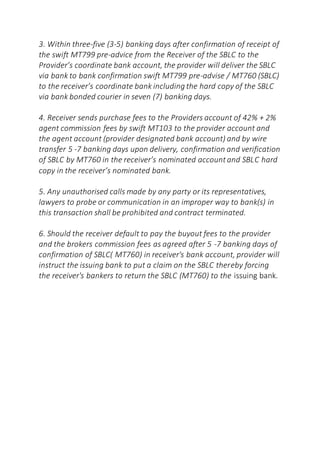

This document outlines the procedures for purchasing a Standby Letter of Credit (SBLC) for a total face value of XX Billion Euros. It involves two tranches totaling this amount, with payment of a 42% purchasing fee plus a 2% agent commission fee. The provider will deliver the SBLC via SWIFT message within 3-5 banking days of receiving payment, along with the physical document within 7 banking days via bonded courier. Payment is due from the receiver to the provider and agent within 5-7 banking days of receiving and verifying the SBLC.