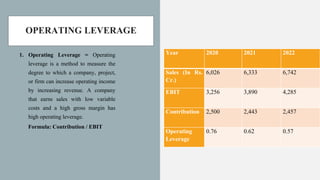

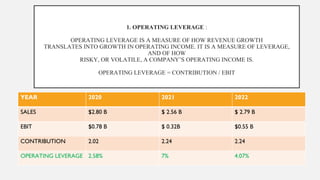

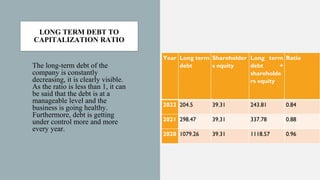

This document provides an analysis of the capitalization, leverage, and dividend policies of Torrent Pharmaceuticals, a leading pharmaceutical company in India. It summarizes Torrent's market capitalization over the past three years, which was $7.01 billion as of November 2022. It also analyzes the company's operating leverage, financial leverage, combined leverage, and debt-to-equity ratio for 2020-2022. The analysis finds that 2022 was financially the best year for Torrent, with lower leverage ratios and debt-to-equity compared to prior years.