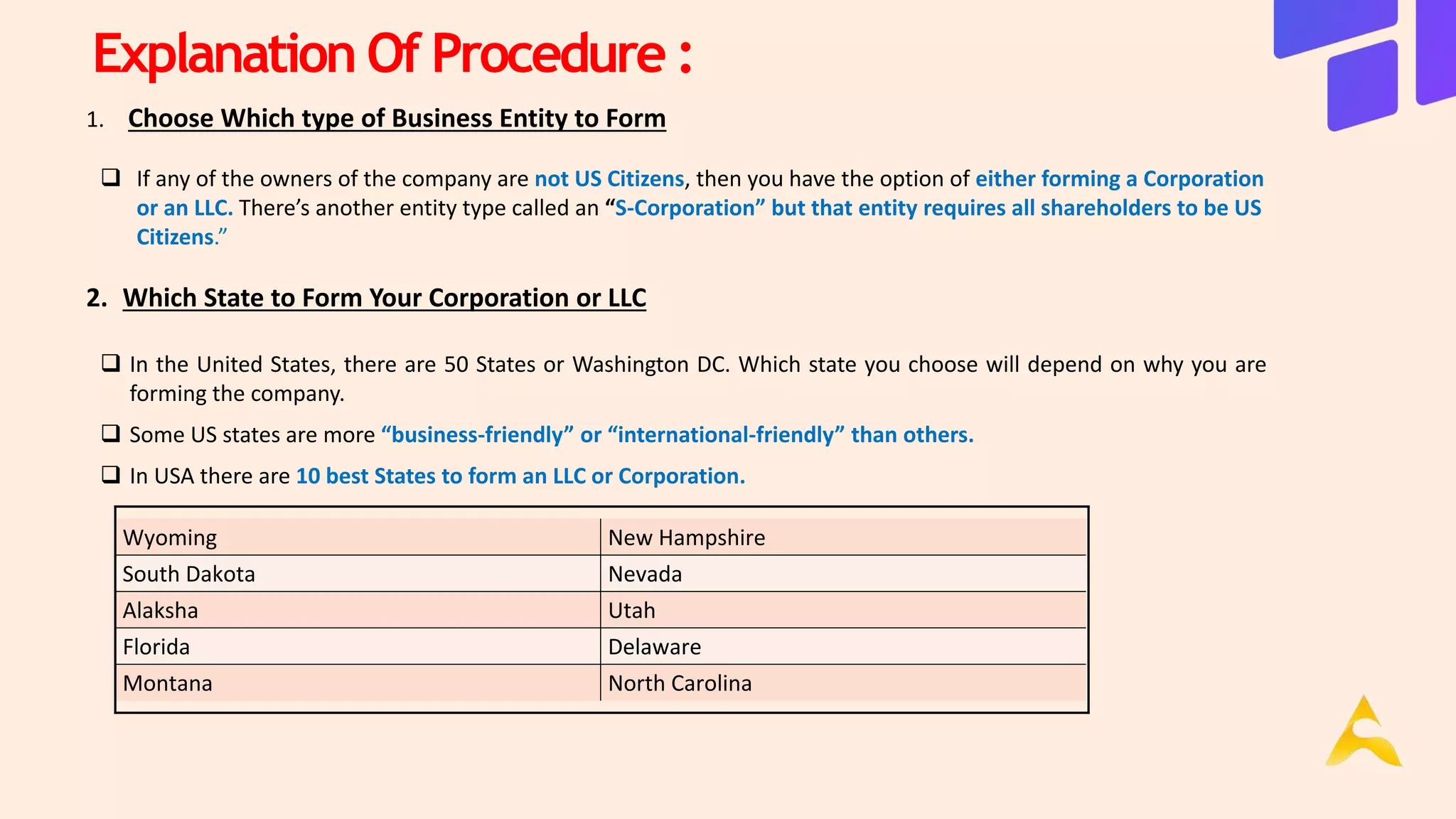

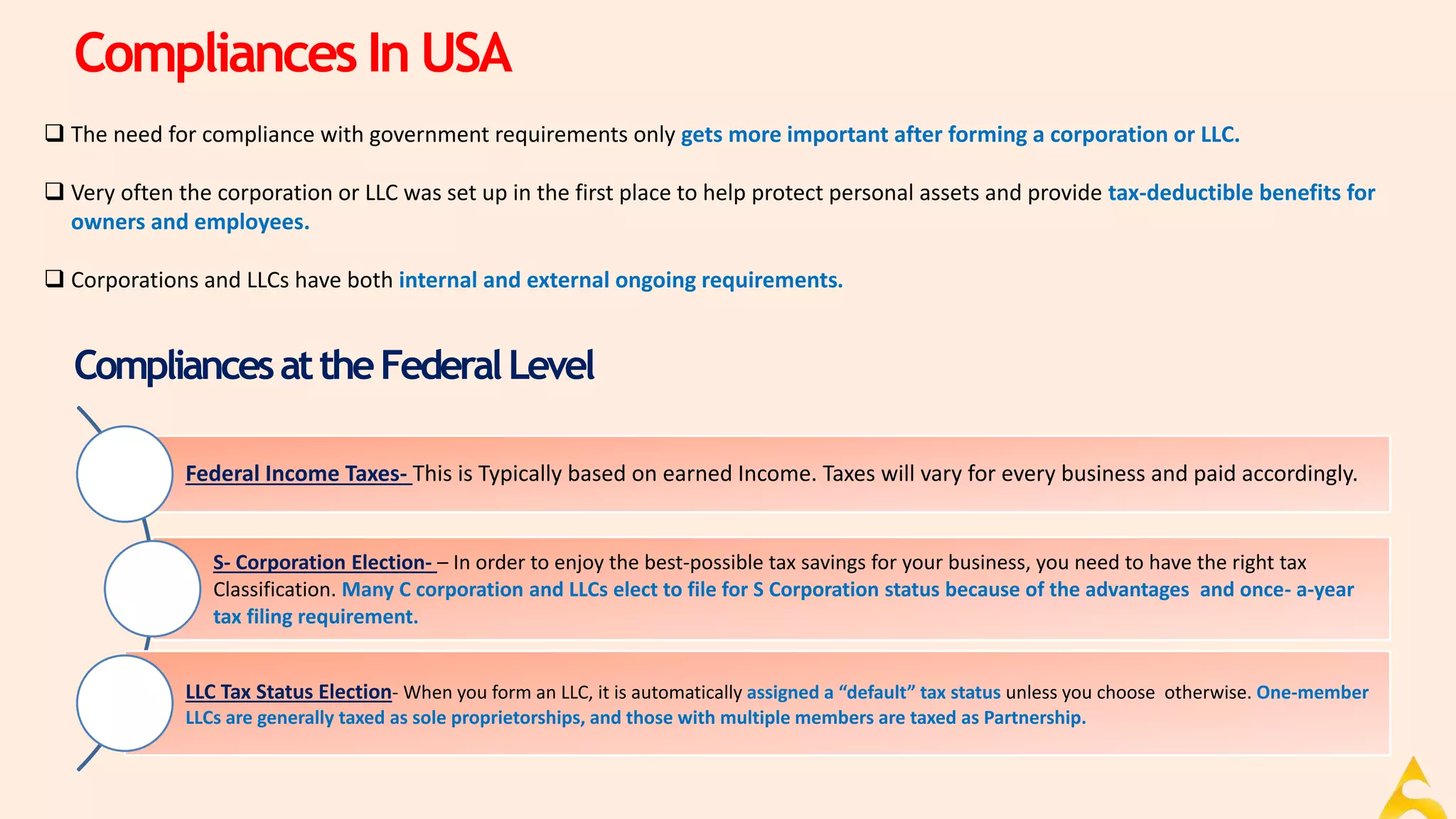

The webinar focuses on the procedures and advantages of setting up a business in the USA by foreign entities, detailing the types of business entities available and the process of incorporation. It highlights the benefits of US market access, technological advancements, and favorable tax conditions in certain states like Wyoming and Delaware. Compliance with federal and state regulations post-incorporation, including tax obligations and ongoing requirements, is also discussed.