The document explores the multifaceted nature of entrepreneurship, covering its definition, critical elements, stages of new venture formation, and influences on entrepreneurship in different regions, particularly the Asia-Pacific. It emphasizes the importance of individual entrepreneurs, opportunities, resources, and the environment in fostering entrepreneurial activities, as well as the role of government in promoting entrepreneurship through favorable policies. Additionally, the text discusses the education of entrepreneurs, asserting that entrepreneurship can be taught and learned, and highlights key trends affecting entrepreneurship, such as globalization and innovation.

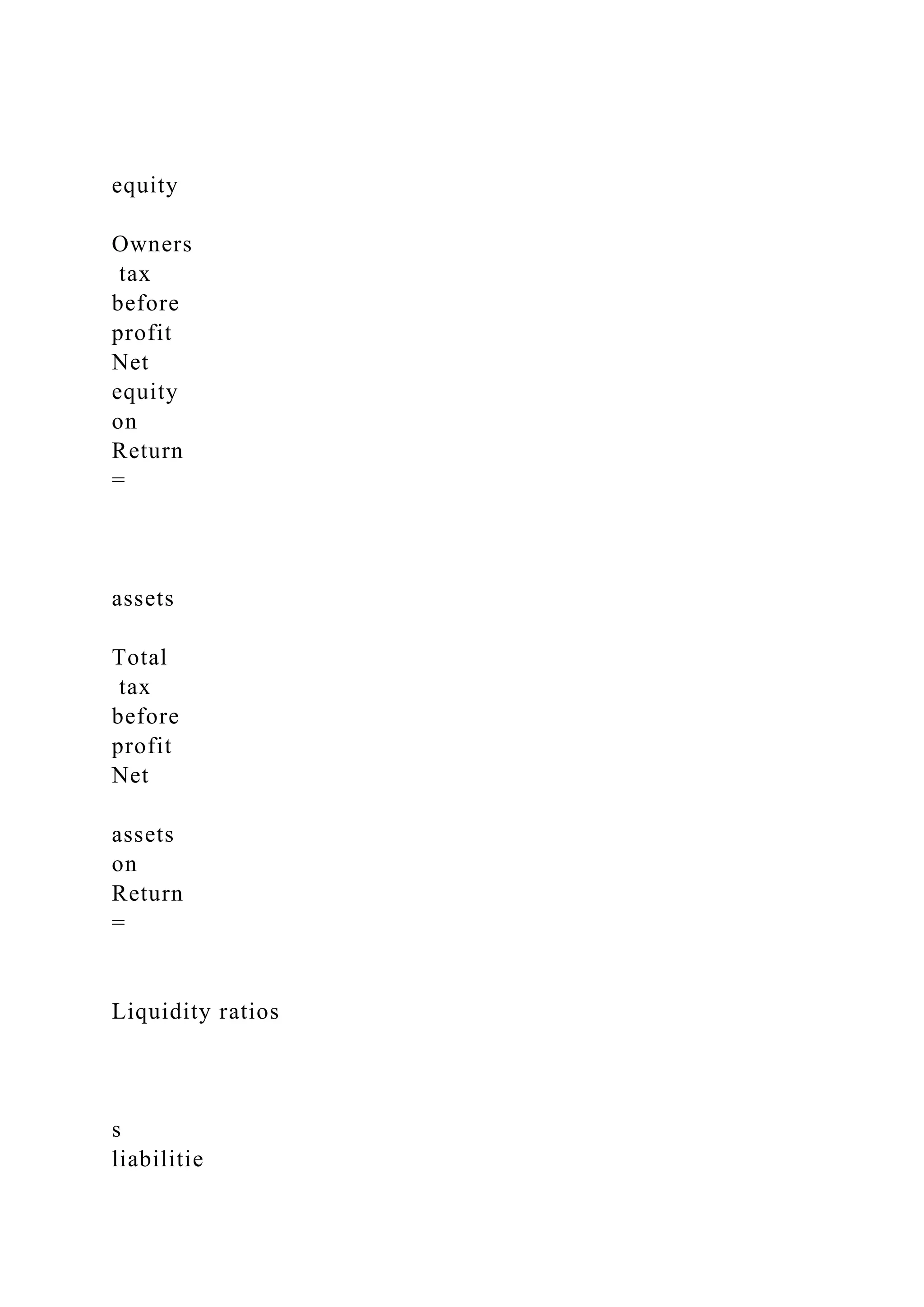

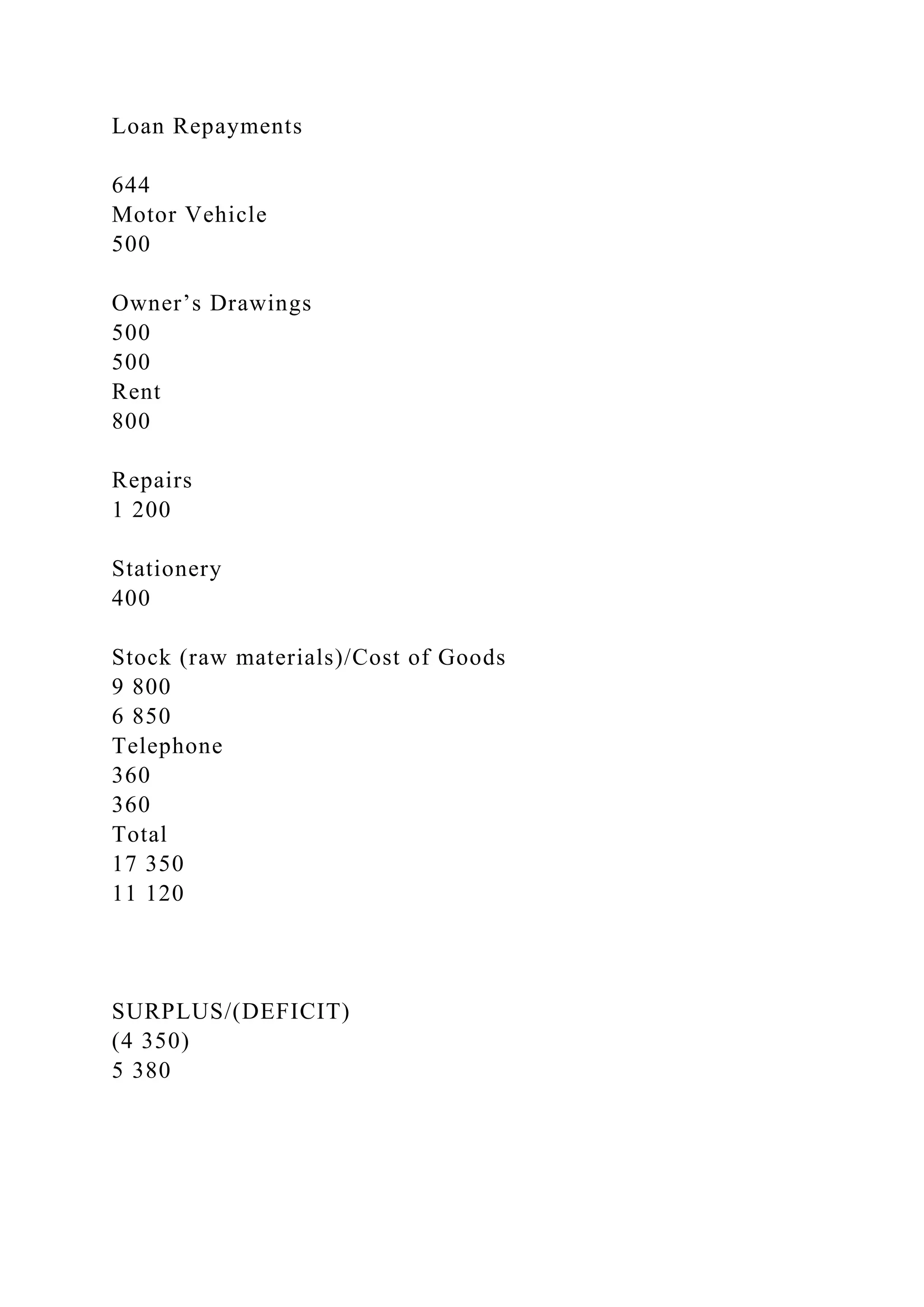

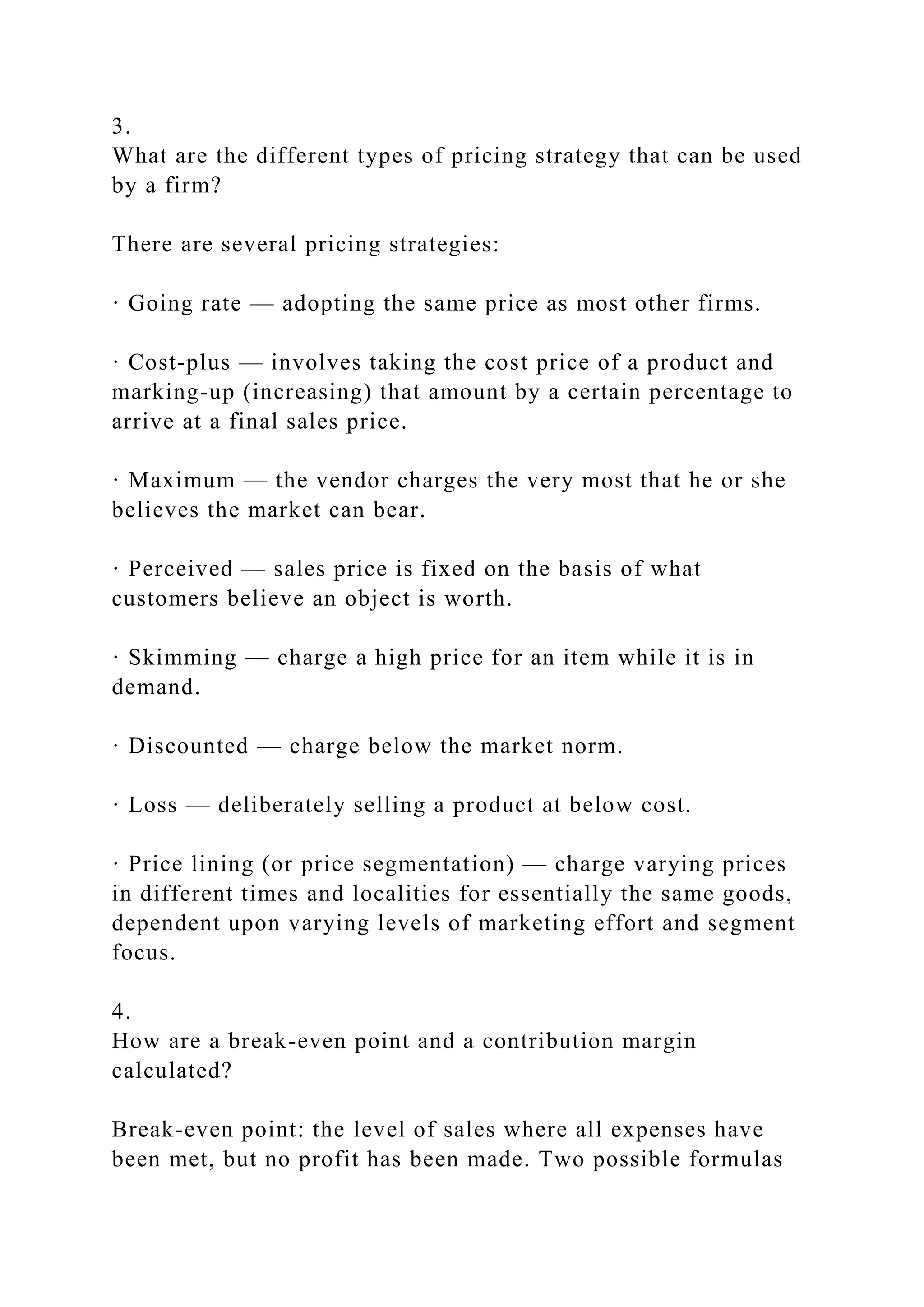

![can be used, depending on whether the number of items to be

sold or the dollar turnover needed to reach BEP is being

assessed:

Break-even point in units = total fixed costs/[unit sales price –

variable cost per unit]

Break-even point in dollars = fixed costs/contribution margin

Contribution margin: the proportion of money left in each dollar

of sales, after variable costs have been met, that is available to

cover fixed costs and contribute to profits.

CM = [total sales – total variable costs]/total sales

NB: If expressed as a percentile, the contribution margin can

then be used to calculate break-even point (note that this figure

is expressed as a dollar value, not number of items sold):

Break-even point in dollars = fixed costs/contribution margin

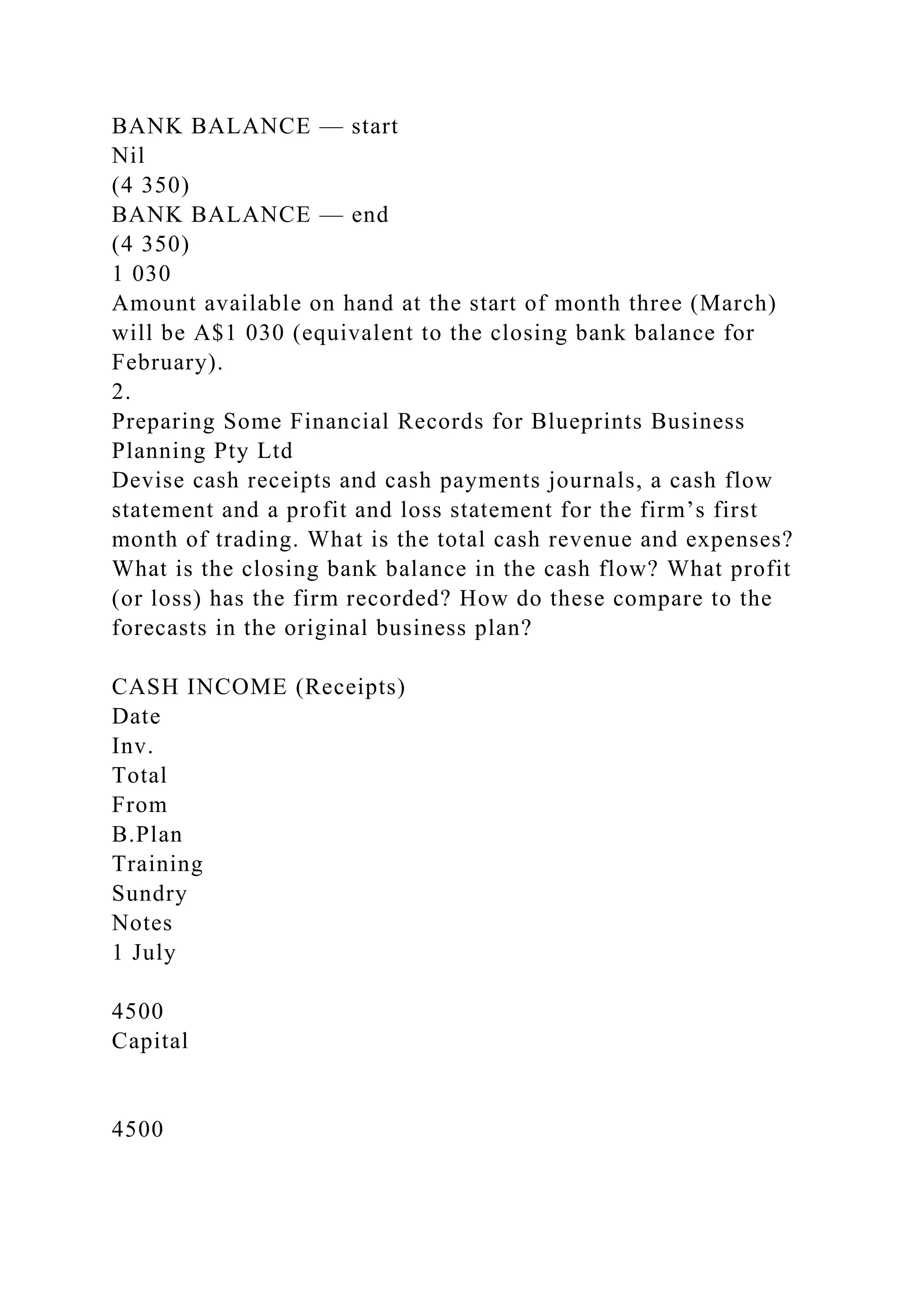

5.

Explain the different types of intermediary that exist in the

placement component

of the marketing mix.

· Brokers — bring together the buyer (consumer) and the seller

(business) to help the two parties negotiate a purchase between

them.

· Agents — act as permanent intermediaries. They market the

product to consumers for a fee. Very similar to brokers.

· Wholesalers — purchase goods, and then sell them directly to](https://image.slidesharecdn.com/s-c-221107154025-c1e11516/75/S-C-DS_Store__MACOSXS-C-_-DS_StoreS-Cchapters-docx-154-2048.jpg)

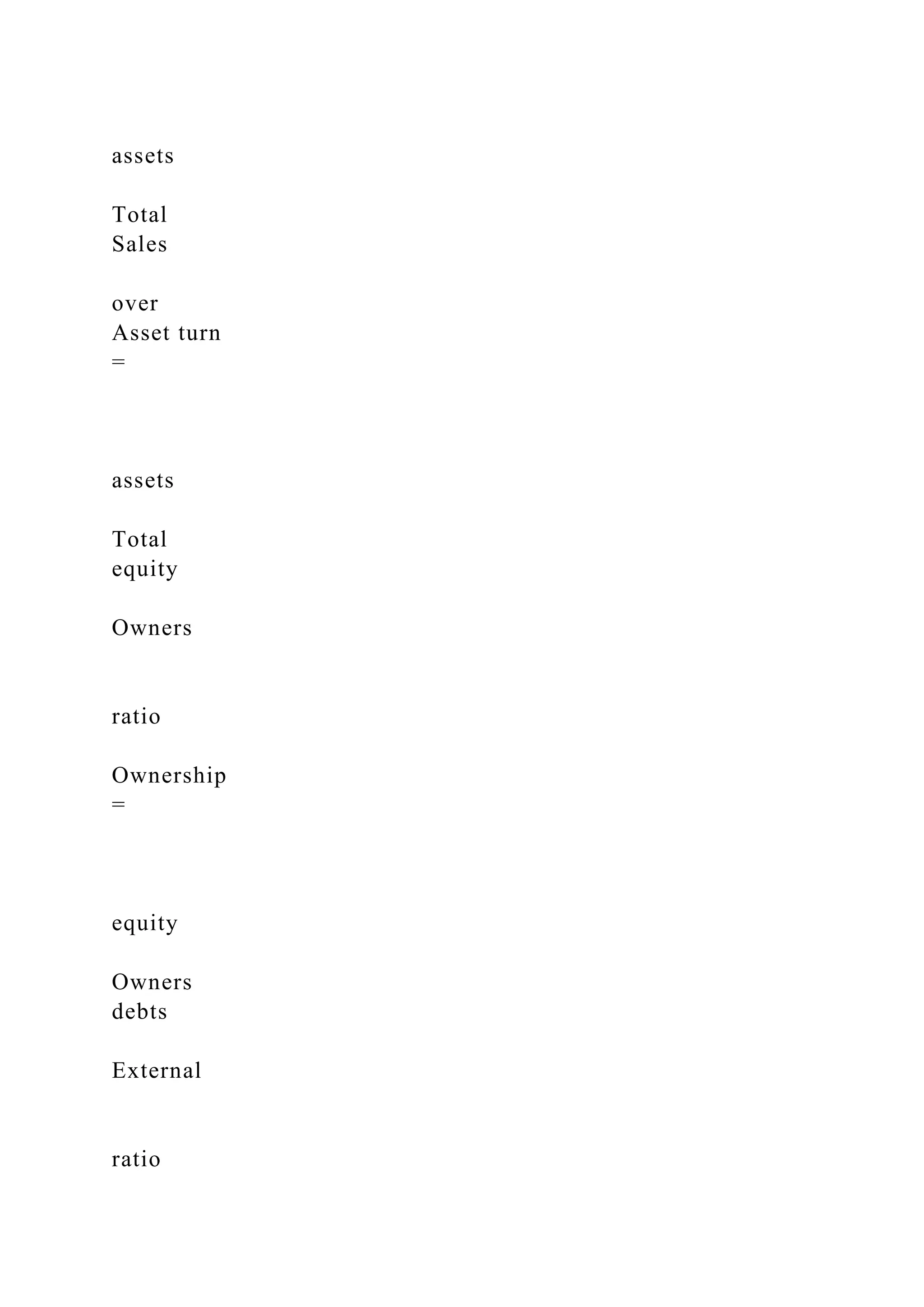

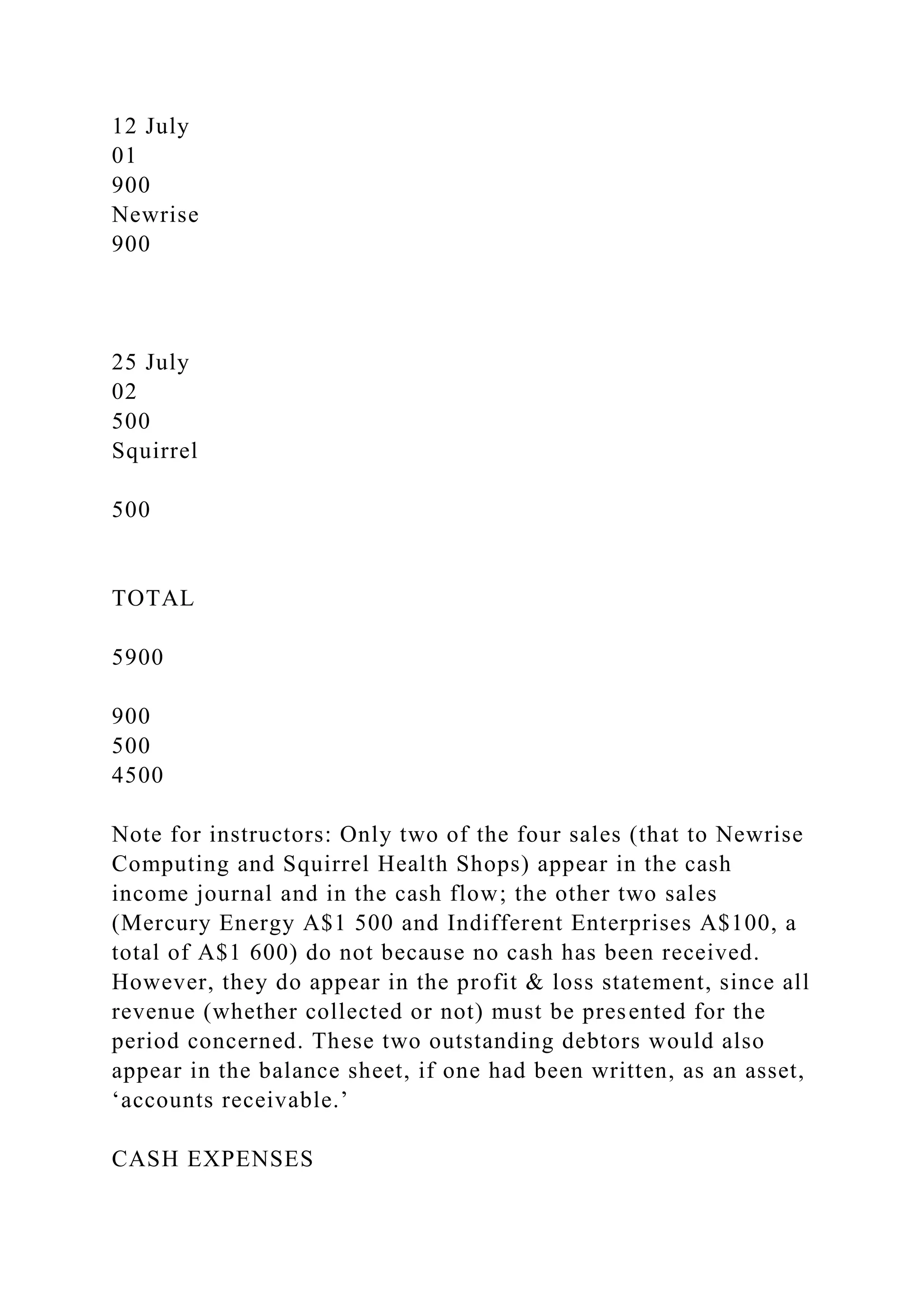

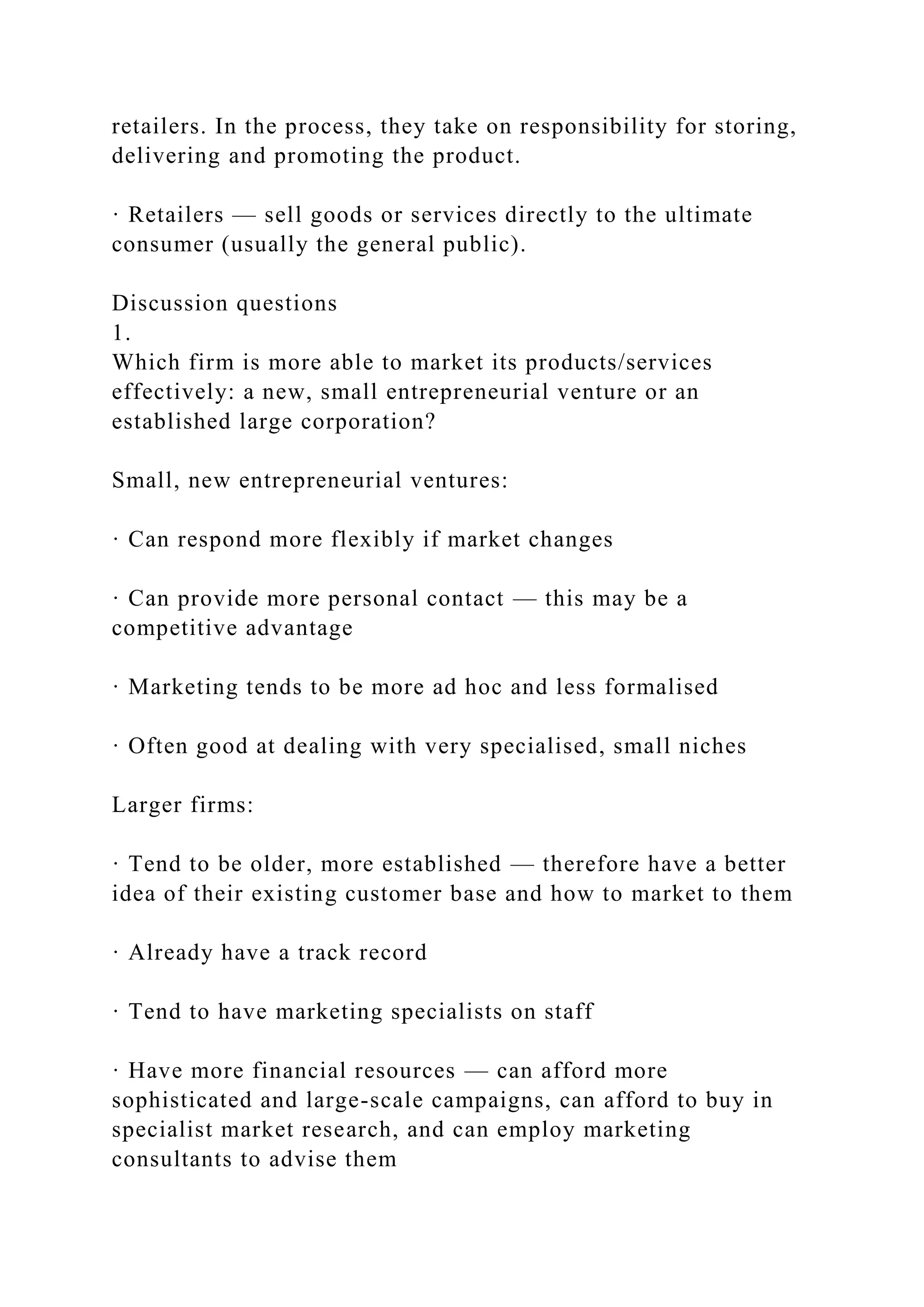

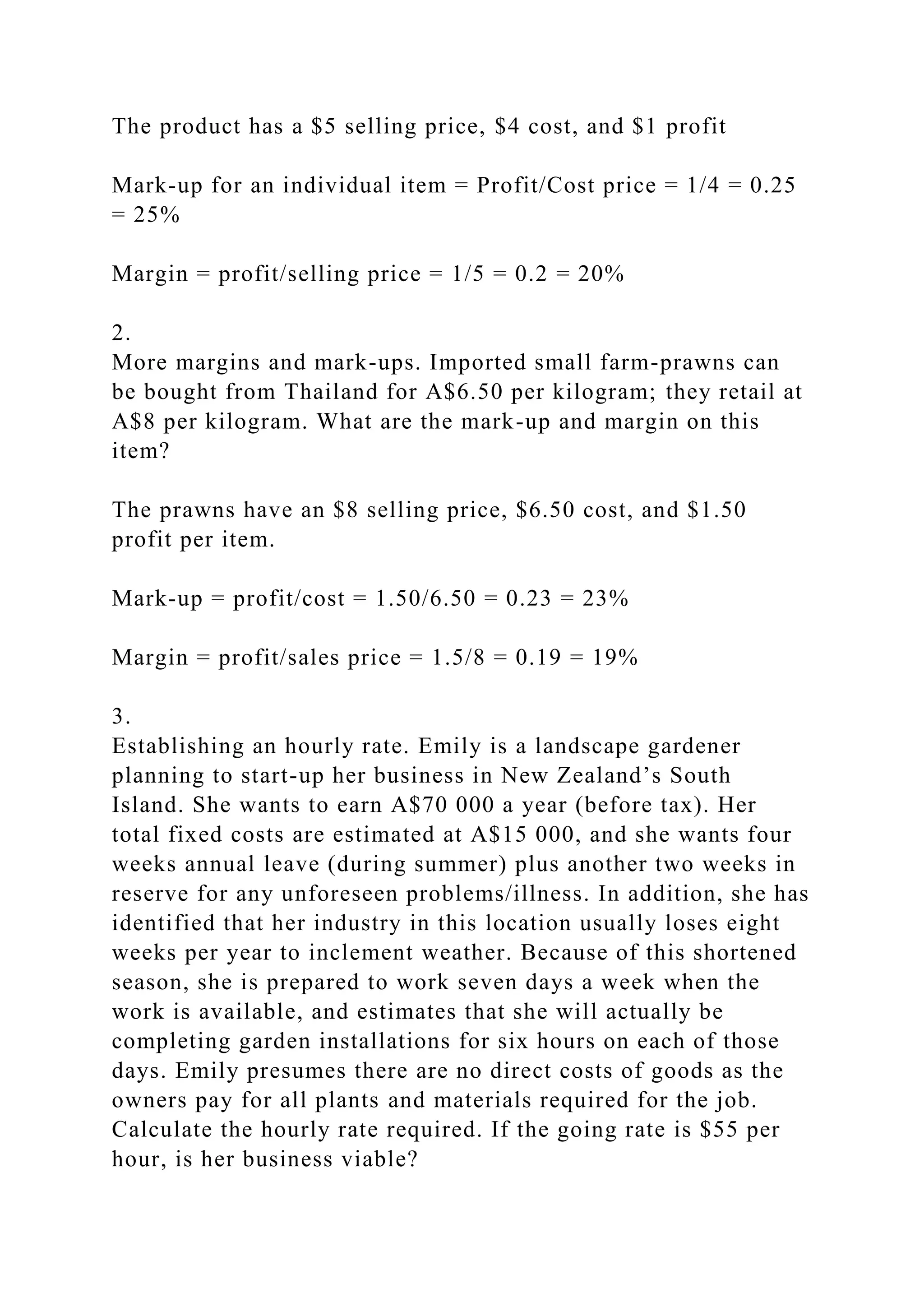

![Hourly charge rate = Total funds required/hours available

Total funds required = owner’s drawings required ($70 000) +

fixed Costs ($15000)

= $85 000

Hours available = 38 wks x 7 days/week x 6 hours/day = 1596

per annum

Hourly charge rate = $85 000/1596 = $53.26. Her business is

viable (just), since her needed rate is less than the going hourly

rate of $55 per hour. The proposal is very tight with 7 days of

the week utilised everything will need to go as planned to reach

target profit levels. In reality she would probably need to push

the rates up by at least another 10- 20% to account for less than

100% capacity utilisation.

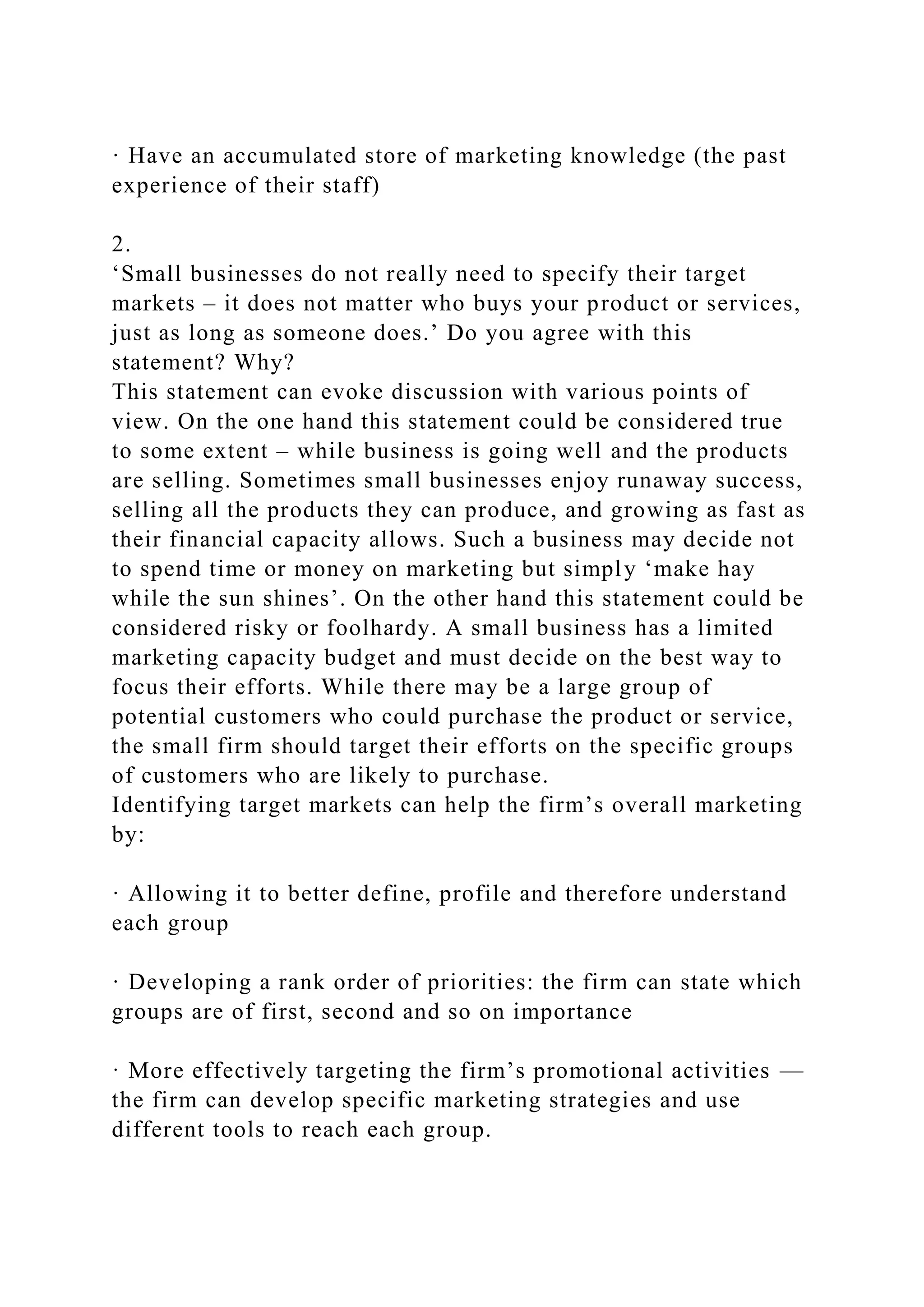

Case study: Handmade Homewares

1.

Calculate the break-even point of this business, using the

contribution margin.

Step 1. Work out variable and fixed costs.

As stated in the exercise, the operating expenses of the firm

consist of $60,200 in fixed costs and the remainder ($12 500)

are variable costs.

Total variable costs = CoGS + $12500 = 737500 + 12 500 =

750000

Step 2. Work out contribution margin.

CM = [Total sales – total variable costs]/Total sales = [850 000](https://image.slidesharecdn.com/s-c-221107154025-c1e11516/75/S-C-DS_Store__MACOSXS-C-_-DS_StoreS-Cchapters-docx-159-2048.jpg)

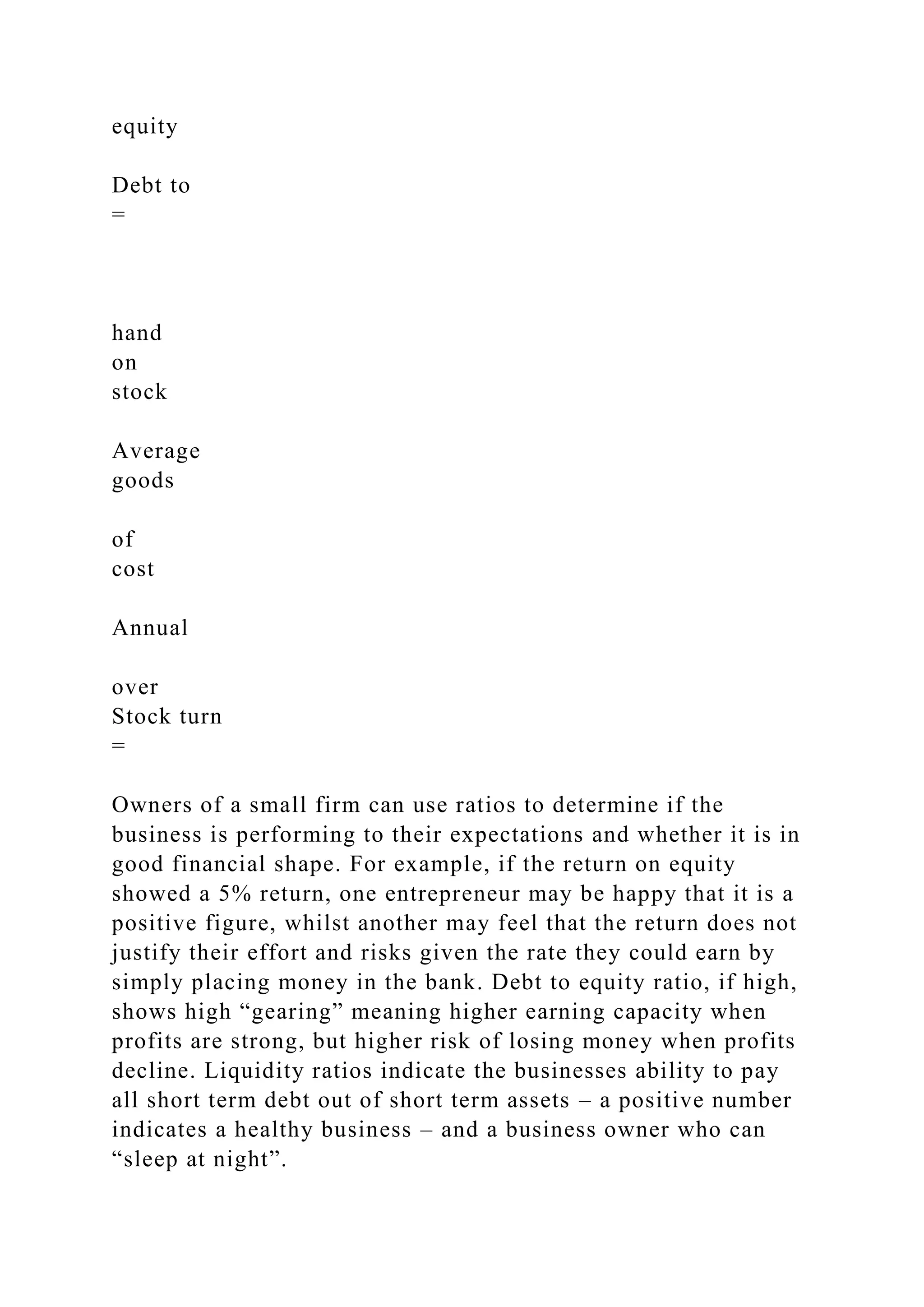

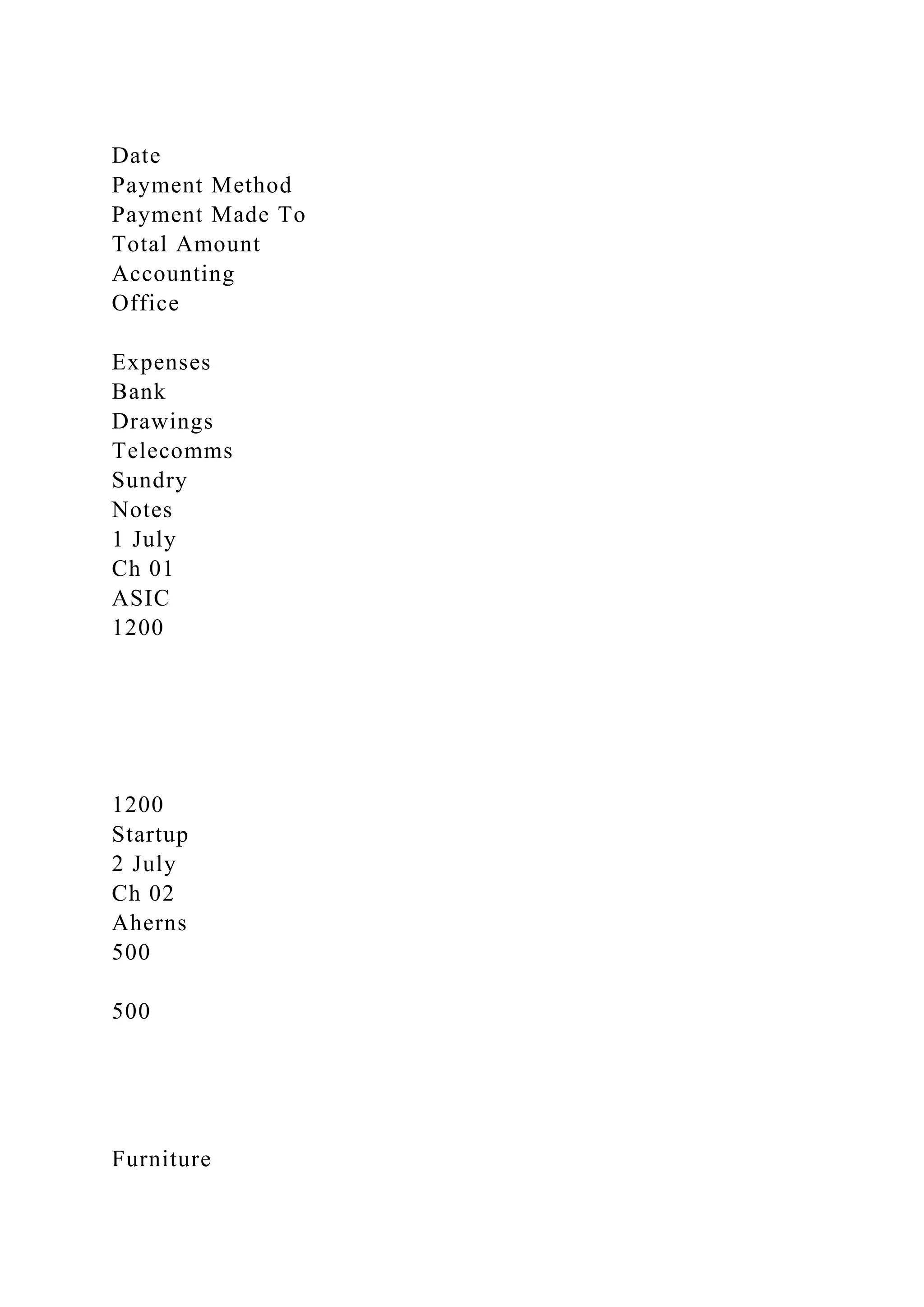

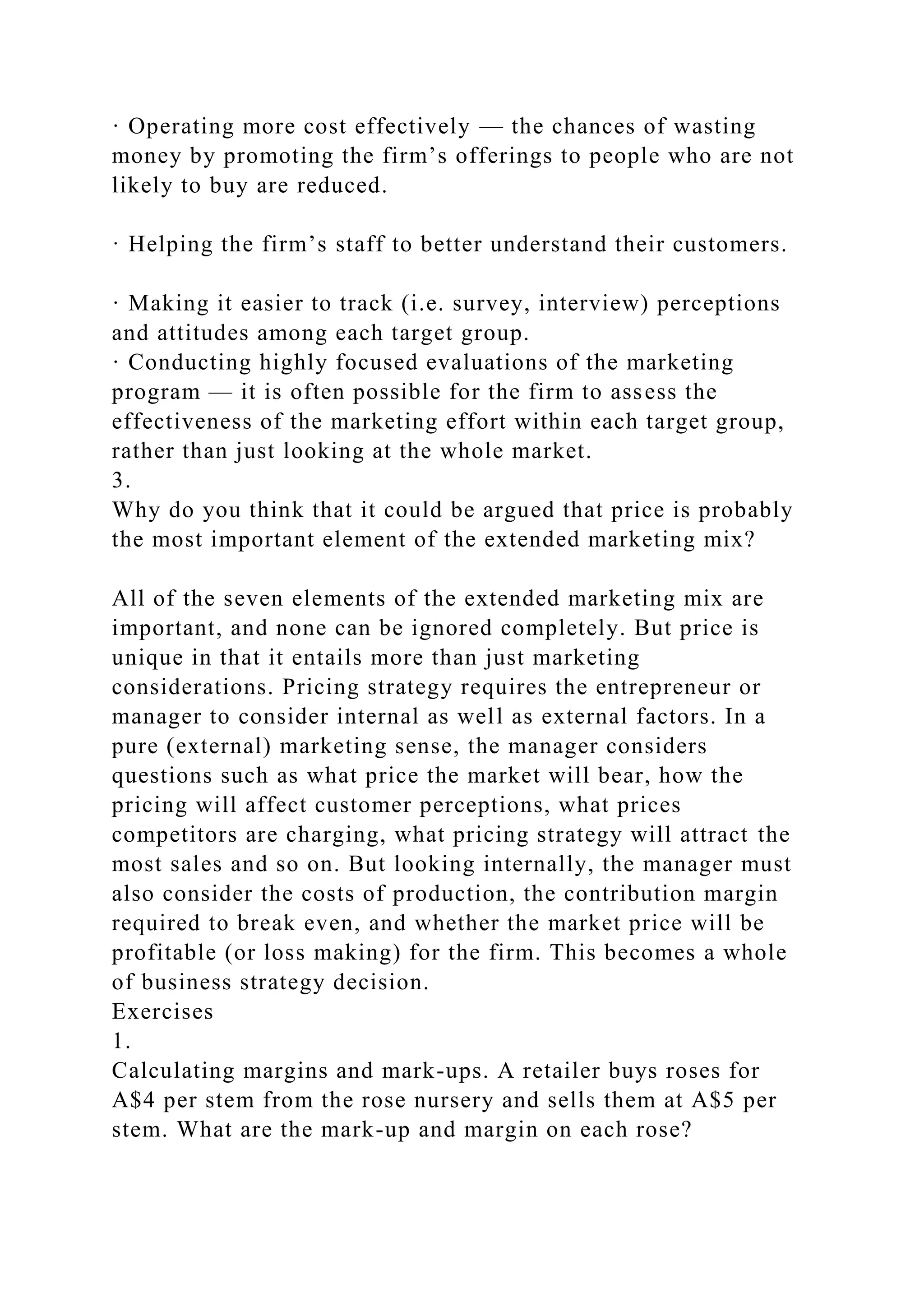

![– 750000]/850 000

CM = 0.11765 = 11.765% (rounded)

Step 3. Calculate break-even point.

Break-even point in dollars = fixed costs/contribution margin =

60200/0.11.765

= $511687.21

2.

Bertie’s father said that if Bertie could lift sales to A$1.1

million he would exceed his required profit of A$65 000, do you

agree? (Use contribution margin again to calculate this.)

Step 1.

Calculate CM (= 0.11765 from above)

Step 2.

With 11.765 cents in every $1 sale above $511687.21 going to

profit, a profit of $69215 would be made ([$1,100,000 -

$511687.21] x 0.11765). So it is true that Bertie would exceed

his target of $65,000.

3.

Is it reasonable for Bertie to expect a part-time seasonal

business to pay him the equivalent of his fulltime job? Explain

your reasoning

There is no objective link between business profits and potential

salaries, only the subjective consideration of opportunity costs,

as judged by the individual business owner. Opportunity costs

are everything the person gives up in order to start the business,

not limited to financial costs. Bertie is giving up more than just

his salary. A business like this entails more uncertainty and risk

than a fulltime job. Bertie could make profits in business or he

could make losses – whereas he will never make a loss in a

fulltime job. To offset this increased risk, Bertie may rationally](https://image.slidesharecdn.com/s-c-221107154025-c1e11516/75/S-C-DS_Store__MACOSXS-C-_-DS_StoreS-Cchapters-docx-160-2048.jpg)