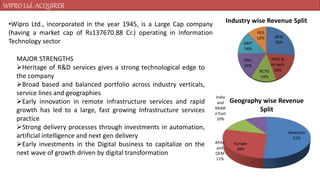

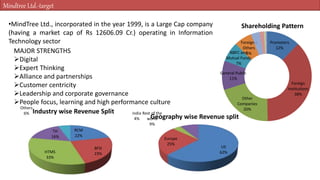

Wipro Ltd. makes an offer to buy MindTree Ltd in an acquisition deal. Key points of the summary are:

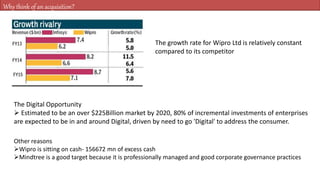

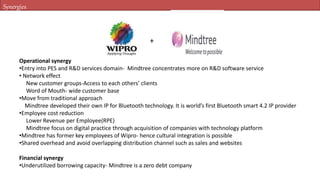

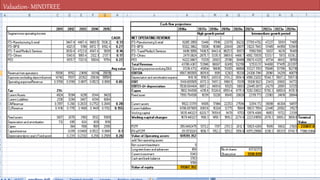

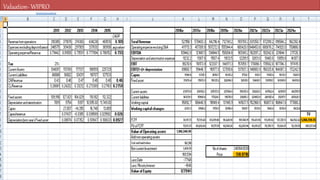

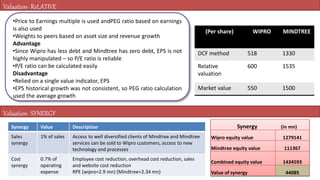

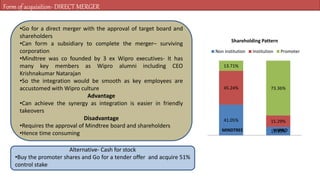

- Wipro is looking to acquire MindTree to gain access to its digital capabilities and customers in high growth areas like digital, as well as realize synergies from the combination.

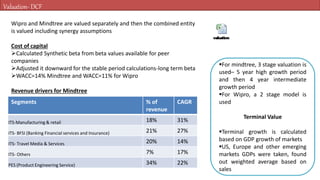

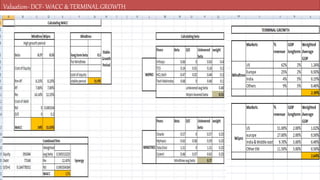

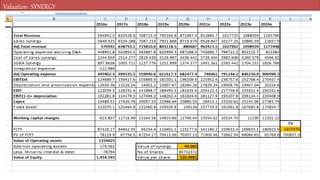

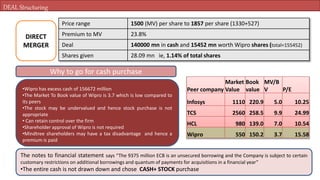

- A DCF valuation of both companies independently and together with synergies values MindTree between Rs. 1,330-1,535 per share and finds a 23.8% premium is reasonable.

- Wipro proposes acquiring MindTree entirely in cash for Rs. 1,500-1,857 per share, or Rs. 14,000 cr in cash and Rs. 1,545 cr in W